This is a short version of a paper written for the Risk Management for Financial Institutions MSc. The paper is written on the personal title of the author.

This is a short version of a paper written for the Risk Management for Financial Institutions MSc. The paper is written on the personal title of the author.

Introduction

Much of the academic literature on blockchain (Davidson, De Filippi and Potts [2016], MacDonald, Allen and Potts [2016], Christopher [2016]) overlooks the very fundamental question for which solution blockchain is a good solution and for which it is not. This paper aims to answer the question for which problems blockchain is a solution, using the rational choice framework to assess how and why blockchain works for some types of transactions, and how and why it does not work for other types of transactions.

Conceptual framework: alignment of interests and power relations

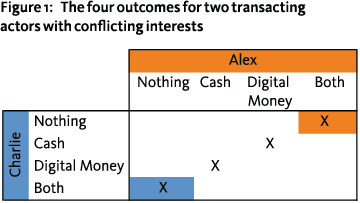

Assuming Alex and Charlie are rational actors and Alex is about to trade digital currency for cash with Charlie, their trade has four potential outcomes, the trade resolves as planned, the trade doesn’t resolve, Alex defrauds Charlie and gets both, or Charlie defrauds Alex and gets both. The outcomes are visualised below (coloured boxes represent the optimal outcome for both actors). This theoretical exercise shows the need for some sort of third party mechanism to prevent that neither party will attempt to defraud the other; it is rational for both parties not to trade at all in a justified fear of being defrauded by the other party.

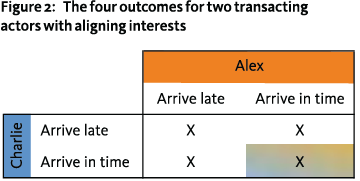

Contrasting this transaction with conflicting interests, consider a transaction with aligning interests: Alex and Charlie go to a blockchain conference and deliver a keynote speech together; they travel together with Alex’ car and can only deliver the speech together, so they both have an incentive to be on time at a joint meeting point. Schematically, this looks like the figure below (again; coloured boxes represent the optimal outcome; in this case overlapping). In this case, Alex and Charlie do not need a third party mechanism to prevent that neither party will attempt to arrive late, because they both maximize their own utility by arriving in time. The optimal outcomes of both actors are aligned.

Contrasting this transaction with conflicting interests, consider a transaction with aligning interests: Alex and Charlie go to a blockchain conference and deliver a keynote speech together; they travel together with Alex’ car and can only deliver the speech together, so they both have an incentive to be on time at a joint meeting point. Schematically, this looks like the figure below (again; coloured boxes represent the optimal outcome; in this case overlapping). In this case, Alex and Charlie do not need a third party mechanism to prevent that neither party will attempt to arrive late, because they both maximize their own utility by arriving in time. The optimal outcomes of both actors are aligned.

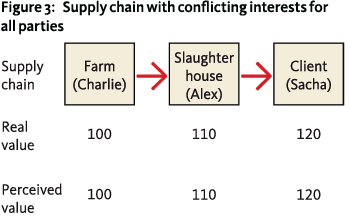

To fully grasp why the concept of aligning and conflicting interests is so relevant to assess whether or not a blockcahin solution is appropriate or not, consider adding one additional party to the equation (Sacha). Three parties can have a combination of aligning interests among each other. Alex and Charlie failed their FinTech career (they were late at the aforementioned congress) and start a cow meat business. Assuming a profit margin of 10, the chain looks like this:

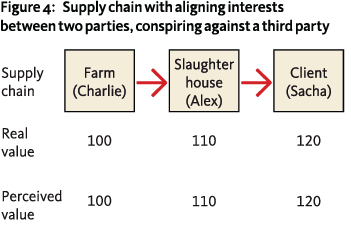

The relations between all parties are conflicting in the same sense as the first example. Now consider that Charlie and Alex conspire against Sacha by adding (cheaper) horse meat to the cow meat and selling this to Sacha as if it is cow meat. Alex and Charlie split the profit of this conspiracy. The example looks like the chain below, in which the interests of Charlie and Alex are more aligned than in the previous example. In this example, it would not be in the interest of Charlie and Alex to have a third party mechanism to prevent fraud, exactly because their interests are aligned.

