MINDSET MATTERS BOTH WAYS TO REDUCE THE ROLE AND IMPACT OF BIASES AND HEURISTICS

INTRODUCTION

Investing and financial markets are two components underpinning the science of Economics. Subsequently, Economics in itself, features in the wider group of social sciences. Whilst the use of models can add value in this space, information analysis and decision making are always propelled by human behavior. The behavior of economic actors is influenced by their characters, moods and emotions at the time of ‘acting’ and wellknown behavioral biases and heurists. Behavioral characteristics, or so-called traits like attention to detail, curiosity, creativity, perseverance and drive are all important in investment management, but are also key ingredients to, for example, the career of the most successful professional athletes. In both professions, the stakes are high and performance is measured, transparent and compared by the entire (financial) world. These traits, combined with ‘technical’ financial knowledge were evidenced by individuals uncovering irregularities at firms like Enron, MBIA, Wirecard, Madofffunds and even the underpricing of risks in subprime mortgages during the 2000s. In other words, these personality traits are very relevant as part of the due diligence (DD) process on investment managers to uncover both true alpha as well as risks. It also goes both ways. Not only is it about how traits and the character of persons matter when performing a DD, it is important to understand which traits of an investment team are important to assess during a DD. The secular shift towards ESG- and impact-investing and increased focus on engagement activities by asset owners and managers will further increase the role of these personal traits for the investment industry in general.

This article explores the traits of a DD-team and the traits of an investment manager to be assessed during a DD as just one part of an extensive set of activities performed throughout a comprehensive DD that can improve the quality of the DD‑results. However, these traits are not just relevant for a DD, but these are in general important traits and skills for all investment professionals to pay attention to in our challenging and continuous evolving environment. Likewise these traits are relevant to embed in teams consisting of regulatory professionals, corporate finance experts and investment bankers as well as forensic accountants.

First, this article starts with describing where the assessment of traits fits in the DD-process and why it matters. Subsequentially, it describes the traits relevant for teams performing a DD. The next paragraph elaborates on the traits of the investment team to be assessed during the DD process. Lastly, this article concludes with the two key takeaways for CIO’s or managers who are responsible for DD-activities, but these are similarly relevant for investment professionals in general.

BEHAVIORAL CHARACTERISTICS: WHY IT MATTERS AND WHERE IT FITS WITHIN THE DD-PROCESS

Assessing an investment manager as well as making continuous decisions on investments in a portfolio requires searching for and analyzing information succeeded by decision making. In the last decades, numerous papers and books have shown that both of these processes (information processing and decision making) are prone to human biases and heuristics.2 Therefore decision making in investing never recedes to rational decision making, nor is it entirely quantifiable like in Physics. Biases and heuristics are determined by, among other factors, behavioral traits of a person as well as his emotions and mood at specific moments in time. Paying attention to these traits, or otherwise stated the personality and character of people involved, is instrumental for all investment professionals. This article will show how this relates to DD.

REFLECTIONS ON EXPERIENCE WITH DD AND THE ROLE OF TRAITS WITH BOTH INVESTMENT PROFESSIONALS AS ACADEMICS

The assessment, observations and statements in this article on the role of traits in the DD-process are based upon combining 25+ years of DD-experience and investment decision making with being a lifelong student of behavioral finance. The observations on DD’s include DD’s on a wide range of investment strategies and asset classes, but also assessing how other investment managers and/or teams perform DD’s. That experience informed me about the universal role of traits for a broad set of investment strategies. The traits listed below are also informed by the traits acknowledged as important for investigative journalists, forensic accountants and intelligence agents. These professions, like DD- and investment activities, entail deep dive research in a wide range of information sources, overcoming hurdles and obstacles along the way and subsequently derive conclusions. The assessments and observations in this article are of my own, but during my entire career I have reflected upon these matters with both colleagues as well as academics. In other words these are based upon abductive reasoning.

PROFESSIONAL SPORTS AND INVESTING SHARE LOT OF SIMILAR REQUIRED TRAITS

The article does not cover the financial and quant skills that are directly related to an investment process. Reason being is that these depend upon the investment strategy. However, there is a continuum, overlap and cross dependency between individual behavioral traits versus pure technical skills and abilities. Two important social traits, being cooperative and having a team mentality, are addressed as combined with the individual behavioral traits these will improve the quality of the analysis and decision making of the team.

