Since the beginning of 2023, investors have been timing the first rate cut of central banks. Central banks’ mantra is “we are data-dependent”. This implies that their next policy steps depend fully on the information incoming data will provide. Inflation numbers have come down substantially, but with strong wage pressure and healthy profit margins, the last miles back to target could prove difficult. At which point is policy restrictive enough? When is the transmission mechanism of monetary policy properly working and how long does it take to observe the intended effect on inflation? Is central bank policy already too tight for too long, and should one lift their hedging ratios before it is too late? Or will the last miles of inflation prove to be more sticky and should we wait with overweighting interest rate sensitive assets? This essay covers the theoretics of monetary policy transmission and studies the current transmission of ECB’s policy in the European economy.

TRANSMISSION – THE THEORETICAL STORY

TRANSMISSION – THE THEORETICAL STORY

When discussing economics, it’s crucial to acknowledge the inherent complexity in pinpointing the precise influence of one variable on another. The circumstances of each situation can vary, making it challenging to determine precise relationships. The same principle applies to policy rates and inflation. While it is challenging to determine the precise extent to which an increase in policy rates is needed to bring inflation back to the target level, one can explain why higher policy rates would result in lower inflation.

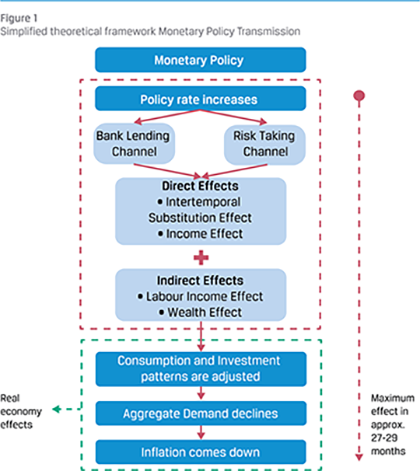

When the policy rate increases, it has a ripple effect on the overnight rate that banks pay. Additionally, as more interest rate hikes are anticipated in the future, the entire forward curve shifts higher. How do these higher interest rates impact the real economy? Research has identified multiple effects and channels through which monetary policy operates. In this essay, the focus is on the channels that feed through to consumers and businesses.

Two direct effects of monetary policy are the “Intertemporal Substitution Effect” and the “Income Effect” (Slacalek et al. 2020, Kaplan et al. 2018). The intertemporal substitution effect describes that when interest rates are higher, individuals tend to opt for increased savings and reduced spendings. For consumers this implies that it is more rewarding to put your money in a savings account then to spend it now. For corporates, as the cost of borrowing increases, they will require higher returns from new investment projects. This will make it less likely to start new ones. The second well-cited effect, the income effect, depends on your net exposure to interest rates. When you’re a net-borrower, you have a negative income with higher rates, the opposite is true for net-savers. More indirect effects are the “Labour Income Effect” or the “Wealth Effect” (Slacalek et al. 2020, Kaplan et al. 2018). The labour income effects assumes that as monetary policy is actively slowing the economy, expectations for future employment and earnings growth will decrease. Aggregate employment will decrease after monetary tightening, with the labour income being sensitive to the cycle. The wealth effect describes that rising interest rates lower the present value of your assets, such as your property, as those assets are discounted by higher discount rates. This effect makes you feel less wealthy, which would affect your consumption negatively.

Those theoretical effects feed through the economy via two different channels. The first is the Bank Lending Channel. When banks themselves encounter higher interest rate costs, they pass those costs on to their customers. We have experienced how quickly lending rates, such as mortgage rates, increase as a consequence of tighter monetary policy. This ‘Bank Lending Channel’ explains how it becomes more costly for consumers and businesses to borrow money and their ‘Lending Standards’ become stricter.

Those theoretical effects feed through the economy via two different channels. The first is the Bank Lending Channel. When banks themselves encounter higher interest rate costs, they pass those costs on to their customers. We have experienced how quickly lending rates, such as mortgage rates, increase as a consequence of tighter monetary policy. This ‘Bank Lending Channel’ explains how it becomes more costly for consumers and businesses to borrow money and their ‘Lending Standards’ become stricter.

The second channel, the ‘Risk Taking Channel’ describes that when interest rates are on the rise and central banks actively slow down the economy, the risk appetite of banks, and consequently their willingness to lend, decreases. Banks face a greater risk that their customer, now burdened with much higher costs and lower value of collateral, may not be able to repay.

