Introduction

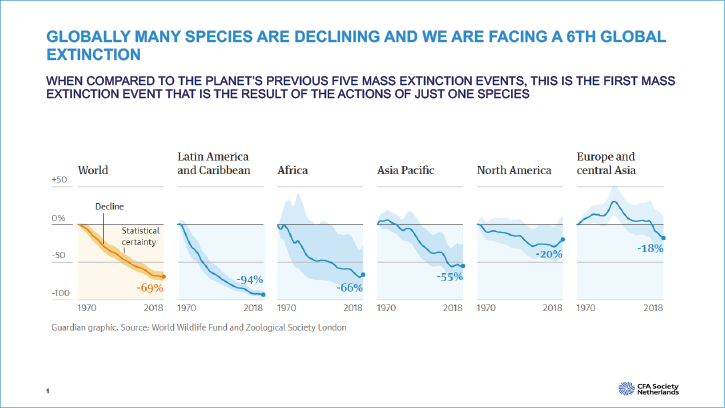

Biodiversity encompasses the variability of all living organisms across ecosystems and plays a crucial role in sustaining life and providing essential ecosystem services. However, human-induced changes have led to a rapid deterioration of biodiversity, primarily driven by land and sea use change, direct exploitation, climate change, pollution, and invasive alien species. This loss has far-reaching economic implications, affecting global GDP and posing risks to investors.

The interconnection between biodiversity loss and climate change is undeniable, as both exacerbate each other’s negative impacts. For instance, nature and biodiversity can offer valuable climate change adaptation and mitigation solutions, such as acting as carbon sinks. The economic implications of biodiversity loss are significant, with over half of global GDP depending on high-functioning biodiversity, and the degradation of ecosystems costing the global economy more than $5 trillion each year.

To measure a company’s impact on biodiversity, the Corporate Biodiversity Footprint (CBF) is used, estimating the negative impact on biodiversity across its value chain. Efforts to combat biodiversity loss are gaining momentum, highlighted by the Post-2020 Global Biodiversity Framework adopted at the UN biodiversity conference COP15. This framework sets out specific targets to halt and reverse biodiversity loss, including the conservation and protection of at least 30% of the world’s land and seas by 2030.

Addressing biodiversity loss requires a different approach than climate change due to its multiple drivers and site-specific interventions. However, addressing biodiversity loss is essential for achieving the UN Sustainable Development Goals (SDGs), as it underpins human well-being, a healthy planet, and economic prosperity. Investment solutions in combating biodiversity loss include sustainable production and consumption models. Developments have not gone unnoticed at CFA Society Netherlands. The Responsible Investment Committee organized a seminar to dive deeper into what is happening and what can be done.

The speakers at the event were:

Alice Sireyjol (Amundi)

Simona Kramer (Rail&OV)

Jeroen Bos (AXA IM)

And moderated by:

Ridzert van der Zee (Triple A – Risk Finance)

Presentations

Alice Sireyjol of Amundi kicked off the seminar with an interactive session regarding the importance of biodiversity in investment decisions: “With a global 69% decline since the 70s, the world is facing a 6th mass extinction caused by humans. Alice explained how biodiversity loss represents a significant impact and risk for our society and global economy. She finished her presentation with pragmatic perspectives for investors: 1) It is key to invest in solutions as well as in the transition 2) Investments should be made towards both listed and unlisted companies to be holistic on biodiversity 3) Biodiversity approaches should continuously improve based on the best available methods 4) Stock picking for portfolios shouldn’t be based solely on data but with a combined top-down and bottom-up approach 5) Active engagement is fundamental for a transition on biodiversity.”

