ALL JUST HYPE OR CAN IT BECOME THE NEW SOLAR PV?

According to the World Resources Institute, the energy sector is responsible for approximately 73% of global greenhouse gas emissions. Accordingly, directing capital towards investments that support the transition of the energy sector towards a decarbonised, decentralised, flexible, and consumer-oriented future will be a decisive factor in determining which global warming trajectory we will follow from here on out.

From a technology perspective, this primarily entails an extensive buildout of renewable energy generation capacity as well as vast improvements in energy efficiency. Furthermore, direct electrification via grid and batteries offers a cost-effective and efficient way to decarbonise many sectors. However, as the 2030 checkpoint approaches, increasing consideration is given to areas where direct electrification reaches its limits. This concerns the so-called “hard-to-abate” sectors such as industrial processes, heavy-duty transport and heating and power in buildings.

From a technology perspective, this primarily entails an extensive buildout of renewable energy generation capacity as well as vast improvements in energy efficiency. Furthermore, direct electrification via grid and batteries offers a cost-effective and efficient way to decarbonise many sectors. However, as the 2030 checkpoint approaches, increasing consideration is given to areas where direct electrification reaches its limits. This concerns the so-called “hard-to-abate” sectors such as industrial processes, heavy-duty transport and heating and power in buildings.

The use of green hydrogen, i.e. hydrogen produced through electrolysis with a clean power source or by converting waste, can offer solutions in all these areas, but often the associated technologies still lag behind in efficiency and cost competitiveness. However, with the right policies in place, and the sector starting to scale up its production and prices decreasing accordingly, there is little doubt that green hydrogen will become a crucial part of the solution to climate change. In its “Net Zero by 2050” scenario, the International Energy Agency (IEA) estimates that green hydrogen will meet 10% of total final energy consumption by 2050.

WHILE PROGRESS IS BEING MADE, INVESTMENTS IN GREEN HYDROGEN STILL NEED TO INCREASE SIGNIFICANTLY FOR A NET ZERO BY 2050 SCENARIO TO REMAIN WITHIN REACH

This article will focus on the production of hydrogen through electrolysis using wind or solar energy as a power input, as this is the dominant method to produce green hydrogen today. It aims to give an assessment of the key factors that can make such production facilities investable at scale for infrastructure capital. It therefore looks at the status quo and the progress being made, both globally and in the Netherlands, goes on to give an overview of potential offtakers, and then dives into the individual cost drivers of production in order to finally sketch out a rough timeline for the future development of green hydrogen.

STILL SHORT OF TARGETS DESPITE SIGNIFICANT PROGRESS BEING MADE

As of 2020, the total amount of hydrogen produced globally stood at approx. 90Mt, using almost exclusively fossil fuels as feedstock, which resulted in CO2 emissions of roughly 900 million tonnes, equivalent to 2.86% of global energy related CO2 emissions. Green hydrogen production therefore needs to be significantly scaled up over the coming years to both replace emissions-intensive (grey) hydrogen production methods, and to introduce green hydrogen for use in sectors previously reliant on direct or indirect (refined fuels) use of coal, oil, or natural gas.

In mid-2021, global electrolyser capacity reached just over 300MW, double the amount registered five years earlier. This increase is expected to accelerate significantly with close to 400 projects currently under development, which would account for close to 90GW capacity by 2030 if all projects reach operational stage. However, the 90GW would produce only 8Mt of hydrogen, which is an order of magnitude short of the 80Mt required under the IEA’s “Net Zero by 2050” scenario (IEA, 2021a).

When looking at corresponding capital requirements for the green hydrogen space, the situation looks similar. While progress is being made, investments in green hydrogen still need to increase significantly for a net zero by 2050 scenario to remain within reach. The 17 countries who currently have dedicated hydrogen strategies have committed at least USD 37 billion, adding to commitments from the private sector of some USD 300 billion. While the deployment of these amounts would already be a huge step, the required amount estimated by the IEA through 2030 stands at USD 1,200 billion (IEA, 2021b).

COMMITMENT TO HYDROGEN IN THE NETHERLANDS

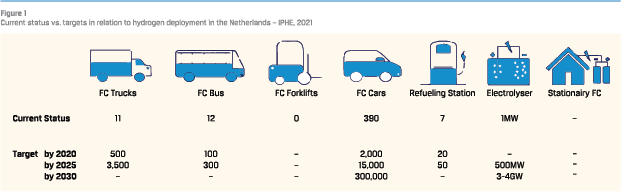

While the current hydrogen economy in the Netherlands is still at an early stage, substantial efforts are being made towards the further buildout of hydrogen energy infrastructure. The Dutch hydrogen strategy includes a target electrolysis capacity of 500MW by 2025 and 3-4GW by 2030, essentially starting from zero with currently only 1MW in operation. Similarly ambitious targets have been set for the transport sector, as shown in Figure 1.

