Equity markets have gone through remarkable change since stocks were invented hundreds of years ago. Since 1940, mutual funds gave investors a practical way to diversify their holdings and achieve professional asset management. With the advent of modern portfolio theory, index funds emphasized risk management and lowered investment management and transaction costs. And along the way, financial derivatives came to the foreground, giving investors flexibility in achieving their equity exposure. Now the newest milestone — exchange-traded fund — combines the benefits of its predecessors into one fund vehicle for individual and institutional investors.

Introduction

Introduction

This article reviews the history of exchange traded funds (ETFs) and also details how these products operate and discusses some of their characteristics.

Just 12 months ago, there were only 30 ETFs registered in the U.S. Only 13 of these focused on US domestic equities. Today there are 78 different portfolios available to any investor with a brokerage account, and the number of U.S.- equity ETFs has increased more than three-fold to 54. While the number of funds has risen by 160%, total ETF assets have increased by 86% to nearly $63 billion, up from less than $34 billion at the end of 1999. This growth rate is particularly impressive given the sizeable depreciation experienced by many equity markets this year. Frank Russell’s research shows that they are not aware of any other major financial product category that came close to matching the asset growth rate of exchange-traded funds in 2000. Exchange-traded funds are funds that are typically trading close to their net asset values, but unlike traditional mutual funds, ETFs trade on a national stock exchange (US, UK, Netherlands, Canada etc). Operating as index-tracking funds,ETFs boast low portfolio turnover which helps to reduce transaction costs and minimize capital gains. As the world ’s largest institutional investment manager and largest index fund manager, BGI also manages the world ’s largest group of ETFs,known as iShares. These funds are traded on the American Stock Exchange (Canadian, UK and Dutch Stock exchange),and are vailable to individual and institutional investors through any type of brokerage account. Other ETF’s have names such as “Opals”, “Spiders” “LDRS” and “Diamonds”.

History of ETF’s

The foundation and origination of the ETF’s goes back to the USA. Exchangetraded funds started gaining popularity in the US in the late seventees:

Supershares

In the November/December 1976 issue of Financial Analysts Journal, Professor Nils Hakansson published a paper titled “The Purchasing Power Fund: A New Kind of Financial Intermediary.” The theoretical “Purchasing Power Fund” envisioned a new financial instrument made up of “Supershares” that provided payoffs only for a prespecified level of market return. The underlying assets of the Purchasing Power Fund were index funds.

SuperTrust

In the late 1980s, Leland, O’Brien, Rubenstein Associates (LOR), a firm known for developing portfolio insurance products, believed there was a demand for a simplified version of the Purchasing Power Fund as a hedge product. With the backing of large institutional investors, such as the IBM pension fund, LOR wanted to create a socalled “SuperTrust” based on Hakansson’s “Supershares” ideas. In order for the SuperTrust to work, the product needed an underlying index investment that could be listed on a stock exchange and could continuously offer and redeem shares - an ETF. The U.S. Securities and Exchange Commission (SEC) had previously authorized securities that could be either openended or exchange-listed, but they had not authorized securities that could have both characteristics.

Index Trust SuperUnit

In 1990, LOR undertook the task of petitioning the SEC to allow the creation of an ETF as the underlying security for the SuperTrust. LOR chose the S&P 500 Index as the structure and named the investment the “Index Trust SuperUnit”. In 1990, the SEC issued the Investment Company Act Release No. 17809, the “SuperTrust Order”, that granted LOR specified exemptions from the Investment Company Act of 1940 (the Act). Specifically, the order granted exemptions from the rules regulating unit investment trusts and the SEC’s rules and regulations governing investment companies. The SEC also made exemptions to the rules governing the way securities are sold and exchanged. This order allowed the first ETF. After additional regulatory delays, LOR introduced the SuperTrust and the Index Trust SuperUnit in 1993. The SuperTrust and the SuperUnits offered advantages over other hedge products. However, even LOR’s simplified version of Professor Hakansson’s Purchasing Power Fund turned out to be too complex for the marketplace and the SuperTrust did not get the financial backing that LOR had hoped for. Making matters worse, demand for all hedge products had fallen off dramatically. The SuperTrust was terminated in 1996

Although LOR developed the Index Trust SuperUnit as an investment underlying a hedge product, there was some discussion of the product being valuable as a stand-alone S&P 500 Index investment. The Index Trust SuperUnit enabled investors to trade directly in the S&P 500 Index as if it were a listed corporation. Yet, the Index Trust SuperUnit was marketed and priced as a hedge product and thus was not viable on its own.