The relations between all parties are conflicting in the same sense as the first example. Now consider that Charlie and Alex conspire against Sacha by adding (cheaper) horse meat to the cow meat and selling this to Sacha as if it is cow meat. Alex and Charlie split the profit of this conspiracy. The example looks like the chain below, in which the interests of Charlie and Alex are more aligned than in the previous example. In this example, it would not be in the interest of Charlie and Alex to have a third party mechanism to prevent fraud, exactly because their interests are aligned.

The examples below show that a mechanism to increase trust – such as blockchain – only works were interests are conflicting. A blockchain solution itself does not create trust, because the inputs in the blockchain can be wrong in case interests are aligned (such as in the last example).

In case the first input of the ‘truth’ is inputted wrongly because the actor inputting this ‘truth’ is under pressure from another party, the whole chain is wrong. No verification mechanism after this first step will help solve this problem. For example, if the slaughterhouse of the previous example is powerful and (semi-)monopolist and the farm is small, barely profitable and fully dependent on the one slaughterhouse for its survival, it may be forced into defrauding the chain. One party could have so much power over the other that any ‘truth’ that the weak party would input in the blockchain and that should be verified by the strong party, may be the preferred ‘truth’ of the strong party rather than the real truth. The blockchain itself does not automatically produces the truth – it is just a mechanism that verifies ‘a truth’ created by multiple parties, whether that ‘truth’ is actually true or not. With highly unequal power relations, that ‘truth’ is at risk.

In case the first input of the ‘truth’ is inputted wrongly because the actor inputting this ‘truth’ is under pressure from another party, the whole chain is wrong. No verification mechanism after this first step will help solve this problem. For example, if the slaughterhouse of the previous example is powerful and (semi-)monopolist and the farm is small, barely profitable and fully dependent on the one slaughterhouse for its survival, it may be forced into defrauding the chain. One party could have so much power over the other that any ‘truth’ that the weak party would input in the blockchain and that should be verified by the strong party, may be the preferred ‘truth’ of the strong party rather than the real truth. The blockchain itself does not automatically produces the truth – it is just a mechanism that verifies ‘a truth’ created by multiple parties, whether that ‘truth’ is actually true or not. With highly unequal power relations, that ‘truth’ is at risk.

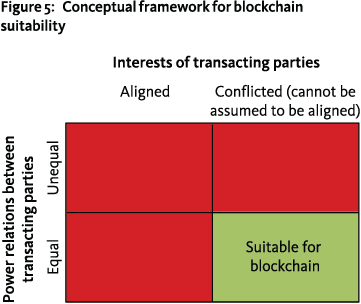

The section above leads to the construction of a simplified framework to assess the suitability of blockchain solutions, as shown below. Two examples are tested with this framework: trade finance and food traceability.

The example of trade finance

An average trade finance process is conceptually close to the process showed in Figure 3 in the interests all parties have, albeit somewhat more complex because a trade flow and a financing flow go into opposite directions. Trade is a classic example of a challenge to overcome distrust – does party A pay first and not having the goods yet, or does party B send the goods first, and pays then? To overcome this, banks finance the trade before it arrives, on the condition of proof that the goods are being sent (the ‘bill of lading’). In ‘normal course of action’, all parties have an interest in trading as planned, as smoothly as possible. But none of the parties can assume that the interests are aligned, in much the same manner as the trade between Alex and Charlie in Figure 2. Therefore, parties in a trade finance transactions can be classified as having conflicting interests (or, more precisely, each party cannot assume that their interest is aligned with the other party).