ASSESSMENT OF TRAITS AS A CRITICAL PART OF THE DD-TOOLBOX

My humble goal is to describe several important traits to consider during a DD process and why these are important. Each part of the investment process, including decision making, that is assessed by a DD-team is influenced by human behavior impacted by traits. So, the objective for listing these is to use the list when building a DD-team and performing the actual DD. Deliberately paying close attention to traits and assessing these during a DD will add to the comprehensiveness and quality of the process as well as the assessment of the investment manager and his team. It improves the understanding of the investment process and assists in identifying minor and major risks in the strategy and the investment management organization. Subsequentially, it also matters for decision making regarding in or out as well as sizing the investment in the manager. Therefore it also relates to risk management and it is relevant for both Investment DD-(IDD) and Operational DD-processes (ODD).

The traits in the two subsequent paragraphs are relevant for both DD-teams and an actual investment teams, though their degree of importance differs. The relative importance relates to the following factors:

- The number of decisions a team makes.

- The role and potential usage of feedback without too much delay.

- The ability and costs to adjust the investment decision afterwards.

A DD team investing in just a few managers on an annual basis will be less able to learn from its decisions, compared to a manager investing in listed equities with a relative diversified active investment approach. The latter can learn from making hundreds of investment decisions, including sizing and trading, each year, thus learning from recent experiences when applying the process. Mauboussin (2012) expands on this point further. In addition the portfolio manager (PM) can easily adjust positions if he determines he wants to exit. This contrasts with investing in private equity or funds with longer term lock-ups funds or even directly in illiquid private investments. For these investments, both the IDD and ODD-teams or the investment management team has to make sure it has done all the thorough efforts and deep dive research before making an investment. Adjusting afterwards, based upon new information that potentially could have been uncovered during the DD process, often results in significant transaction costs switching to another manager. Therefore traits like being skeptical and surgical are relatively more important for the latter strategy

OBJECTIVES OF A DD: FINDING A STRONG PERFORMER AND UNCOVER MOST OR ALL RISKS

Selecting an external investment manager and assigning mandates worth millions or even billions of Euros requires a high level of fiduciary duty. Risks associated with selecting a ‘disappointing’ manager can result in monetary losses like lagging performance or misappropriation of funds in the event of fraud, but also less directly through performance drag from locked up capital, switching costs to another manager, reputational risks and even claims from asset owners or beneficiaries. Therefore, a thorough and structured DD is required to reduce above stated risks. It adds to the quality of decision making and documentation of the different steps and being more comfortable with the selection. However, one should never rule out the possibility that investments turn out different than expected.

The initial stage of a DD process involves describing the objectives and scope of the DD. In this article, the aims of a DD are to provide an extensive and thorough assessment of the quality of an investment manager and its ability to deliver upon the investment objectives of the asset owner. I.e. delivering at least the expected (relative) performance within the agreed upon risk- and ESG-parameters. Some of the most important activities of a DD are:

- Assessing the quality of the investment philosophy, process, team, firm and its ESG qualifications.

- Assessing the consistency across the triangle of: investment process as described in the document like a Requests For Proposal, b. verbal descriptions of the process and most importantly, c. detailed performance analysis. This assists in assessing if historical performance was achieved via luck or skill.

- Identify red flags that can result in risks after making the investment. This concerns both IDD and ODD-topics which potentially can be mitigated or avoided via contractual agreements or organizational adjustments.

The scope of the article is not specifying all the different steps, stages and analysis of a DD process and subsequent decision making. However, awareness of behavioral biases and heuristics is part of each step as performing each stage is influenced by humans and not just a pure technical exercise. It always includes judgement around which information to use, the observations from data analysis, reflections on interviews etc. This determines the behavioral requirements of the team performing the DD. These are described in more detail in the following paragraph.

BEHAVIORAL TRAITS OF DD-TEAMS AND RELATED TOOLS & TECHNIQUES

This paragraph describes the basic traits each DD-team needs to have. It additionally lists several related behavioral tools and techniques that can assist the DD-team.

TEAM TRAITS AND COMPLEMENTARITY

TEAM TRAITS AND COMPLEMENTARITY

As stated above, a DD requires a range of different steps and a very thoughtful and meticulous approach. This can only be achieved if the DD team, besides having the investment and analytical skills, data and tools, sufficient time and budget, has a range of essential behavioral qualities among them. It is not required that each member exhibits all traits, however a CIO or manager leading DD-activities must assess if each trait is sufficiently present across the DD-team. Not only should each trait be present in the team, the team also needs to use all traits at each stage of the DD. These traits are important for the depth and breadth of the analysis and reduce risks from biases and heuristics during this process. Figure 1 contains the list of important traits after which the role of each trait in the DD process is substantiated. One should note that it is often the amalgamation of several traits that makes the role of these traits for a DD easier to comprehend. A CIO has to spend sufficient time to assemble a DD-team that has all traits, but also the complementary additional investment and analytical skills. Explicitly: the proper composition of the team. He should pay special attention to the complementarity of characters, skills and traits, but also on how associates or juniors can be part of a team to train and mentor these persons. In addition, when performing an update DD on a current external manager always at least one pair of fresh eyes should be included. It reduces endowment effects, anchoring and confirmation biases. Finally, to round off on team traits, diversity in the team and a ‘healthy’ level of staff turnover is appropriate to reduce group think, but it should not be to the detriment of decisiveness.