Down Comes the SPDR (Pronounced “Spider”)

The American Stock Exchange LLC, through its subsidiary PDR Services LLC and the Standard & Poors Depository Receipt (SPDR) Trust, took advantage of the SuperTrust Order to petition for and receive an SEC Order that in 1992 authorised a stand-alone S&P 500 Index-based ETF as a unit investment trust. The SPDR Order specified some additional exemptions allowing for easier exchange of shares, a concept pioneered in the SuperTrust and explained below. Unlike the Index Trust SuperUnit, the SPDR gained acceptance in the marketplace and became the first commercially successful ETF.

OPALS

In 1993, Morgan Stanley took advantage of the less restrictive regulatory environment for issuing securities in Luxembourg to create Optimized Portfolios as Listed Securities (OPALS) that are listed on the Luxembourg stock exchange. OPALS are ETFs that reflect different Morgan Stanley Capital International (MSCI) indexes. OPALS are marketed primarily to institutional investors whose governments approve the offering of OPALS. OPALS Class B shares are available in the U.S. to institutional investors with at least $100 million under management. OPALS have low expenses that range from 9 to 40 basis points. Morgan Stanley gained valuable experience with OPALS. Since OPALS are not subject to the restrictions imposed on SEC-authorized unit investment trusts, Morgan Stanley had broader investment management discretion over OPALS. Morgan Stanley had the opportunity to try out new investment techniques that would later be applied to SEC-authorized ETFs

WEBS Add Another Round of Innovations

In 1996, Morgan Stanley wanted to offer investments similar to OPALS to retail investors in the United States. Morgan Stanley joined forces with Barclays Global Investments and the American Stock Exchange (AMEX) to create World Equity Benchmark Shares (WEBS) that are similar to OPALS, but are SEC registered. Morgan Stanley drew on its OPALS experience to organize WEBS as an Investment Company, rather than a Unit Investment Trust. This innovation allowed Barclays, the investment manager for WEBS, some of the additional investment management discretion that Morgan Stanley enjoys with OPALS.WEBS are responsible for other innovations as well. While the SuperFund and SPDR pioneered the concept of exchanging shares, WEBS made a specific advance in the method of exchanging shares that acts to reduce the tax liabilities generated by the ETFs. (The SPDR and MidCap SPDR did not have this feature and this would cause a tax problem for the MidCap SPDR in particular later on.) The tax aspects of ETFs are detailed below. WEBS also used the term “index fund” in relation to their ETFs, a term previously associated only with openended mutual funds.

Dow Jones Joins In

In 1997, the SEC issued an Order covering the Diamonds ETF which is based on the Dow Jones Industrial Index. Diamonds are sponsored by the same group that sponsors the SPDRs. The Diamonds incorporated the tax benefits in the WEBS Investment Company but remained a unit investment trust. While the mechanism used to achieve tax benefit in the WEBS was implied, it was specifically stated during the creation of Diamonds.

Sector SPDRs

In 1998, the organizations responsible for the SPDRs and Diamonds abandoned the unit investment trust structure and applied to the SEC for authority to organize Select SPDRs as an investment company. The SEC issued the SPDR Order that same year containing the favorable tax language. Merrill Lynch played a key role in the development of the Select SPDRs helping to expand the marketing force behind ETFs.