An average trade finance process is conceptually close to the process showed in Figure 3 in the interests all parties have, albeit somewhat more complex because a trade flow and a financing flow go into opposite directions. Trade is a classic example of a challenge to overcome distrust – does party A pay first and not having the goods yet, or does party B send the goods first, and pays then? To overcome this, banks finance the trade before it arrives, on the condition of proof that the goods are being sent (the ‘bill of lading’). In ‘normal course of action’, all parties have an interest in trading as planned, as smoothly as possible. But none of the parties can assume that the interests are aligned, in much the same manner as the trade between Alex and Charlie in Figure 2. Therefore, parties in a trade finance transactions can be classified as having conflicting interests (or, more precisely, each party cannot assume that their interest is aligned with the other party).

An example from India shows why a blockchain solution ‘works’ for trade finance exactly because there are conflicting interests between competing parties. Before a blockchain solution, trade companies could upload invoices on different platforms and let financiers bid to fund the invoice, but there was no way to verify if the invoice would get double financed (Bermingham 2018). Then blockchain came into the picture: “We saw a tonne of opportunity, as with these types of exchanges there are lots of opportunities for fraud. […] They had a need to identify when an invoice had been factored on a competitor’s exchange. But because they’re competitors they didn’t want anyone else to be able to identify their customers. We had three untrusting competitors, although they’re working together, needing a platform that would work between them, but is cryptographically secure” (Chanard in Bermingham 2018). Hence, the blockchain very well suits a transactional challenge of trade finance in India.

An example from India shows why a blockchain solution ‘works’ for trade finance exactly because there are conflicting interests between competing parties. Before a blockchain solution, trade companies could upload invoices on different platforms and let financiers bid to fund the invoice, but there was no way to verify if the invoice would get double financed (Bermingham 2018). Then blockchain came into the picture: “We saw a tonne of opportunity, as with these types of exchanges there are lots of opportunities for fraud. […] They had a need to identify when an invoice had been factored on a competitor’s exchange. But because they’re competitors they didn’t want anyone else to be able to identify their customers. We had three untrusting competitors, although they’re working together, needing a platform that would work between them, but is cryptographically secure” (Chanard in Bermingham 2018). Hence, the blockchain very well suits a transactional challenge of trade finance in India.

On the other dimension of blockchain suitability, power relations, things are less clear. Parties with very different power relations may do trade finance transactions with each other. However, given the transactional nature and the often large geographical separation of transacting parties in trade finance, it is not directly clear to what extent a more powerful party can leverage its power to its own benefit.

Both through the lens of aligning/conflicting interests and power relations among participants, blockchain seems to suit the trade finance process. It can be put in the green quadrant of Figure 5.

The example of food traceability

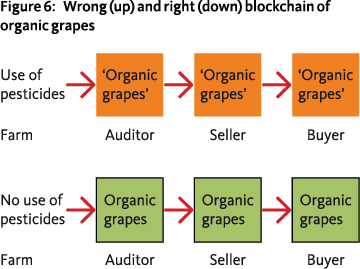

Ge et al (2017, p2) have researched the “the blockchain technology (BCT) and its implications for agrifood, especially how it can impact specific aspects of supply chains and what is needed to apply BCT in agrifood chains”. Their research question is closely aligned to the more conceptual question that his paper poses. The use case involves organic table grapes being produced in South Africa, being certified by an accreditation authority, and they have individual bar codes per box, and all change of ownership is recorded in the blockchain. “If the farm uses some kind of unauthorised pesticide, and this is discovered during an audit, then the auditor is able to revoke any certificate issued by the farm. This is recorded on the blockchain so anybody validating the certificate is able to see this. An auditor is also able to revoke accreditations on the level of an accreditation-body (the party issuing accreditations to certificate-bodies)” (Ge et al 2017, p16).

Assume that one day, the auditor discovers the use of pesticides in grapes. In a theoretical world, this discovery should be part of the blockchain and the customer would see that one tray of organic grapes is actually not organic. This is, of course, not what will happen in the real world. The first question to ask is what the auditor will do with such a discovery. From a rational choice point of view, the auditor may do what is in its own interest. If the auditor strongly depends on this client and assumes a low probability of getting caught, the auditor may ignore the case of pesticide use, very much in line with the ‘meat fraud’ of Figure 4 and the power relations example. But even assuming that the auditor is not a strict rational actor, the answer is far from clear. An opponent of the rational choice framework would probably also come to the conclusion that the auditor may not necessarily report everything he sees – not out of rational considerations but because of cognitive biases (Marnet 2007, p194-8) that could in some occasions be caused by stress (Weick 1983). These ‘inputs for decision making’ may be dismissed in rational choice theories but could lead to the same outcome: a ‘wrong’ blockchain.