SIDESTEP: ARE INVESTING AND SPORTS ALIKE?

It is by no means a coincidence that several of these traits are also important in professional sports and some of the tools and techniques stated below are derived from analytical tools and concepts used in sports to increase the odds of the outcomes of skill versus luck.4 Also there have been examples of coaches that have been used by investment firms, not to explain how finance works, but to share information on how an investment team can learn how to assess and use traits and skills related to ‘performance’ in multiple ways. Professional cycling, football, and even F1 teams are continuously updating their ‘hardware’ and combining it with psychologists to improve performance, thereby bridging the gap between art and science, but also combining soft skills with hard skills. Investing and performing DD is comparable to professional sports at the highest levels and this comparison is amplified as the stakes are similarly high.5 These high stakes are not based on the extent of ‘fame and glory’ achieved, but instead the millions and billions that can be gained or lost when selecting and sizing an investment and especially an investment manager.

In the next subsections the background of the traits is explained.

DRIVE AND PERSISTENCE ‘DRIVES’ DD QUALITY

Drive and a passion to achieve strong results for clients and beneficiaries are maybe the most important traits for a thorough DD and amplify the impact of the other traits. One might have a curious mindset, embrace critical thinking and have attention to detail, it still requires going for the extra mile to uncover risks and seek an ever wider set of available information. Drive ensures the DD will be both sufficiently broad and deep. Drive and determination also assist in the thorough preparation for the DD-meetings with the investment team, including preparation for different scenarios across a DD-process as well as during meetings. One needs to study the portfolio in sufficient detail as well as the fundamentals of companies in the current portfolio and/or previous positions to go in depth with the PM and analysts to assess the quality of their analysis and portfolio management skills. Otherwise, one would take their observations and investment conclusions for granted, while being unable to challenge them with varying views. It could result in falling into the trap of anecdotal evidence.

DETERMINATION AND NOT GETTING CLEAR ANSWERS AS A RED FLAG

During the process, the team has to be determined to have their questions answered whereby its members also understand the reasoning behind the answers. If the manager does not want to answer a question or evades it, one should carefully consider if one wants to proceed with the DD and a potential subsequent investment. A DD-team has a fiduciary duty towards its employer and beneficiaries to be determined to undercover and understand all issues.

CURIOSITY, CRITICAL THINKING AND BEING SKEPTICAL COMBINED WITH CREATIVITY REDUCES BIASES AND BEING NAÏVE.

Any member of the DD-team has to be sincerely interested to understand the entire investment process and be willing to critically assess and validate its foundations and the execution of the process. One trait in line with curiosity and critical thinking is a skeptical mindset and embrace the ‘trust but verify’ mentality. That latter trait, combined with persistence and perseverance and creative thinking can overcome availability and confirmation biases and avoids neglect. This entails putting the effort into finding different information sources, interviewing additional people etc. In other words, a deep dive in the ‘dark matter’, activities and processes that are harder and less often or not researched, and seeking non-conforming evidence. It also includes playing devil’s advocate, especially towards the finalization of the conclusions of the report, i.e. the decision making. Preferably this includes a pre mortem as well. These techniques also assist in overcoming herding behavior. Again, drive is important as often times one encounters interference, resistance or even obstruction when researching unexplored ‘territory’, sometimes even within its own company. Critical thinking also assists in avoiding basing conclusions on lively anecdotes of past, usually profitable, investments of the manager or being deluded when bombarded with a breath of mostly irrelevant information. In addition to avoiding availability and information biases, critical thinking also reduces the risk from representativeness biases.

DUE DILIGENCE IS NOT TICKING THE BOX, BUT THINKING OUTSIDE THE BOX

Traits linked to creativity are also being flexible and agile. The investment industry is changing constantly and investment processes differ between managers and even more between asset classes. Being sufficient flexible is an important trait for the DD-team, especially when researching unexplored territory.

TRUST BUT VERIFY AND CONSISTENCY CHECKS

A ‘trust but verify’ and a skeptical mindset are both important for the consistency checks in a DD as one of its goals. I.e. assessing if statements in a RFP are consistent with the verbal explanation of the process by the investment team members as well as the subsequent actual and historical investments (sizing, trading, etc.). Trust but verify also comes into play after a DD meeting, when one digests and recaps the breath of information. If one cannot comprehend the information or inconsistencies are identified and concerns arise, one should address it again and again until the issue is resolved. Traits as determination and perseverance are again important for this.