Nasdaq Joins In

In 1999, the SEC issued the Nasdaq100 Trust Order under the unit investment trust structure. While the Nasdaq-100 is similar in structure to the Diamonds, the Nasdaq-100 uses a modified capitalization-weighted index as the underlying index. This modification was done for policy reasons so the Nasdaq-100 ETF itself is indirectly managed in a limited but significant way. The Nasdaq-100 trust gained quick acceptance in the marketplace.

iShares

Also in 1999, Barclays Global Investors applied to the SEC for an order covering about 50 ETFs. Barclays calls their products “iShares”. Barclays, having learned from its WEBS partnership with Morgan Stanley, uses the investment company structure to create what are best described as indexes based on Russell, S&P, and Dow Jones Indexes. In May 2000, Barclays Global Investors began rolling out a full line of iShares. With a total of more that 60 ETFs (S&P funds, Dow Jones funds, Russell funds and MSCI funds), iShares cover most of the investable world. In fact,this venture represents the first time that all four index providers have come together under any one offering

The creation and redemption process

The creation and redemption process

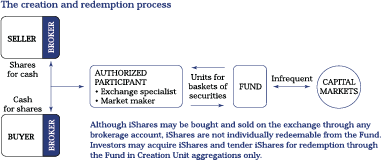

Unlike mutual fund distributors, the sponsors of ETFs do not sell ETF shares to the public for cash. Instead, the ETF sponsors exchange large blocks of ETF shares in-kind for the securities of the companies that make up the underlying index plus a cash component representing mostly accumulated dividends. The large block of ETF shares is called a “Creation Unit” which is exchanged for a “Portfolio Deposit” of stock and the “Cash Component”. Some of these institutional investors hold the creation units in their own portfolios. Others, generally broker-dealers, break-up the creation units and offer the ETF shares on the exchanges where individual investors can purchase them from brokerage firms just as they would any other listed security

ETFs are redeemed the same way but in reverse. Broker-dealers buy enough ETF shares from individual investors to make a creation unit block. The broker-dealers then exchange with the ETF sponsor the creation unit for a basket of securities and the small amount of cash. Other institutional investors will trade back the creation units in their portfolio with the ETF sponsor for securities and cash.

Creation units are continually created and redeemed due to investor demand and for arbitrage purposes. The values of the ETF track closely but do not match exactly the values of the underlying security so institutional investors can measure the price of the underlying securities in the index against the price of the ETF. If the price of the underlying securities is higher than the price of the ETF, the institutional investors will trade a lowerpriced creation unit back to the ETF sponsor in exchange for the higher priced securities. Conversely, if the price of the underlying securities is lower than the ETF, the institutional investor will trade back to the ETF the lowerpriced securities in exchange for a creation unit. This arbitrage mechanism eliminates the problem associated with closed-end mutual funds - the ETF trading as a premium or discount to the value of the underlying portfolio.

All of these creations and redemptions are very important, not only to keep the price of the ETF properly reflecting the value of the underlying securities, but also for the tax reasons discussed later. The individual investor can purchase ETF shares through the exchange and the shares might come from either individual investors or from the institutions. It is important to remember that ETFs are not mutual funds and that there is a lot of behind-thescenes swapping of securities

In summary:

As part of the share creation and redemption process, authorized participants (i.e.,institutional traders such as brokers and institutional investors) help to maintain efficient trading in the funds. Shares/security lists are transferred in-kind to/from these participants, minimizing capital gains and the level of cash required by the fund. Technically, a portfolio creation file is maintained to indicate which securities, the number of shares for each security, and the amount of cash required to make up one creation unit.(One creation unit is typically equal to a pre-set number of ETF units (for example 50,000 iShares) Authorized participants can trade baskets of cash and stocks (in-kind) helping to maintain orderly pricing in the markets.

Although ETF’s may be bought and sold on the exchange through any brokerage account, ETF’s are not individually redeemable from the Fund. Investors may acquire ETF’s and tender ETF’s for redemption through the Fund in Creation Unit aggregations only. ETFs generally have expenses that are similar to low-cost, no-load, indexbased mutual funds. Please see appendix for the expense ratios.

The global picture

The global picture

Although most of the growth in ETF assets so far has been in the US, Europe is also beginning to pick up on this trend as well as Canada, Japan Hong Kong and Australia. Even markets as Singapore are considering ETF’s at the moment.

In Europe the UK and Germany have been leading the trend to be followed by Euronext (Netherlands, Belgium, Paris) as well as the markets in Sweden and Switzerland.

