The development and application of a decision support model for Dutch pension funds

Summary

This publication presents the results of a research on real estate as a potential liability hedge for Dutch pension funds. Regulation (nFTK) causes the need for pension funds to implement Liability Driven Investment and to find liability hedging investment strategies. Current Liability Driven Solutions offered in the market all have their drawbacks; either they are too costly or not yet available on a large scale. Therefore a quantitative support model is developed to help professionals making a solid and thorough decision when it comes to real estate as a liability hedging investment. To find liability hedging real estate for Dutch pension investors, the model measured mismatch risk (tracking error) of 240 different (non-) listed real estate indices from the 25 most mature real estate countries with the pension liabilities.

One of the main results is that many specific real estate indices can be labelled as a liability hedge. Another important conclusion is that the sector retail has the best liability hedging potential. Second best is the residential sector, then the industrial sector and lastly the office sector. To which extent one real estate sector scores better than another depends on the preferences of the management of the pension fund and thus with the adjustable settings of the model.

Liability Driven Investment

Liability Driven Investment

Dutch pension funds have the mission to maintain a sustainable pension system by providing reasonable, preferably inflation protected pensions for all their participants against an acceptable and stable price. An analysis on the (future) environment of Dutch pension funds showed that, according to new regulations (nFTK), both assets and liabilities now have to be valued on a marked to market (fair value) basis. Consequently, nFTK links the liabilities with the investments and, as a subsequence of this, indirectly with the investment strategy of pension funds. It causes the need for pension funds to implement Liability Driven Investment (LDI).

Liability Driven Investment is a way of investing in which the main goal is to gain sufficient assets to meet all liabilities, both current and future.

LDI is a relative investment framework, which has the objective of controlling the volatility of the funding ratio. The funding ratio is defined as the sum of the assets divided by the sum of the liabilities. The liabilities take centre stage and the benchmark will now be the liabilities of the pension fund itself as they are considered to be the risk free investment. Rather than grouping investments by asset class, Liability Driven Investment groups assets by their risk compared to the liabilities. LDI introduces two portfolios, each having their own function in a LDI framework. A distinction is made between assets that fit in a risk optimizing portfolio (ROP) and assets that fit in a liability hedging portfolio (LHP). LHP includes assets which track the value changes of the liabilities as much as possible, while ROP tries to generate extra absolute return. The structure of both portfolios is as follows:

Risk optimizing portfolio (ROP)

Risk optimizing portfolio (ROP)

- Aimed at generating extra return for indexation or a reduction in premiums

- Are considered as risky investment strategies

- Contains assets that generate absolute return

Liability hedging Portfolio (LHP)

- The benchmark is the pension liabilities

- Aimed at decreasing interest/ inflation risk

- Contains assets with minimum relative risk

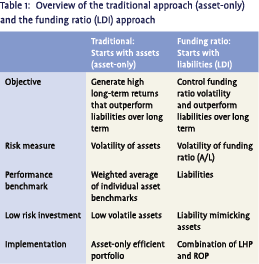

Table 1 gives a clear overview of the differences between the traditional asset-only approach and the funding ratio approach. The table illustrates that in the asset only framework investments are grouped by asset class, while the Funding ratio approach groups investments by risk category measuring them directly against the non-static pension liabilities.

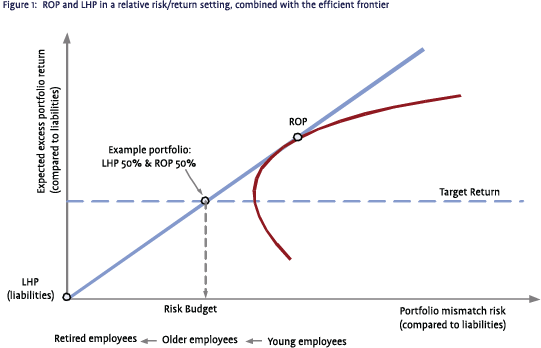

As mentioned in table 1, the new portfolio will be a weighted combination of a liability-hedging portfolio and a risk optimizing portfolio, depending on the amount of risk the pension fund is willing to take. This can be seen in figure 1, where LHP and ROP are set in relation to the efficient frontier. In essence, figure 1 features three parameters that define the context within which pension fund investors have to operate:

- The liabilities as the relative risk-free portfolio and benchmark, in theory perfectly tracked by LHP

- Target return requirement of the pension fund

- Maximum mismatch risk, restricted by the risk budget of the pension fund

Applying this new strategic framework in practice requires a different mindset from investors. Investors now have to start with the liabilities before embarking on a specific investment. Liability Driven Investment offers a solution for the marked to market valuation as well as for the stricter solvency requirements and recovery period introduced by nFTK. Furthermore, the new investment framework can be an answer to the decreasing solidarity between participants and the possible future changes in the demands of the pension participants. For example, if younger people want to take more risk in their investment portfolio, this is possible by investing a bigger share in the ROP.

Applying this new strategic framework in practice requires a different mindset from investors. Investors now have to start with the liabilities before embarking on a specific investment. Liability Driven Investment offers a solution for the marked to market valuation as well as for the stricter solvency requirements and recovery period introduced by nFTK. Furthermore, the new investment framework can be an answer to the decreasing solidarity between participants and the possible future changes in the demands of the pension participants. For example, if younger people want to take more risk in their investment portfolio, this is possible by investing a bigger share in the ROP.

One of the new key focal points of pension funds is to define and find liability hedging investment strategies for the LHP. In order to be a hedge against the value changes of the pension liabilities, such strategies must have similar risk return characteristics as the pension liabilities benchmark.

Only in this way the funding ratio volatility can be controlled. This article tries to explore such strategies within real estate.

The main question of this article is therefore the following:

Which real estate investments are candidates for Dutch pension funds to offer a hedge against the changes in value of the corresponding liabilities?

Real Estate as a liability hedge

Under the assumption of a ‘steady-state’ pension fund, an investment is a good liability hedge if its returns move with the rate of inflation and the interest rate, similar to Inflation-Linked Bonds (ILB). In other words, there is no mismatch between the performance of the investment and the changes in value of the pension liabilities.

It means that liability-hedging real estate strategies need to be more ‘ILB-like’ being influenced by interest rates and inflation in the same way as these factors influences the liabilities. The cash flow payment scheme of liability hedging real estate investments should reflect a bond, having (almost) a fixed coupon and a fixed repayment. It also means that other specific risks that influence the total returns of real estate should be minimized or avoided as they imply additional and unwanted risk (e.g. vacancy or bad location).

This implies the following characteristics for liability hedging real estate:

- The value of real estate has a similar reaction, up or down, to changes in interest rates as bonds have. The duration of the Dutch pension liabilities increased after nFTK and are relatively high. Even though it is hard to calculate the duration of real estate, it can be said that the longer the length of the lease, the higher the duration of that sprecific real estate object is.

- Low vacancy risk means a relatively fixed coupon. This other specific and unwanted risk is minimized by having a good location, high object quality, scarcity in the market or a highly regulated market.

- The higher the scarcity or the more regulated a real estate market is, the less risk an investor has that the capital growth will be a risk as well. In other words, the investor is more certain that the capital growth actually will be a positive cash flow of higher quality, just as the principal payment of a fixed income security.

- The capital growth of real estate, or principal, is based on supply and demand for real estate. Most volatility comes from the capital growth part of real estate returns. It can be argued that the income component behaves like a fixedincome asset, while the capital growth behaves more like equity. Therefore, the less weight the capital growth part has in the total return, the better its liability-hedging characteristics will probably be. The use of leverage shifts the relative importance from the income return towards the capital growth part of the total return. It means that leverage should be minimized for liabilityhedging real estate. Core real estate strategies make lower use of leverage.

- Some real estate leases offer a (partial) hedge against inflation (eg. An ‘inflation-plus’ link in Australia or an ‘upward-only’ lease in the UK), which is positive for the inflation protected pension liabilities of most Dutch pension funds.