ANALYTICAL SKILLS: METHODOLOGICAL, DISCIPLINED, STRUCTURED, ATTENTION TO DETAIL AND SURGICAL PRECISION

A DD-process should never be a chaotic unorganized set of activities. It requires a methodological, disciplined, structured, well thought out planned set of activities. This reduces risks linked to neglect and the availability bias. It is important to determine the objectives of each step in the DD-process, the meetings, the different analyses and how to structure all information gathered in such a matter that an informed conclusion can be made. Preparing, examining and digesting all the information sources during the DD-process requires having sufficient analytical skills within the team. Also part of the analytical traits and skills in this article is sufficient attention to detail and being surgical in ‘peeling down’ the investment process and performance attribution from high level characteristics, to the individual parts like positions and trading decisions.

SELF-CONFIDENCE

Last but not least, one important trait is having sufficient selfconfidence in one’s ability to assess the breadth and depth of the information and being comfortable (‘no stress’, ‘no fear’) to discuss these at an informed level with the PM and analysts. I.e. not being submissive. Self-confidence is partially ingrained (or not ingrained) in the individual, but can be enhanced by the combination of experience with DD’s (number, frequency, breath of strategies). The drive and determination to be thoroughly prepared on the investment process, attribution, single historical and current positions, bios of team members, information from background checks can also increase the level of self-confidence ahead of the DD-meetings. One must also be convinced that there are no meaningless or foolish questions. If one worries about asking the wrong or stupid question, one is already inclined to err on the side of caution of not asking the final decisiveness question to get to the bottom of an issue.

Often times the representative of an investment manager is a very senior person and respected both insight and outside the firm, i.e. an ‘authority’. This does not mean one should not ask a diverse set of detailed questions. One should also not shy away from insisting on a clear and direct answer to a question instead of an evasive answer. Being skeptical, having self-confidence combined with a determination to continue to ask questions to resolve an issue is especially important during an ODD to avoid any potential fraud risks in the investment infrastructure or operational processes and procedures.

COOPERATIVE AND TEAMWORK MENTALITY

The DD-process, including the resulting reports and conclusions, involves the combined effort of a diverse team and a range of difference analysis. For both the analysis and the decision making to arrive towards the final DD-conclusions requires being cooperative and having a teamwork mentality combined with the other traits. The manager of the DD-team plays a crucial role to actively solicitate the individual team member, often times somewhat different, conclusions to arrive to a final recommendation or view. For this purpose the process of deliberating with each other is as important as the analysis itself. Synergies arise from being cooperative and having a true teamwork mentality. This implies being curious in and having an open mindset towards different opinions within the DD-team itself and actively solicitate contradictory opinions.8 Having drive, attention to detail, perseverance and being curious is one part. Having a process to digress on the wealth and breath of information and diverse opinions and bringing it together in a manner that debiases the decision-making process is the second part. The DD-team leader plays a crucial role in preserving that the decision-making structure is in harmony with the behavioral traits and structure and diversity of the team.

ADDITIONAL BEHAVIORAL SKILLS AND TOOLS USEFUL FOR DD-PURPOSES

In addition to the traits above, several skills and tools linked to behavioral traits are relevant in a DD. The first two are important for the DD-team to incorporate, while the remainders are relevant for assessing the behavioral characteristics of the investment manager.

- Cross-examination and communication skills. This concerns skills related to the proper sequencing of topics and questions for a meeting and how to phrase these questions. The latter not only relates to using open or closed questions, but also the specific language used and tone of voice. Especially when going over historically negative contributors to performance or issues at the investment team or firm, this might feel ‘confronting’ for a PM. One should not shy away from these critical questions. Discussing how these negative events occurred, how he or she responded and how he or the firm has learned from them, should be done in a professional manner.10 The DD-team members should avoid letting the conversation run out of control. The way the investment manager responds to challenging questions is also informative in itself. Cross-examination and communication skills can be informed by seeking assistance from investigative journalists or (ex)-intelligence agents.

- Negotiation skills: Negotiating fees and other contractual terms, often times at the latter stage of ‘positive’ DD’s, requires a list of additional skills and traits for which some are unrelated to the above. However, these are important to incorporate somewhere in the firm as the negotiations on terms are the cheapest means to improve upon actual results via cost reductions and modification or exclusion of risks. Terms may include but are not limited to: fees and expenses, key men clauses, most favored nation clauses, redemption terms, liability risks etc. How to negotiate, including the sequence of matters, use of language, also requires certain skills and traits. Negotiation courses or procurement departments can be used to acquire these.11

- Background checks on key individuals of the asset manager will further improve the assessment of the characters of the persons responsible for the investments. It includes verification of bios, reviewing public judicial filings of the corporation and most importantly it’s key decision makers. Several specialist firms operate in this field. One can draw parallels with when your firm hires senior staff. It will also assess behavior during interviews and frequently will perform background checks. Why not doing so when allocating billions on behalf of your beneficiaries? In addition, interviews can be held with departed employees and previous investors to gain further insights into, among others, the behavior of key persons.