As interest rate costs increase for consumers and businesses while the risk appetite of banks decreases, the total credit provided in an economy shrinks. Companies do not plan to expand their businesses or hire new employees. Furthermore, their pricing power decreases as the total demand for their business declines. Consumers try to limit their spending and postpone big expenses. With lower credit provision and reduced confidence in the future state of the economy, total consumption, and investment decrease. This, in turn, lowers aggregate demand. The labour market loosens, and workers have a weaker position in wage negotiations. Lower wage pressure from employees, decreased pricing power of businesses and reduced aggregate demand all contribute to lowered inflation.

TRANSMISSION – HOW LONG WILL IT TAKE?

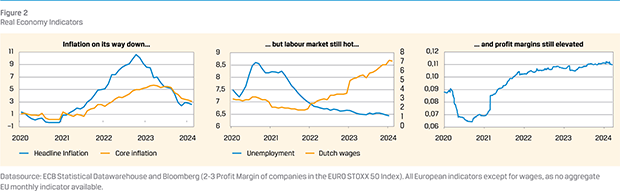

How long will it take before the maximum effect of monetary policy feeding into prices becomes evident? The Federal Reserve (FED) started hiking rates in March 2022. The European Central Bank (ECB) started four months later, in July 2022. Inflation has come down significantly since then (figure 2-1), and longer-term inflation expectations are converging closer towards 2% target levels. Does this mean that the job is done, and policy rates should be normalized before high policy rates do more harm than necessary?

THE COUNTERFACTUAL OF THE CURRENT POLICY COULD BE EVEN HIGHER INFLATION

Research agrees on one fact when talking about monetary policy lags: those transmission lags are variable and long. A meta-analysis from Havranek and Rusnak (2013) shows that the average transmission lag is twenty-nine months. So, the maximum effect on inflation (on average 0.90% percent after a 1.00% increase in policy rates) takes place after more than two years. In developed economies, this lag is even a bit longer. Recent ECB (see Lane, 2023) studies show that the maximum effect of a 1.00% increase in rates is expected twenty-seven months after the fact. The last 1.00% increase in policy rates happened from January to July 2023 for the FED and from May to September 2023 for the ECB. This theory would imply that the maximum effect on inflation is still to come.

We do have some reasons to believe that this time, monetary policy transmission will work differently. A case could be made for longer transmission lags. Chief economist of the ECB, Philip Lane (2023) explains that, compared to the Great Financial Crisis (GFC), consumers and businesses carry lower debts. Lane also states that there are relatively fewer floating rate mortgages. With more fixed rates mortgages and lower debts, consumers are better insulated from changes in the interest rate. Another reason for longer transmission lags is the tightness in the labour market. When strong labour demand is being met by labour supply shortages, strong earnings growth will put upward pressure on inflation. When the starting point of the labour market is much stronger than in previous cycles, more tightening is then necessary before the ‘Labour Income Effect’ would work. To put it differently, the counterfactual of the current policy could be even higher inflation due to tight labour market conditions. Those arguments would mean that the translation from higher interest rate to the real economy works less well and it would take longer before policy pushes down price increases.

We do have some reasons to believe that this time, monetary policy transmission will work differently. A case could be made for longer transmission lags. Chief economist of the ECB, Philip Lane (2023) explains that, compared to the Great Financial Crisis (GFC), consumers and businesses carry lower debts. Lane also states that there are relatively fewer floating rate mortgages. With more fixed rates mortgages and lower debts, consumers are better insulated from changes in the interest rate. Another reason for longer transmission lags is the tightness in the labour market. When strong labour demand is being met by labour supply shortages, strong earnings growth will put upward pressure on inflation. When the starting point of the labour market is much stronger than in previous cycles, more tightening is then necessary before the ‘Labour Income Effect’ would work. To put it differently, the counterfactual of the current policy could be even higher inflation due to tight labour market conditions. Those arguments would mean that the translation from higher interest rate to the real economy works less well and it would take longer before policy pushes down price increases.

On the other hand, many FED presidents have emphasized that monetary policy lags could be shorter than the ones observed earlier. Daly (2022) from the Federal Reserve of San Francisco elaborates on the fact that due to clearer forward guidance, financial conditions and real activity are adjusting to expected monetary policy tightening. During the hiking cycle FEDs’ forward guidance that ‘ongoing increases in the target rate will be appropriate’ contributed to the expectations that rates would increase further. This argument would imply that the translation from policy rates to the Bank Lending and Risk-Taking Channel work better, as higher policy rates are being priced in long before the fact happen.