From a conceptual point of view, this ‘wrong’ blockchain in food traceability can both be caused by aligning interests and by unequal power relations. It may be in the interest of both the farm and the auditor to act as if nonorganic grapes are organic (interests are not necessarily conflicting between the two; posing a threat to blockchain suitability). Power relations between auditor and auditee may also be unequal, given that it is business practice that the auditee pays the auditor. In any way, there is no way that the consumer knows the difference between the wrong and a right blockchain as presented below.

The suitability of blockchain for food traceability does not score in the green quadrant of Figure 5. Both on the level of interests (potentially aligning) and on the level of power relations (potentially unequal), it is not guaranteed that a blockchain solution would solve the transactional problem posed. The next section concludes by laying out how a blockchain solution for an unsuitable transactional problem may cause harm, and how to risk assess this.

Conclusion and implications: risk managing the suitability of blockchain

The question posed at the beginning of the paper is now conceptually answered and supported with two real world examples. Blockchain is a suitable solution for transactional problems where all parties in the chain have conflicting interests (or rather, cannot assume to have aligned interests) and between parties with more or less equal power relations. The two examples presented in this paper – trade finance and food traceability – fit in the green quadrant and in the red zone of Figure 5 respectively, demonstrating how some efficiency-enhancing solutions may or may not actually be suitably solved by blockchain.

The implications of the answer to the question posed in the paper is that the potential implementation of blockchain across any organization should be treated as a risky process. A framework to assess the suitability of blockchain should first and foremost start with the most critical question – and this is not the efficiency question. It is the question whether or not the very design of blockchain fundamentally contributes to solving a transactional challenge. This question should – at least – be answered by assessing the features of the transactional challenge as presented in the conceptual framework of Figure 5.

The implications of the answer to the question posed in the paper is that the potential implementation of blockchain across any organization should be treated as a risky process. A framework to assess the suitability of blockchain should first and foremost start with the most critical question – and this is not the efficiency question. It is the question whether or not the very design of blockchain fundamentally contributes to solving a transactional challenge. This question should – at least – be answered by assessing the features of the transactional challenge as presented in the conceptual framework of Figure 5.

The harmful effect if blockchain is being viewed as a catch-all solution for improving efficiency, is that it may create the false impression that ‘truth’ is guaranteed by blockchain (at, for example management board level or customer level). A worst case scenario would be to trust in the truth of the blockchain because of misunderstanding the limitations of it, much like global banks used relatively simple metrics like Value at Risk in the run up to the global financial crisis as key decision inputs, while these metrics have shortcomings that are not often fully understood (Taleb 2009).

Note

- Matthijs Hannink MSc FRM is Toezichthouder Specialist at De Nederlandsche Bank.

Sources

- Ali, Muneeb, Jade Nelson, Ryan Shea Shea and Michael J Freedman, 2016, Bootstrapping Trust in Distributed Systems with Blockchains, USENIX Mag 41:3, 52-58

- Bermingham, Finbarr, 2018, Blockchain solution to prevent trade finance fraud goes live in India, Global Trade Review, https://www.gtreview.com/news/ fintech/blockchain-solution-to-prevent-trade-financefraud-goes-live-in-india/, visited on 29 April 2018

- Bank for International Settlements Committee on Payments and Market Infrastructures, 2017, Distributed ledger technology in payment, clearing and settlement: An analytical framework

- Groenewegen, Jesse, Marijn Heijmerikx and Jurriaan Kalf, 2017, The impact of Blockchain on trade finance, Rabobank website, https://economics.rabobank. com/publications/2017/november/the-impact-ofblockchain-on-trade-finance/, visited on 22 April 2018