- Behavioral analytics: These analytical tools assess behavioral decision-making regarding sizing, but most importantly trading in and out of winning versus losing positions. These tools magnify the information about the actual buying, selling and sizing process of the manager. It is used to assess the consistency of the process in writing and by verbal account of the PM with actual behavior around winners versus losers. It will inform you about the role of loss aversion and endowment effects. Several specialist firms on behavioral analytics have tools available to offer these insights if provided with daily position data (Inalytics, Cabot).12 These techniques can also be used, however somewhat adapted, to both quantitative strategies and private investments. For the latter it relates to assessing potential historical behavior on ‘throwing good money after bad money’ investments and timing of exits.

BEHAVIORAL TRAITS OF THE INVESTMENT MANAGER

This paragraph provides an overview of the behavioral traits of an investment manager, those of their underlying team members, and their role to be assessed during the DD process. The scope of these traits and skills is broader than those listed for a DD-team as described above. Reason being is that the investment manager is the one who has the discretion to operate within the guidelines and is actually making the investments on a daily basis. This also implies increased tension caused by significant market events (leading to potentially fight or flight reactions with respect to portfolio management), fundamental developments in companies or the negotiations of private investment deals with numerous stakeholders. Due to size limitations, it is not possible to go in depth into each of the traits to be assessed, and how these are directly or indirectly related to investment behavior including potential biases and heuristics. However, because this article concerns behavioral elements relevant in DD, an overview of the relevant traits of the manager itself should be included. The traits should be assessed and documented by the DD-team and evaluated in relation to the investment strategy, process and results achieved. Namely once again the consistency assessment between the process in writing, as implemented by the team and subsequent results.

ASSESSING TRAITS OF THE KEY DECISION MAKERS, THE PM AND IMPORTANT INVESTMENT TEAM MEMBERS

An assessment of the traits of both the PM and other potential key decision makers should be made as well as other important investment team members, including analysts. The importance and role of traits and skills often differs between them. Furthermore, as stated in the previous paragraph all the traits important for the DD-team are also important for actual investment teams. For the sake of completeness, these are included in the list below.

SPECIAL ATTENTION TO KEY DECISION MAKER FOR INVESTMENTS AND THE BUSINESS

The most important reason to place particular focus on the personality of the key decision makers is that personality is ingrained and hardly changes over time. Therefore it will be present during the lifecycle of the investment and likely to be especially present across financial cycles and/or periods of poor performance, in which emotions and cortisol levels increase. Also the personality of a key decision maker is likely the dominant factor driving the philosophy, process, strategy, how he works with staff and not the other way around. As stated above, there should be considerable consistency between his character, personal traits and skills and the way he invests. In other words, character and personality should be significantly reflected in the investment strategy and process of an investment manager (besides his investment skills). Therefore, especially if the ultimate success of both the company and investment strategy is determined by a single person, a deep dive into his traits and skills is required. This includes a detailed background check. If the personality of the key decision maker does not match with the required traits for the specific investment strategy, process and team set up, then a red flag should be raised: avoid a PM wearing a straightjacket that does not fit him.

Character and traits are important in how a person manages the investment, but likewise as much as how he manages the business, the people in the organization as well as how he treats and works with his current, past and future investors and service providers. Also this management behavior has to be consistent: for instance pleasant and friendly to his investors while not being a bully for analysts, traders or brokers either. The DD should also assess his motivations to set up the business and investment strategy: are these consistent and sufficiently aligned with its investors?

USE A STRUCTURED APPROACH INSTEAD OF JUST INTUITION TO GENERALIZE ABOUT A PERSON’S CHARACTER

It is very natural for people and almost automatic to review personality and character, but it is similarly natural to make a mistake at an unguarded moment to fail to assess and/or missing just a relevant personal trait to make a proper assessment. Intuition in the assessment of personality is well acknowledged and helpful, i.e. reliance on ‘blink’ in daily life matters. However, when investing billions a deeper dive is required. Combining intuition with a documented characterization of a person during a DD further strengthens the assessment and reflection about the traits of key people.

WHY REQUIRE A PSYCHOLOGICAL ASSESSMENT OF A NEW SENIOR COLLEAGUE WHILE NOT FOR YOUR INVESTMENT MANAGER MANAGING BILLIONS?