Model

When the investments are a good liability hedge, a pension fund can then keep its funding ratio steady regulated by nFTK. As mentioned, there must be minimum mismatch between the performance of the real estate investment and the changes in value of the pension liabilities. Mismatch risk (MMR), or tracking error, is the volatility of the (excess) mismatch return. Excess return is the return on the assets minus the return on the liabilities. MMR is measured as the standard deviation of the difference between the return on the assets and the return on the liabilities. The lower the mismatch risk the better the investment is a liability hedge. In formula:

MMR = σ[ra-rl ]

Where: MMR = Mismatch risk (tracking error), σ = Standard deviation (volatility), ra = Total return of the assets, rl = Total return of the liabilities

MMR takes positive as well as negative deviations into account. As liability hedging criteria are still to be set by pension fund managers, all deviations from the mean are seen as risk. In addition, in this research, if an asset shows a higher return than the liabilities but also with a high MMR, it will be classified as a poor Liability hedge. The model made helps professionals to make a solid and thorough decision when it comes to real estate as a liability hedging investment.

To find liability hedging real estate for Dutch pension investors, the model has measured MMR of the main real estate indices with the marked to market valued pension liabilities. In total, 240 indices are used from the 25 most mature real estate countries including several different real estate sectors. The model increases insight as it uses some other asset classes like equities, fixed income and commodities as well. In this way, the mismatch performance of the real estate indices is related to the mismatch performance of the other asset classes. To verify the practical appropriateness of the model, the mismatch of some of the internal APG Investments real estate products/proposals is measured.

The pension liabilities are reconstructed by using the real yield series of Inflation-Linked Bonds (ILB) from Bridgewater and added to that, the Dutch inflation based on the consumer price index (CPI). If interest rates go down or inflation goes up, the pension liabilities increase in value. An ILB has a similar reaction to changes in interest rates and inflation. Inflation-linked bonds are designed with only one specific objective in mind, which is to protect investors from inflation. They provide a fixed real return stream, while its nominal return fluctuates with the yield curve. As inflation-linked bonds are a liability hedge in real terms, it makes them much less uncertain than long duration nominal bonds.

The following assumptions were made when the model was constructed:

The following assumptions were made when the model was constructed:

- The model is built from the point of view of a Dutch pension fund investor.

- Real estate indices are used as a proxy of real estate investment returns.

- Returns on inflation linked bonds are used as a proxy of the value changes of pension liabilities.

- The model only measures historical returns in nominal terms and is not forward-looking.

- The model is based on a steady state pension fund. It does not take into account a changing liability profile due to changed actuarial estimates.

- The model only takes into account parallel yield shifts. Non-parallel shifts like twists (increasing/ decreasing steepness of the yield curve) or butterflies (greater or lesser concavity of the yield curve) are not taken into account.

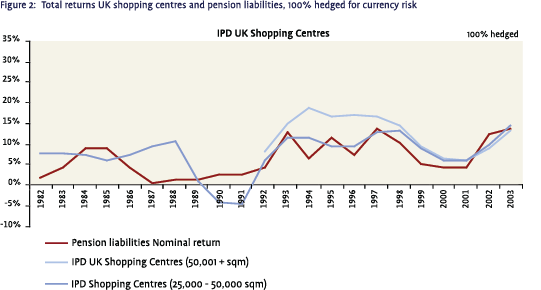

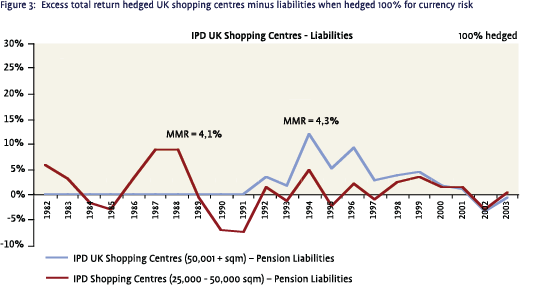

An example of a good mismatch performer is given in figure 2 and 3. Two different UK shopping centre indices appear to be a good hedge against the value changes of the liabilities. Figure 2 shows the total returns of the ILB index/the pension liabilities as well as the total returns of two UK shopping centre indices separately. The total returns of both the shopping centre indices show considerable co-movement with the liabilities. This implies a limited volatility of the difference in the returns and thus a low mismatch risk. The limited volatility is apparent in figure 3. The figure shows the excess return of the two indices compared to the pension liabilities. Mismatch risks are indicated. A mismatch risk of 4.1% means that in each year there will be 68% probability1 that the real estate index will miss the pension liabilities returns by + or – 4.1%.