- Buterin, Vitalik, 2015, Visions, Part 1: The Value of Blockchain Technology, Ehereum Blog, https://blog. ethereum.org/2015/04/13/visions-part-1-the-value-ofblockchain-technology/, visited on 15 April 2018

- Davidson, Sinclair, Primavera De Filippi and Jason Potts, 2016, Economics of Blockchain, Proceedings of Public Choice Conference

- Friedman, Milton and Leonard J Savage, 1952, The Expected-Utility Hypothesis and the Measurability of Utility, The Journal of Political Economy 6: 463-474.

- Goldman Sachs, Blockchain – The New Technology of Trust, Goldman Sachs Website, http://www.goldmansachs.com/our-thinking/pages/ blockchain/, visited on 14 April 2018

- ING, 2018, Bringing blockchain to agricultural commodity trade, ING Website, https://www.ing.com/ Newsroom/All-news/Bringing-blockchain-toagricultural-commodity-trade.htm, visited on 22 April 2018

- Jeffries, Adrienne, 2018, ‘Blockchain’ is meaningless, The Verge, https://www.theverge. com/2018/3/7/17091766/blockchain-bitcoin-ethereumcryptocurrency-meaning, Visited on 29 April 2018

- Karagiannis, Konstantinos, 2017, Hacking Blockchain, Presentation for RSA Conference 2017

- Kharif, Olga, 2016, Wal-Mart Tackles Food Safety With Trial of Blockchain, Bloomberg Technology, https://www.bloomberg.com/news/articles/ 2016-11-18/wal-mart-tackles-food-safety-with-test-ofblockchain-technology, visited on 28 April 2018.

- MacDonald, Trent J, Darcy Allen and Jason Potts, 2016, Blockchains and the Boundaries of Self-Organized Economies: Predictions for the Future of Banking in BANKING BEYOND BANKS & MONEY, Chapter X, Springer.

- Marnet, Oliver, 2007, History repeats itself: The failure of rational choice models in corporate governance, Critical Perspectives on Accounting 18, 191-2007

- Meijer, David B, 2016, Blockchain Technology: Trust and/or Control? University of Delft Repository

- Mulligan, Cathy, JP Rangaswami, Sheila Warren and Jennifer Zhu Scott, 2018, These 11 questions will help you decide if blockchain is right for your business, https://www.weforum.org/agenda/2018/04/ questions-blockchain-toolkit-right-for-business/, visited on 29 April 2018.

- Purvis, Katherine, 2017, Blockchain: what is it and what does it mean for development? The Guardian, https://www.theguardian.com/global-developmentprofessionals-network/2017/jan/17/blockchain-digitaltechnology-development-money, visited on 29 April 2018

- Nakamoto, Satoshi, 2008, Bitcoin: A Peer-to-Peer Electronic Cash System, Bitcoin.org

- Schrieberg, Felipe, 2017, Can Blockchain Technology Stop Whisky Counterfeiting? Forbes, https://www.forbes.com/sites/felipeschrieberg/2017/ 09/29/can-blockchain-technology-stop-whiskycounterfeiting/#22699bf791a0, visited on 28 April 2018

- Simon, Herbert A, 1955, A Behavioral Model of Rational Choice, The Quarterly Journal of Economics, 69:1, p 99-118

- Simon, Herbert A, 1979, Rational Decision Making in Business Organizations, The American Economic Review, 69:4, p 493-513

- Taleb, Nassim Nicholas, 2009, Errors, robustness and the fourth quadrant, Institutional Journal of Forecasting 25: p 744-759

- Editors, The trust machine, 2015, The Economist, https://www.economist.com/news/leaders/21677198- technology-behind-bitcoin-could-transform-howeconomy-works-trust-machine, visited on 29 April 2018

- Weick, Karl E, 1983, Stress in Accounting Systems, The Accounting Review 58:2, p 350-369

in VBA Journaal door Matthijs Hannink