The assessment of a list of traits is not just a checklist and tick the box exercise. Each considered trait and skill should be assessed as well as discussed among the DD-team as judgements on traits can differ among team members. Listing and describing each briefly makes sure that these are at least assessed and subsequently can be used to cross check with the description of the investment process and how the team operates and makes decisions. Furthermore, a list can be used to reconcile how the manager acted on previous investments using behavioral analytics.

RELATIVE IMPORTANCE OF EACH TRAIT DEPENDS UPON THE INVESTMENT STRATEGY AND THE PERSON’S ROLE IN THE PROCESS

The traits are not meant to be applicable for all investment strategies or all investment staff to the same extent. For example: for more quantitative strategies, traits like being structured and analytical play a more dominant role than for a concentrated short term equity trading style investment strategy. For the latter decisiveness, flexibility, market savviness are more relevant.

Several traits are important for all strategies like drive, passion, being honest and ethical.

Please also note that a ‘larger’ or ‘higher’ degree or ‘level’ of a trait is NOT always preferred (i.e. more is better) for several of the traits listed. Stated differently, perceived quality is not always a positive function of a ‘level’ of a certain trait. For instance, too much structure implies often that a PM becomes too rigid and not sufficiently adaptive to changing environments. In line with this, too much flexibility often times leads to short termism and insufficient attention towards the consistent application of the process. Depending upon the strategy, the DD-team has to assess if the degree of a certain trait present at a PM and other team members is sufficiently close to the appropriate degree, while the DD-team should also be aware of the balance and trade-offs between the traits. The appropriate degree likewise depends upon the person’s role in the process. For instance having an analytical mindset and attention to detail are very important traits for analysts, but these can be paralyzing for a PM. For him the capacity to know what matters and disregard peripheral detail is often critical. Analysts need to focus on the trees and the PM on the forest.

Please also note that a ‘larger’ or ‘higher’ degree or ‘level’ of a trait is NOT always preferred (i.e. more is better) for several of the traits listed. Stated differently, perceived quality is not always a positive function of a ‘level’ of a certain trait. For instance, too much structure implies often that a PM becomes too rigid and not sufficiently adaptive to changing environments. In line with this, too much flexibility often times leads to short termism and insufficient attention towards the consistent application of the process. Depending upon the strategy, the DD-team has to assess if the degree of a certain trait present at a PM and other team members is sufficiently close to the appropriate degree, while the DD-team should also be aware of the balance and trade-offs between the traits. The appropriate degree likewise depends upon the person’s role in the process. For instance having an analytical mindset and attention to detail are very important traits for analysts, but these can be paralyzing for a PM. For him the capacity to know what matters and disregard peripheral detail is often critical. Analysts need to focus on the trees and the PM on the forest.

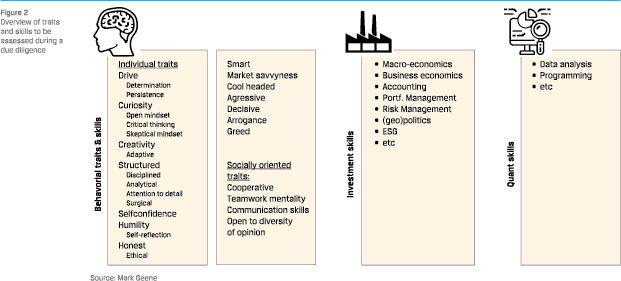

Figure 2 contains three segments of traits and skills, whereby the segment concerning behavioral traits includes several social skills. It also contains a more extensive list of traits and skills versus the other two segments. Reason being is that these latter are not the focus area of this article.

Not all traits in the first segment are described at length because most are self-explanatory or already described above. Below, several important ones and those that require additional explanation are highlighted below and in the following subparagraphs:

- Drive, result oriented: The passion for investing and generating excess returns and go for the extra mile.

- Curiosity and being open minded: Constant seeking new and additional information to avoid confirmation biases. It also entails being skeptical towards, among others, input and research from external sources like ‘experts’ and sell side research.

- Adaptive and constant learning: Society and financial markets are changing constantly. Together with being open minded, an investment manager should be sufficiently adaptive and eager to learn if changes to the process and portfolio are required.

- Humility and self-reflection: This includes awareness and acknowledging one’s own weaknesses resulting in mitigation efforts towards these vulnerabilities. It requires a 360 degree mentality, not letting ego stand into the way of investments and being open minded. I.e. frequently critically looking in the mirror on process, business and staff. In addition to actively soliciting feedback from colleagues and investors, it includes systematically collecting and analyzing previous good (could be luck) and bad investment decisions for learning purposes. One of the questions one should always ask during a DD is: How frequent do you assess any vulnerabilities, biases or heuristics in your investment process and how do you debias the process including decision making? Subsequently one can ask about the experiences from applying debiasing techniques have been.