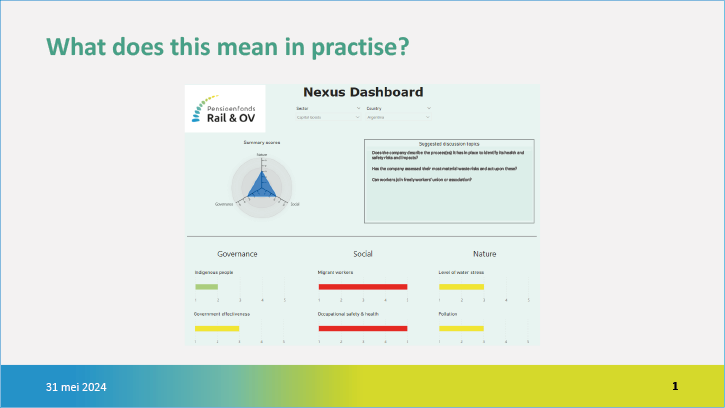

The next speaker was Simona Kramer of pension fund Rail&OV covering the strategic implications from an asset owner perspective: “Asset owners may have the feeling that biodiversity loss is a “too big to grasp” problem. At Rail&OV we approached the topic by first conducting a deep-dive study in collaboration with a knowledge partner (WWF-NL). This helped us to define clear steps we wanted to achieve within a year. In 2024, Rail&OV we have defined some focus areas:

- Integration across the investment cycle

- First attempts to integrate biodiversity across the mandates

- Expand biodiversity targets

- Expanding active ownership strategy

- Examine how to approach climate, biodiversity and social aspects in an integrated manner

Especially the last point seems to be a novelty. Based on our desk research there is lack of relevant frameworks and data that would allow investors to look at climate change, biodiversity, and social aspects in a holistic and more integrated manner. As all three topics (climate change, biodiversity and human rights) are identified as material to Rail&OV investment portfolio, such integrated approach is necessary. We hope to have broader sectoral discussion on this topic which will lead to development of relevant frameworks.”

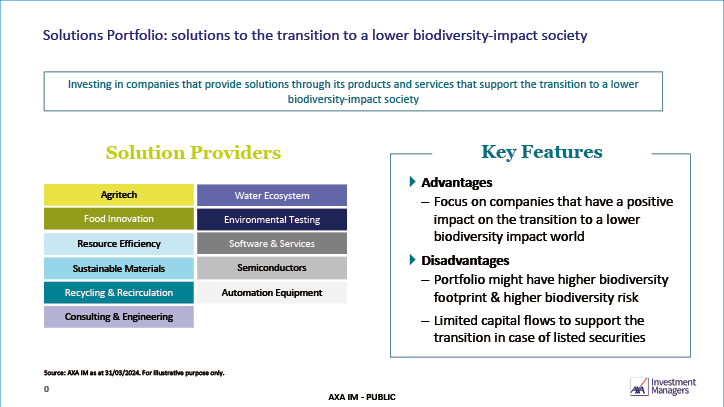

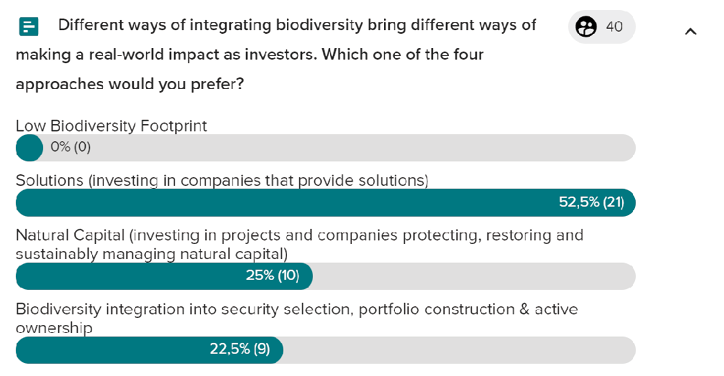

Finally, Jeroen Bos of AXA IM shared his experiences of how to implement biodiversity in a global listed equity portfolio: ”Biodiversity is an increasingly important and material topic to take into account when making investment decisions. Furthermore, the topic of biodiversity is closely linked and interconnected to Climate Change, another important topic in the investment industry. The integration of biodiversity aspects in investment Portfolios can be done in a variety of different ways by investors. During the event AXA Investment Managers shared four different ways of approaching Biodiversity in investing. Firstly, one can construct a portfolio of companies that have a very low negative impact on biodiversity through their operations and hence this portfolio will have a low biodiversity footprint. Secondly, construct a portfolio of companies that provide solutions to help society transition to a lower biodiversity impact society. Such a portfolio can clearly be very different from a low biodiversity footprint portfolio. Thirdly, construct portfolios that actually invest in Natural Capital itself to help protect and restore biodiversity. Lastly, one can simply integrate material biodiversity aspects in security selection, portfolio construction and active ownership (voting & engagement). The above clearly shows different options when it comes to thinking about biodiversity and investing and different options will also come with different ways of making an impact as an investor.”