I have now covered the theoretical journey from policy rates to inflation and the length of this effect. Let’s explore whether current European data provides practical evidence for these transmission channels.

EUROPEAN DATA – REAL ECONOMY

The latest economic data on inflation shows that both headline and core inflation are trending downwards (figure 2-1). But the European unemployment rate is showing no signs of labour market easing and wages and profit margins are still edging higher (figure 2-2 and 2-3). As rising wages adds to services inflation, the ECB urges that more information on wage data is needed, before they can claim victory and start lowering rates.

The question arises: Will the last miles for inflation follow orderly? Or will the tightness in the labour market and the apparent strength in corporate pricing power prevent central bank from releasing their restrictive stance? Figure 1 illustrates how policy changes first filters through the Bank Lending Channel and the Risk-Taking Channel before it is expected to impact the real economy. Therefore, it is necessary to take a step back and assess how monetary policy transmitted onto the banking system, before it affected the real economy

EUROPEAN DATA – BANK LENDING AND RISK-TAKING CHANNEL

EUROPEAN DATA – BANK LENDING AND RISK-TAKING CHANNEL

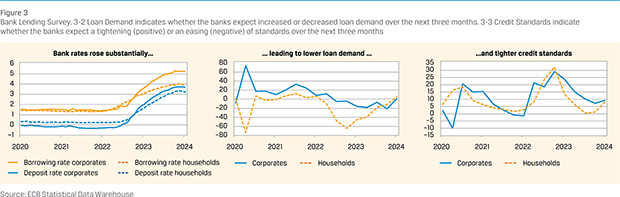

Figure 3-1 confirms that higher interest rates transmitted to both households and corporates. European data until January ’24 reveals that the average borrowing rate for households rose to 3.87% and for corporates to 5.22%. Analyses conducted by the ECB (see Lane 2023, Chart 17) show that when comparing the response in bank rates to hiking cycles in 1989, 1999, and 2005, the relative response is quite significant. This suggests that banks are indeed passing on the higher rates to their customers, providing evidence of a successful ‘Bank Lending Channel’.

The Bank Lending Survey (BLS) provides insights into how banks perceive loan demand and credit standards. The survey captures a forward-looking component by asking banks about their expectations regarding the development of loan demand and credit standards in the next quarter. When observing the BLS outcomes since the start of the tightening cycle, the data shows tighter central bank policy is transmitted successfully into tighter credit standards and lower loan demand (figure 3-2 and 3-3). However, the latest data shows that even though bank rates are still at their peak, both loan demand and credit standards have improved quite a bit.

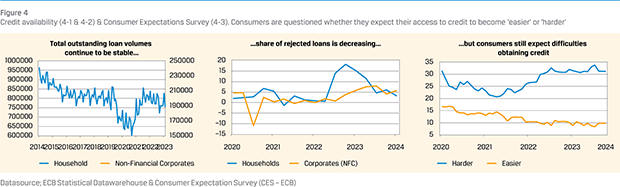

DATA SEEMS TO SUGGEST THAT THE MAXIMUM EFFECT IS ALREADY BEHIND US

When looking at other figures of credit, a mixed picture is drawn. Figure 4-1 shows that tighter policy did not translate into lower total outstanding volumes of loans that are running on banks’ balance sheet. And although the share of rejected loans for both households and corporates increased substantially at the beginning of the hiking cycle, those rejection rates are currently trending downwards. Since 2020, the ECB has been conducting the Consumer Expectations Survey (CES), which captures consumers’ expectations regarding the future state of the economy. In this survey, consumer express their expectations about their access to credit for the next quarter (Figure 4-3). Those expectations show that ever since the ECB started hiking, consumers expect their access to credit the next quarter to be harder than the previous quarter.

When looking at other figures of credit, a mixed picture is drawn. Figure 4-1 shows that tighter policy did not translate into lower total outstanding volumes of loans that are running on banks’ balance sheet. And although the share of rejected loans for both households and corporates increased substantially at the beginning of the hiking cycle, those rejection rates are currently trending downwards. Since 2020, the ECB has been conducting the Consumer Expectations Survey (CES), which captures consumers’ expectations regarding the future state of the economy. In this survey, consumer express their expectations about their access to credit for the next quarter (Figure 4-3). Those expectations show that ever since the ECB started hiking, consumers expect their access to credit the next quarter to be harder than the previous quarter.