HOW HAVE YOU DEBIASED YOUR INVESTMENT PROCESS?

- Honest and ethical. These traits of key decision makers should be applied by them at all levels of activity: investing, business matters, including interaction with staff and investors. It includes straight talking and providing direct answers to investors. It implies not hiding information or come up with evasive answers or unrepresentative anecdotes.

- ‘Smart’ and ‘wisdom’: With smart and wisdom I mean something different from intelligence. It concerns the proper, profitable and relevant application of intelligence towards the investment objectives, but also including most of the above like acknowledging and mitigating personal weaknesses. Know what you don’t know or not capable of.

THE COMBINATION OF TRAITS AND THE TRADE OFFS

It is the combination of traits that determines the quality of the investment manager. In addition one has to have an appropriate ‘level’ of relevant traits in the team. Too much drive and ambition to achieve results, combined with overconfidence can result into hubris, blind spots, doubling down on poorly performing investments and/or pressing staff too hard resulting in turnover or unethical behavior.14 Also the manager might press for an increase of assets under management (business goal) and spend too much time on the investor side of the business at the detriment of the investment objectives. He should also always remain critical and avoid becoming attached to positions. The combination of a sufficient degree of curiosity, eagerness to learn and humility is helpful to introduce measures to mitigate or even avoid biases including self-attribution bias, overconfidence and hubris as well as the affect heuristic.

Depending upon the investment process and strategy one carefully has to assess if the PM is aware of the subsequent tradeoffs and how he balances traits as creativity, adaptiveness, open minded and critical learning versus being structured and disciplined. A few examples of these trade-offs are:

- For a more long term fundamental or systematic investment strategy: How does he avoid jumping on the latest fads or promising (sub)sectors in the market or in investment data and analytics (like AI, big data etc.) versus a rigorously developed, implemented and time tested process? How do you balance an open mind and adaptiveness to new information regarding a company or (sub)sector or technical market events drifting prices away from your own fundamental assessment versus remaining disciplined and determined (persistent) to the position in a company and/or investment theme?

- For a more shorter term or trading style strategy: how does he combine being disciplined and cool-headed, and not letting emotions drive decision making while also remain market and risk savvy and act aggressive and decisive if needed?15 This includes seizing upon investment opportunities in difficult times and the ability and willingness to act contrarian by not letting emotions of team members or clients stand in the way of taking advantage of market circumstances. Such tradeoffs are informed by having self-confidence and remain emotionally detached from individual positions.

TRAITS TO BE AVOIDED

This paragraph rounds off with several traits that are mostly negatively related to the quality of an investment manager. If present at the key decision maker, these should be assessed thoroughly in how these influence the investment process. If one is sufficiently comfortable, one can proceed with the DD-process, otherwise one can either terminate the process prematurely or introduce mitigating measures in the investment contract and develop specific monitoring items subsequent to the investment.

- Arrogance: A moderate degree of self-confidence for a PM is important. Reason being is that, for active strategies, he must have the view that markets are wrong or are underestimating the value of an investment. He must also have confidence he can outperform the markets, which is already difficult when the majority of empirical and academic evidence is against it. However, a too high degree of self-confidence can result in arrogance, overconfidence and attribution biases, but also in risks of not taking into account diversity of opinions or views on the process and actual investments. I.e. risks arising from the availability bias and neglect. If the key decision maker acts arrogant it can also negatively impact team morale and result in unnecessary turnover.

- Greed and seeking status among peers: Too much greed can severely harm investment results. It can lead towards asset gathering beyond the maximum capacity of the strategy at the detriment of performance. Greed can also result in being overly focused on performance instead of balancing it with risks involved. Especially greed and a singular focus on financial results will be ‘tested’ in the secular drive towards ESG- and impact investing. In the new era, a manager has to balance financial goals with sustainability and impact objectives.

CONCLUSION

This article described the reasoning behind and the role of behavioral traits of DD-teams and the traits of an investment manager to which the DD-team has to pay attention. These traits are important for both public and private investors and DD-teams focused on public and private investments and investment strategies (long only, long/short, active, passive). The balance and importance of the different traits depends, among others, upon the frequency and distribution of the duration of the actual investments and the ability to adjust afterwards including associated costs. The most important traits for both teams, either performing a DD or making actual investments, are drive, curiosity, creativity, being skeptical but combining it with adaptiveness and a cooperative mindset.