While the current hydrogen economy in the Netherlands is still at an early stage, substantial efforts are being made towards the further buildout of hydrogen energy infrastructure. The Dutch hydrogen strategy includes a target electrolysis capacity of 500MW by 2025 and 3-4GW by 2030, essentially starting from zero with currently only 1MW in operation. Similarly ambitious targets have been set for the transport sector, as shown in Figure 1.

As part of the strategy, the country intends to leverage its large offshore wind potential in the North Sea for the production of green hydrogen. Further factors enabling the expansion of hydrogen infrastructure in the Netherlands include the wide availability of gas transport networks, high potential for hydrogen storage in salt caverns and empty gas fields, and favourable geographical position and existing port infrastructure making the country a favourite to become a global hydrogen trading hub. Initial projects are developed by large industrials and utilities such as the North Sea Port in the Scheldt Delta region where ammonia producer Yara has teamed up with offshore wind giant Orsted and utility Engie to produce green ammonia.

IMPORTANCE OF TYING GREEN HYDROGEN PRODUCTION TO ADDITIONAL RENEWABLES CAPACITIES

Since the production of green hydrogen via electrolysis requires renewable power, the two main infrastructure assets required, i.e. renewable energy plants and electrolysers, are expected to become part of integrated projects in many cases. From a systemic point of view, tying green hydrogen production facilities to additional clean power production assets is imperative, as standalone electrolysers would put a strain on power networks, increasing demand and raising power prices. Accordingly, assessing the economic viability of green hydrogen production facilities often requires an assessment that goes beyond screening the costs of commissioning and operating an electrolyser.

FROM A SYSTEMIC POINT OF VIEW, TYING GREEN HYDROGEN PRODUCTION FACILITIES TO ADDITIONAL CLEAN POWER PRODUCTION ASSETS IS IMPERATIVE, AS STANDALONE ELECTROLYSERS WOULD PUT A STRAIN ON POWER NETWORKS, INCREASING DEMAND AND RAISING POWER PRICES

Furthermore, pairing added renewables capacities with electrolysers can provide flexibility on the demand side, thereby helping to mitigate production patterns of renewable energy generation that do not match consumption patterns and therefore threaten grid stability. To illustrate: in times of low electricity demand and high renewables generation, operators are often forced to reduce the output of a generator from what it could otherwise produce given available resources. In other words, available resources are actively underutilised, leading to significant system inefficiencies. Adding flexibility on the demand side is one way to make use of this surplus energy. In times of oversupply, electrolysers can be used to produce hydrogen, which can then be either sold to hydrogen offtakers or be stored and converted back to electricity once demand is high and supply from renewable sources is low.

NO SUPPLY WITHOUT DEMAND

For green hydrogen production projects to be viable, long-term security of demand, ideally from a diversified set of offtakers, is a key requirement. Hydrogen has many promising use cases, particularly in areas that are otherwise hard to decarbonise such as ammonia and methanol production, steelmaking, heavy-duty transport, and long-term energy storage, among others.

The adoption of green hydrogen in all these sectors to a large degree depends on the availability of alternative technologies. Since electrification via grid and batteries is generally the cheaper and more efficient solution, the use of hydrogen is better placed in sectors where direct electrification is not viable. These hard-to-abate sectors often rely on large amounts of energy in dense and light form, require long-term storage capabilities or the possibility to transport energy over long distances.

SINCE ELECTRIFICATION VIA GRID AND BATTERIES IS GENERALLY THE CHEAPER AND MORE EFFICIENT SOLUTION, THE USE OF HYDROGEN IS BETTER PLACED IN SECTORS WHERE DIRECT ELECTRIFICATION IS NOT VIABLE

Accordingly, utilities in need of low-carbon options to balance their electricity grids can rely on battery technology to deal with short-term fluctuations and short discharge durations. For periodical imbalances and longer discharge durations, green hydrogen is the more economical option. A similar breaking point in terms of vehicle weight and distance, although difficult to pinpoint, seems to exist for transport applications. While battery electric vehicles are primed to dominate the passenger car segment, fuel cell electric vehicles powered by hydrogen have advantageous characteristics to serve long-haul, heavy-duty applications with a centralised base of operation and irregular routes. Finally, heating and powering buildings is subject to seasonal temperature swings. Required energy storage and discharge durations are accordingly long and cannot be served via electrification at large scales, thus making hydrogen a promising solution for the sector in the long term.