Survey

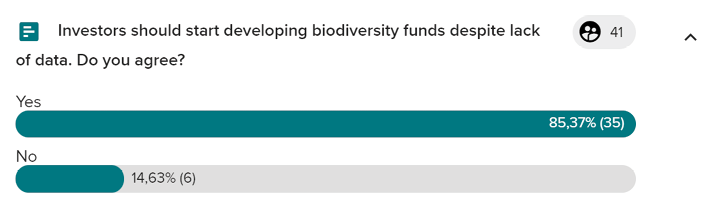

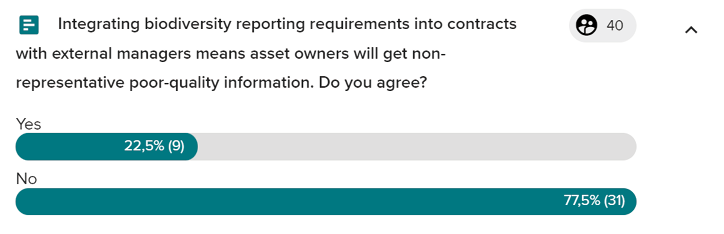

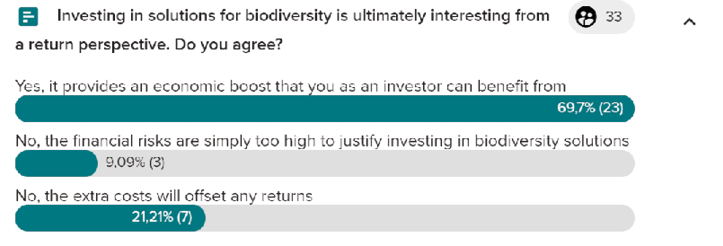

Finally, the seminar closed with a lively panel discussion around four statements:

- Investors should start developing biodiversity funds despite lack of data. Do you agree?

- Integrating biodiversity reporting requirements into contracts with external managers means asset owners will get non-representative poor-quality information. Do you agree?

- Different ways of integrating biodiversity bring different ways of making a real-world impact as investors. Which one of the four approaches would you prefer?

- Low Biodiversity Footprint

- Solutions (investing in companies that provide solutions)

- Natural Capital (investing in projects and companies protecting, restoring and sustainably managing natural capital)

- Biodiversity integration into security selection, portfolio construction & active ownership

- Investing in solutions for biodiversity is ultimately interesting from a return perspective. Do you agree?

The public could vote, and the results are shown in the overview on the right side.

Conclusions

Judging by the success of the event, as evidenced by the high turnout, positive atmosphere, audience interaction and subsequent panel discussion, it is clear that biodiversity is incredibly important to our society and global economy.

Main conclusions of the seminar are to start now with incorporating biodiversity in (strategic) investment decisions despite the lack of data. We do not have the time to wait for ‘perfect’ data to be available for decision making or reporting. Data collections will improve over time, and we have to enhance our approach on the best available methods.

Investors can make a real impact in several ways by investing in both listed and unlisted companies, where voting and engagement are fundamental to the biodiversity transition.

Investing in biodiversity will deliver a good return too by investing in solutions, however the risks and costs associated with it should be considered and justified.

In summary, biodiversity loss poses significant risks to the planet and the economy, but concerted efforts, such as the Post-2020 Global Biodiversity Framework and investment in biodiversity-friendly initiatives, offer hope for reversing this trend and creating sustainable solutions.

|

From left to right: |

|

in VBA Journaal door Martin Sanders, Ridzert van der Zee and Roy Braem