The combined information from the Bank Lending Survey (BLS) and the Consumer Expectations Survey (CES) provides evidence of transmission from monetary policy via the two channels. Higher policy rates increased bank rates for both households and corporates. Banks expected lower loan demand, tighter credit standards and rejected loans more often. Consumers also expect their access to credit to worsen. However, the data seems to suggest that the maximum effect on credit accessibility is already behind us.

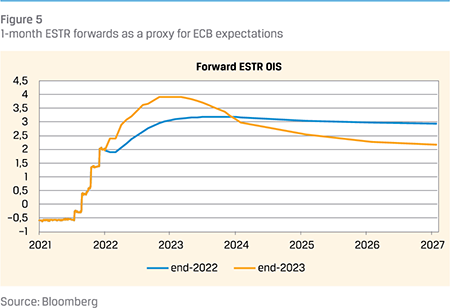

To understand this better, we should return to the argument Daly made about shorter monetary policy lags. She mentioned that due to better forward guidance, future expectations of policy is already priced in markets. This theory also applies for the ECB, even without forward guidance. Figure 5 shows that markets can price easier policy in the future and thereby moderate the tightening stance of the central bank. The picture shows that even though the policy rate between end-2022 and end-2023 increased, rates from maturities after 2025 where lowered due to expectations of easier future policy. Regardless of the communication of the ECB, who tried to convince markets the job was not done yet. This challenges the transmission via the Bank Lending and Risk-taking Channel.

To understand this better, we should return to the argument Daly made about shorter monetary policy lags. She mentioned that due to better forward guidance, future expectations of policy is already priced in markets. This theory also applies for the ECB, even without forward guidance. Figure 5 shows that markets can price easier policy in the future and thereby moderate the tightening stance of the central bank. The picture shows that even though the policy rate between end-2022 and end-2023 increased, rates from maturities after 2025 where lowered due to expectations of easier future policy. Regardless of the communication of the ECB, who tried to convince markets the job was not done yet. This challenges the transmission via the Bank Lending and Risk-taking Channel.

CONCLUSION

The theoretical framework of how central banks influence the economy through policy rate increases is clear. Data on credit creation shows that the channels via which this policy should work are properly working. Higher policy rates resulted in higher borrowing cost and deposit rates. Bank lending conditions worsened and consumers expect their access to credit to deteriorate. Inflation came down substantially, and inflation expectations seem to be firmly anchored.

The central banks’ objective is to time their policy in such a way that future effects are sufficient to bring inflation back to target without triggering too much economic pain. As literature indicates that it could take several more months before the maximum effect on inflation is visible, and considering our proximity to the inflation target, it is very well plausible that the first rate cuts will materialize in the near future. But as financial markets are already pricing an easing cycle for quite some time and some real economy indicators continue to be strong, central bankers will be careful in easing too fast and too quickly. The ECB wants to be predictable, but as suggestions regarding easing can lead to overly enthusiastic markets frontrunning potential rate cuts, they are careful in their communication. The path ahead continues to be hard to predict, as the effects on the real economy comes long after the monetary policy changes. It is only upon the reversal of such policies and a considerable passage of time that conclusions regarding the sufficient level of restrictiveness can be drawn. We are therefore left with no choice than to follow their mantra to be data dependent: economic indicators will be our guiding light.

Literature

- Daly, M.C. (2022) ‘Policy Nimbleness Through Forward Guidance’ San Francisco FED (www.frbsf.org)

- Havranek, T., & Rusnak, M. (2013). Transmission Lags of Monetary Policy: A Meta-Analysis. 33rd issue (December 2013) of the International Journal of Central Banking.

- Kaplan, Greg, Benjamin Moll, and Giovanni L. Violante, 2018, “Monetary Policy According to HANK.” American Economic Review, 108 (3): 697743.

- Lane, Philip (2023) ‘The euro area hiking cycle: an interim assessment’ Lecture at the National Institute of Economic and Social Research (www.ecb.europa.eu) Chart 2

- Slacalek, J., Tristani, O., & Violante, G. L., 2020. Household balance sheet channels of monetary policy: A back of the envelope calculation for the euro area. Journal of Economic Dynamics and Control, 115, 103879.

in VBA Journaal door Anke Cornelisse