The predominantly grey hydrogen produced today is used almost exclusively as feedstock for industrial purposes such as ammonia and methanol production, steelmaking and in oil refineries. Since the infrastructure for hydrogen use is already in place in these sectors, decarbonising this existing demand for hydrogen has a better chance of success in the short term than introducing green hydrogen to applications where hydrogen is rarely used today. However, in the medium to long term, further sectors like transport and heating will be increasingly pressed to adopt low-carbon solutions to minimise their carbon footprint thus enabling a more widespread use of green hydrogen.

CHALLENGES OF GREEN HYDROGEN ADOPTION

Potential end users, regardless of the sector they are active in, are faced with several challenges when planning to switch their operations to green hydrogen. There are challenges arising from the low number of green hydrogen producers currently in the market, which brings a risk of supply interruptions. Adding to that are still immature regulatory frameworks in many regions causing further uncertainty. However, the most decisive challenges are related to the costs associated with upgrading equipment for hydrogen use and the production costs, i.e. the high price of green hydrogen compared to conventional fuels and grey hydrogen.

Without proper incentivisation, energy-intensive industries are unlikely to switch to green hydrogen in the near term, as expenses involved in the production of fossil fuel-based hydrogen production are still significantly lower than renewable energy-powered electrolysis. Today, the production costs for grey hydrogen, i.e. using non-renewable energy sources, stand at around USD 1-2/kg as compared to the USD 4-6/kg for green hydrogen. Initial examples in the steel industry such as Sweden’s SSAB producing fossil-free steel with an on-site electrolyser show that offtakers still need a willingness to pay a premium for the ability to deliver a greener product.

However, three key drivers are expected to help bridge the cost gap between green and grey hydrogen by 2030: (i) scaling up of electrolyser manufacturing, producing larger industrial-scale electrolysers with reduced unit capacity costs, (ii) higher efficiency of electrolysers, and (iii) access to low-cost renewable power. At the same time, grey hydrogen is expected to increase in price due to effective carbon emission pricing.

GREEN HYDROGEN APPROACHING COST COMPETITIVENESS WITHIN THE DECADE

Assuming a combination of the three key input drivers – economies of scale, efficiency gains, and lower costs of renewable energy production – McKinsey expects the cost of green hydrogen to be in the range of USD 2.0-4.0/kg by 2030. As outlined above, production could benefit from the classic learning curve of emerging technologies, with increasing adoption rates driving down costs. This has already been demonstrated by other clean energy technologies such as wind turbines, PV modules and lithium-ion battery storage.

Assuming a combination of the three key input drivers – economies of scale, efficiency gains, and lower costs of renewable energy production – McKinsey expects the cost of green hydrogen to be in the range of USD 2.0-4.0/kg by 2030. As outlined above, production could benefit from the classic learning curve of emerging technologies, with increasing adoption rates driving down costs. This has already been demonstrated by other clean energy technologies such as wind turbines, PV modules and lithium-ion battery storage.

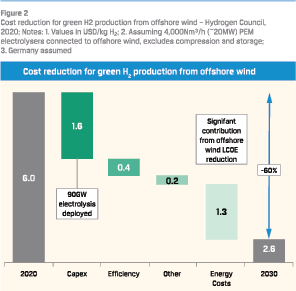

McKinsey furthermore estimates an average 60% cost reduction in the production of green hydrogen from offshore wind in Europe by 2030, which is especially relevant for coastal regions like the Netherlands. The cost reduction will be mainly driven by a substantial decrease in the LCOE of offshore wind and the larger scale of electrolyser deployments totalling 90GW, as depicted in Figure 2. Therefore, assuming an estimated cost of green hydrogen of around USD 2.0-3.0/kg by 2030, an explicit carbon price would likely still be needed to ensure financial viability compared to the USD 0.8-1.0/kg expected for the usage of grey hydrogen.

Consulting firm Wood Mackenzie estimates that a price of USD 40 per tonne of CO2 is required to achieve global cost competitiveness for green hydrogen within the next ten years, in addition to the aforementioned production cost reductions. However, Wood Mackenzie expects that, based on renewable energy costs significantly below USD 30/MWh and 50% utilisation rates for electrolysers, green hydrogen could reach parity within the same timeframe in Australia, Germany and Japan without the need for carbon pricing. With carbon prices in the EU ETS scheme reaching around EUR 80 per tonne in early 2022, things seem to be moving in the right direction.