The assessment of, and importance of traits and ‘soft’ skills will become even more mission critical when investments objectives secularly expand beyond a sole focus on return and risk towards including ESG and sustainability. It requires paying attention to often times new and/or less well developed processes, insufficient and inadequate datasets and modifying the composition of investment teams with the inclusion of a broader and more diverse set of skills and experiences. Decision making will be less focused on one parameter (risk adjusted performance), but instead more geared towards balancing multiple objectives (performance, risk, sustainability, impact). It will make investment decision more challenging and complex (and interesting) and therefore requires a broader set of skills and traits. I.e. not predominantly investment and quant skills, but an increased level of the behavioral traits as described above.

The two main take aways of this article are the following:

- Assess the behavioral traits and skills of the DD-team members and make sure that for each DD-assignment the complementary set of team members exhibit the entire list of required traits and skills. Don’t shy away from ‘embedding’ a psychologist in your team.

- Make sure that the DD-team assesses via a structured and methodological process the behavioral traits and skills. This assessment is ideally augmented by several of the analytical tools and other techniques as described above.

While the key take aways are geared towards DD in this article, these have general application towards and are relevant for all investment and regulatory professionals in todays (investment) environment. Additionally, the conclusions can be applied in related financial activities like corporate finance, investment banking and forensic accountancy.

References

- Bazerman, M. and Moore, D., 2012, ‘Judgement in managerial decision-making’, 8th edition, Wiley.

- Mauboussin, M.J., 2012, ‘The success equation: untangling skill and luck in business, sports and investing’, Harvard Business Review Press.

- Syed, M., 2016, ‘Black box thinking: marginal gains and the secret of high performance’, Penguin Random House.

- Thinking Ahead Institute, 2018, ‘Better decision-making: a toolkit’.

Notes

- This article is written in a personal capacity and represents the opinions of the author and not those of PGGM. I like to thank several anonymous reviewers from both academia and the industry for their input.

- This refers to the endless list of publications from respected academic authors like Kahneman, Thaler, Shiller, Lovallo, Sibony and di Mascio. Bazerman ea. (2012) is especially relevant for several biases and heuristics described in this article, including the concept of bounded rationality in decision making.

- The article is not meant to be a definitive list of all relevant traits where each trait can be fully substantiated with both empirical data and psychology theory. However, these are based on a combination of experience and academic foundations. A lot of these also simply come down to common sense, but often times are not checked or verified if present or absent during a DD. A worthwhile expansion on this article can be enriched by psychologists, both academic and practitioners. I have not come across academic papers that specifically address the role, measurement and impact of behavioral traits on a DD-process or actual investment results of funds. Eventhough several empirical studies have shown the role of biases, like loss aversion, on historical trading behavior.

- See for instance Syed (2016) and Mauboussin (2012).

- The same can be said for observing physiological reactions like increased adrenaline and cortisol levels, caused by stress, that are mentioned in research on trading and sports. Intense DD-meetings and actual investing likely result in similar physiological reactions of the body.

- As stated above, please again note that the traits listed in the subsequent paragraph for investment managers also are very relevant for the DD. One example is an open mindset. If one junior analyst undercovers issues at a well-established firm that has been used by the asset owner, in addition to his trait of self-confidence to speak up, his seniors need to have an open mindset and take issues seriously. It also implies the acknowledgement and acceptance of the critical role of inclusion within teams.

- Being skeptical also implies not taken for granted information gathered via ChatGPT or similar AI-applications.

- For a practical toolkit to improve decision making see Thinking Ahead Institute (2018).

- https://www.mckinsey.com/capabilities/strategy-and-corporatefinance/our-insights/the-case-for-behavioral-strategy#/

- Related to this is being sufficient sensitive towards the person(s) interviewed and having proper judgement on personalities. Some PMs and analysts are not the best presenters or perform well during DD-meetings, while other PMs are great presenters and do well in beauty parades. It is key for the DD-team to see through this during meetings.

- Please note that if the DD-team also negotiates fees several biases can arise as relationships are formed.

- These tools are frequently used by investment firms themselves to assess and improve the investment process, decision making and actual sizing and trading behavior of the PM. I.e. lessons learned and feedback is provided with granular data on individual positions, versus more top down and ‘static’ return based attribution results per sector, country, style. It provides critical information about the ‘dynamics’ of the manager: https://www.inalytics.com, https://www.cabotintech.com.

- One should also assess if the manager is sufficient aware of the concept of time value of money as this is linked to potential biases including endowment effects and stalemate biases.

- One can compare this again with experiences in sports. LeBron James, Michael Jordan and Tom Brady used the combination of physical ability with an unparalleled drive to perform to lead their teams to years of glory. However, the drive of Lance Armstrong pushed himself and subsequently he pushed his team into unethical behavior. This has also been frequently observed in finance.

- This includes avoiding reliance on intuition and gut feeling. These traits are hard to assess for the DD-team and raises questions regarding the repetitiveness of the process.

in VBA Journaal door Mark Geene