One of the main results is that a lot of specific real estate indices can be labelled as a liability hedge. Another important result is that the sector retail has the best liability hedging potential since it generates the most stable direct return. Second best is the residential sector, then the industrial sector and lastly the office sector. To which extent one real estate sector scores better than another depends on the pension liability profile of a pension fund and thus with the adjustable settings of the model.

One of the main results is that a lot of specific real estate indices can be labelled as a liability hedge. Another important result is that the sector retail has the best liability hedging potential since it generates the most stable direct return. Second best is the residential sector, then the industrial sector and lastly the office sector. To which extent one real estate sector scores better than another depends on the pension liability profile of a pension fund and thus with the adjustable settings of the model.

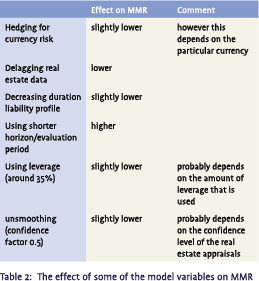

By adjusting the settings, one can see the effect of each variable on the mismatch risk of the real estate indices. However adjusting the variables naturally does have its effect on mismatch risk. Furthermore, as for a few indices both smoothed versus unsmoothed data were used as well as leveraged property returns versus non leveraged returns, the affect of these aspects on mismatch risk is taken into account as well. The following table provides a short overview of the effect on mismatch risk:

Conclusion and relevance

A new way of measuring (real estate) risk based on an innovative concept is developed. The model can calculate mismatch risk for 240 real estate indices. All these calculations are possible while the investor still has the flexibility to adjust the variables to her/ his preferences. With this model, an investor has a good way to get insight into the liability hedging qualities of real estate.

One of the main results is that a lot of specific real estate indices can be labelled as a liability hedge. Another important conclusion is that the sector retail has the best liability hedging potential since it generates the most stable direct return. After that comes the residential sector, then the industrial sector and lastly the office sector. The conclusion even holds stand after adjusting the model settings such as the duration profile of the liabilities and hedging for currency risk. However, adjusting the variables, like hedging for currency risk, naturally does have an impact on mismatch risk (see table 2). To which extent one real estate sector scores better than another depends on the preferences of the management of the pension fund and thus with the adjustable settings of the model.

Practical uses of the model are:

- Support decisions on potential investments

- Further negotiate on an identified liability hedging candidate

- Define new real estate investment strategies

- Formulate a new investment mandate

- Find liability hedges within other asset classes

The model has proved its value. It has already been used in practice to support the real estate department and the innovation committee from APG Investments in its decision to label a specific real estate investment as an innovative strategy, adding it as one of the first innovative liability hedging products into APG’s liability hedging portfolio.

The ultimate goal of liability driven investment is to improve the well-known efficient frontier, ultimately generating a better risk / return reward and thus better pensions for the participants of the pension fund. However, to really be able to do this, more research is inevitable and necessary. This research is one of the many approaches to decide on the liability hedging capacities of real estate.

Literature

- Brealey, R.A. and Myers, S.C., (1996), Principles of corporate finance, fifth edition, McGraw-Hill Education

- Brown, G.R. and Matysiak, G.A., (2000), Real estate investment: a capital market approach, Prentice Hall Financial Times UK

- Goldman Sachs, (December 2006), Reorienting Policy: From Asset Allocation to Risk Allocation, presentation

- Hoorenman, C., Kapiteyn, GJ., Van der Spek, M., Worms, C., (September 2006), Duration van Vastgoed, opening van een discussie, Onderzoek ter gelegenheid van het 4e ROZ/IVBN/VBA Research Seminar

- Hull, J.C., (2005), Options, futures and other derivatives, 6th edition, Prentice Hall

- PIMCO, (2005), A guide to Global inflation-linked bonds, publication

Noten

- Niels Coolen graduated in 2007 at the Eindhoven University of Technology. The publication is based on his masters’ thesis, which was nominated for the IVBN thesis price 2008. Niels wrote his thesis at APG Investments (former ABP Investments). He currently works as a management trainee at ING Real Estate.

- This is under the assumption of having normal distributions.

in VBA Journaal door Niels Coolen