EVEN MORE IMPORTANTLY, GREEN HYDROGEN HAS THE POTENTIAL TO FOLLOW A SIMILAR TRAJECTORY IN TERMS OF COST AS SOLAR PV DID WHILE NATURAL GAS PRICES HAVE BEEN ON A STEADY RISE

Assuming that in the future only clean solutions will remain investable, an even more relevant cost comparison needs to be made between green hydrogen and so-called blue hydrogen, i.e. grey hydrogen combined with some form of carbon capture and storage (CCS). Recent research by the Australian National University (ANU) suggests that the costs of blue hydrogen have been significantly underestimated in the past and severely questions the environmental benefits of the technology (Kurmelovs, 2021). Even more importantly, green hydrogen has the potential to follow a similar trajectory in terms of cost as solar PV did while natural gas prices have been on a steady rise. Accordingly, green hydrogen stands to become an important fuel in the future, the question is just how long it will take.

PATIENCE REQUIRED FOR INFRASTRUCTURE INVESTORS

Based on the above, proximity to industrial clusters in combination with abundant renewable energy sources would be a promising environment for infrastructure investment in green hydrogen production. Specifically, if the price difference between green and grey hydrogen is limited enough (and closing) to spur sustained green hydrogen demand from industries operating in hard-to-abate sectors, investments in hybrid opportunities involving renewable power generation and electrolysis facilities should yield attractive returns.

However, as the current production capacities suggest, the technology is still at an early stage of maturity. We can expect the investment landscape in the green hydrogen sector to follow a well-known trajectory with strategic investors such as traditional oil & gas and industrial companies entering the market early to de-risk fossil fuel activities and pursue their decarbonisation targets. Furthermore, venture capital and private equity firms are expected to become active at the early technology stage before the sector becomes viable at scale for infrastructure capital. Given the current premium required by green hydrogen compared to conventional sources and the cost decline forecast in the years to come, we expect that opportunities in green hydrogen electrolysers should become financially viable for infrastructure investors at scale in the second half of this decade.

Looking at the current green hydrogen investment landscape in its entirety, interesting projects are being developed along the value chain, from waste-to-hydrogen and electrolysis-based green hydrogen production to storage and transport-related opportunities. The associated risks – which include (but are not limited to) development, construction, operational, offtake/ credit, market/price and financing risks – do not differ materially in their nature from other infrastructure sectors and need to be assessed with the same rigour. As of now, it is too early to say how these risks are priced, and hence what the return expectations are, due to a lack of precedents that would allow for a more structural view.

HYPE OR THE NEW SOLAR PV?

Hydrogen as an energy carrier has been around for centuries now, so why have interest and especially confidence in the related technologies experienced such a surge in recent years? To answer the question posed at the outset – is it just hype or can it be the next solar PV – hydrogen, and green hydrogen specifically, stands to become an integral part of our future energy systems rather than the fringe technology it was in the past for three reasons: i) a widespread political will to adopt sustainable energy policies due to binding climate targets, ii) a growing share of renewables in the energy mix creating a need for solutions to balance energy supply and demand, particularly in the medium to long term, and iii) an adjusted focus in the hydrogen economy on areas where competing low-carbon solutions are scarce or non-existent and hydrogen-based solutions therefore have a better chance to become prevalent. Despite the green hydrogen sector still being at an early stage of maturity, it has developed into one of the most dynamic emerging sectors in the sustainable energy infrastructure space that certainly warrants close monitoring over the coming years.

Literature

- Fuel Cells and Hydrogen Joint Undertaking (FCH), 2018, Cost Reduction and Performance Increases of PEM Electrolysers

- Hydrogen Council, 2020, Path to Hydrogen Competitiveness: A Cost Perspective

- IEA, 2019, The Future of Hydrogen: Seizing Today’s Opportunities

- IEA, 2021a, Net Zero by 2050: A Roadmap for the Global Energy Sector

- IEA, 2021b, Global Hydrogen Review

- International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), 2021, Netherlands, https://www.iphe.net/ netherlands

- Kurmelovs, R., 2021, Green Hydrogen beats blue on emissions and financial cost, Australian study finds, The Guardian

- SUSI Partners, 2020, Hydrogen Energy Infrastructure: Investment Potential in an Emerging Energy Transition Sector

- Wood Mackenzie, 2019, Green Hydrogen Production: Landscape, Projects and Costs

Note

We would like to thank Dimitri Schubiger of SUSI Partners and Ruurd W. Haan of RWH Investment Advisors for valuable and constructive comments and suggestions.

in VBA Journaal door Richard Braakenburg and Lucas van Berkestijn