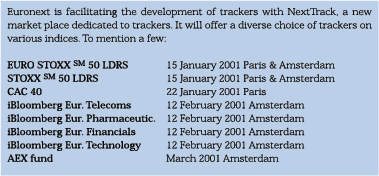

Operationally, ETFs also presented significant challenges which had to be overcome ahead of the launch. Because the BGI managed iShare: iFTSE100 created a new type of security in Europe, the London Stock Exchange needed to develop a new market for the funds. The “extraMARK ”was born out of a close collaboration between BGI and the exchange, including the development of operating guidelines and regulations. Other exchanges in the Netherlands,Italy and Germany have since initiated discussions. In April 2000 the Deutsche Borse launched its ETF segment- called the XTF Exchange Treaded Funds platform segment. In Switzerland the Swiss Stock Exchange has a LDRS (Merrill Lynch) listing and in the Netherland, Belgium and Paris Euronext launced in January 2001 their ETF segment called NextTrack.

ETF’s: A world of options

ETF’s can also be used by investors as a futures surrogate (by plans that cannot or choose not to use futures) to hedge long portfolio positions. For markets in which futures are unavailable (telecommunication stocks,for example), investors can achieve the precise exposure they need, rather than substituting it with one that ’s slightly off the mark. ETF’s can even be sold short on a downtick, unlike individual stocks which can only be shorted on an uptick.Investors can use these funds to hedge their active managers ’ positions with exposure to specific market segments and sectors.This ability to protect long positions in a falling market is especially valuable for plans that are not permitted to employ options.

Efficient cost and tax structure

With competitive expense ratios (as expample: from 9.45 basis points for the iShares S&P 500 Fund to 99 bps for the iShares MSCI emerging market funds), ETF’s offer a cost-effective solution for all investors, individual and institutional. Investors may also benefit from the funds ’tax efficiency, due (in part) to the low turnover of indexing.

Other Features of ETFs

ETFs allow investors to:

- Trade the “market” with a single investment as easily as trading a stock.

- Price, buy and/or sell at any time during the trading day

- Margin.

- Sell short. (ETFs can be sold short on a downtick).

- Execute all order types.

ETFs Compete with traditional mutual funds

ETFs, which started out as underlying securities for hedge products, have evolved over time to become products that resemble and compete against open-ended mutual funds. It is difficult to predict the ultimate success of the ETFs in part of their novelty and limited availability. At the same time, the mutual fund and brokerage industry is changing partly due to the popularity of the ETFs.

Competition on All Fronts

Before we can appreciate the effect ETFs are having on mutual funds, it is important to understand the competitive forces in the investment arena. Simply, there are primarily two parties to an institutional investment transaction: the investor buying and selling an investment and the intermediary that acts as an agent to obtain that investment for the investor. Mutual funds, money managers, etc. are the investors. The stock exchanges, electronic and otherwise, are the intermediaries. For some time a status quo existed between the two parties. Mutual funds offer shares directly to the public and compete with the stock exchanges. Mutual fund managers also purchase large blocks of shares through the exchanges and are large exchange customers as well. This status quo worked reasonably well while the mutual funds grew and the trading volume on the exchanges increased

It seems logical that more and more companies will look to sponsor ETFs.

Mutual fund managers are also pointing out ETFs weaknesses:

- It is difficult (and potentially expensive) to set up a systematic purchase agreement into an ETF. (Each ETF purchase is subject to a brokerage fee.)

- There is no toll free number to get any help or advice with an ETF. A broker or investment advisor may be needed for all but the die-hard do-it-yourself investors.

- The mutual funds settle in one day vs. three days for an ETF. ETF investors must wait two extra days to get the proceeds of selling the investment.

- Mutual funds can outperform ETFs in a rising market because mutual funds reinvest dividends continuously while ETFs generally invest dividends on a quarterly basis. Thus, cash positions can build up in an ETF which are not subject to market growth.

- Mutual funds have a bigger marketing budget than ETFs at this time.

So far it appears that their will be room in the marketplace for both mutual fund and ETF versions of popular index investments.

Conclusion

ETFs are here to stay. They have technical advantages over mutual funds. They are a good investment for suitable individual investors and are a good investment tool for investment professionals. There is a demand in the retail sector for more products that use well-known indexes. There is a growing demand in the investment advisory sector for a wider selection of ETFs using more obscure indexes. Firms such as Barclays, Merrill Lynch, StateStreet and Salomon Smith Barney are taking steps to continuously offer these products.

in VBA Journaal door Drs Marko van Bergen RBA