Many commentators argue that we are at the end of the cycle. But are we just facing a typical business cycle winter or are we facing a perfect storm? This is a difficult question, since financial markets are the result of human interactions that are fuelled by emotions (such as fear and greed) and group dynamics.

A financial bubble will continue to grow as long as we collectively want it to, but as soon as trust in the underlying driver of the bubble is gone, the bubble bursts. This means that it is not possible to predict the future precisely, but we can observe reoccurring patterns emerging in financial markets which allows us to assess the fragility of markets.

As market fragility increases, it becomes more important for investors to consider how their portfolio would weather business cycles, financial bubbles and even a perfect storm. In most cases we need to make our portfolios more robust by broader diversification and have enough convexity to protect against market meltdowns. In this article we will, from a practitioner’s view, discuss how to address this issue in practice.

The nature of markets

The nature of markets

We often consider financial markets as conscious entities to which we attribute emotions and other human characteristics. This is a technique frequently used in children’s stories called ‘anthropomorphism’, where objects are humanised. Markets do not have free will nor do they have an animal spirit. There is no invisible hand guiding markets – this is just a bedtime story told by economists. A financial market is simply an aggregation of all interactions between buyers and sellers. Individuals who are continuously interacting while under the influence of emotions, biases and groupthink. It is our human nature that drives the shortand medium-term dynamics of the financial markets, to which we, as individuals, respond. This intricate human driven feedback loop is what George Soros calls reflexivity.

By accepting that markets are driven by human interactions, we also have to accept that we cannot make precise predictions of the future. But we can observe emerging patterns created by human interactions based on emotions. The forming of financial bubbles follows a similar recurring pattern and they will eventually burst. We cannot precisely predict how large the bubble will become nor when it will burst, but we can look for indicators that roughly help us understand how fragile the situation is. In Maynard Keynes’ words “It is better to be roughly right than precisely wrong”.

The complexity of financial markets is often compared with meteorological systems. There is a vast amount of interaction between the different elements in a meteorological system. This makes it extremely difficult to provide precise weather forecasts covering more than a few days. Despite the intractable interconnectivity of meteorological systems, the meteorologist has the upper hand when it comes to forecasting. The weather is bounded by the laws of physics, while financial markets are at the mercy of the “madness of men” as Isaac Newton put it after losing his fortune in the South Sea bubble.

Patterns in financial markets

In financial markets we can observe human driven patterns such as business cycles, financial bubbles and long-term debt cycles. These are the result of how we operate our businesses, the way we regulate our markets, how we often invest for short-term capital appreciation and are lending each other large sums of money that need to be paid back with interest.

Business cycle dynamics are driven by human decision-makers. Individual companies decide to invest in new capacity when they are at full capacity. It is a rational decision at the company level but, when aggregated at an industry level, it leads to overinvesting in capacity. This is then followed by a period when capacity exceeds demand, which lasts until growth in demand catches up again. Overinvestment in capacity affects company earnings, creating business cycles that are reflected in the market valuation. These different phases of the behavioural-driven business cycle are often illustrated using four seasons. When looking at several investors’ outlooks, many believe that we now are late in the current cycle. Winter is coming, despite the extended Indian summer we are currently enjoying.

Financial bubbles leading to financial crises are also driven by human nature. In most cases, local crises can hit a single country or market segment very hard, but they are typically contained and have limited effects on the global economy. Currency crises (e.g. Zimbabwe 2006, Turkey 2018), banking crises (Sweden 1990s, Iceland 2008), and debt crises (Argentina 2001, Greece 2012) are all familiar to most of us. Some bubbles are mainly fuelled by investor ‘fashion’, which can become speculative. The most recent example of such a bubble is the cryptocurrency mania that peaked in December 2017. When this bubble burst, Bitcoin – the most well-known cryptocurrency – lost over 65% of its value in just a few weeks. In such bubbles, there is a clear disconnect between the underlying assets and their market value and price dynamic is driven solely by emotions like greed and fear.

Financial markets are at the mercy of the “madness of men”

Financial bubbles can be compared with natural disasters such as drought, hurricanes and earthquakes. As with natural disasters, we know that there will be local financial bubbles and, as investors, we just have to accept them as ‘part of our world’. Driven by human psychology, there are also longer-term dynamics that could span several generations. Hyman Minsky (1992) introduced a theory about the long-term credit cycle arguing that stability creates instability. After a major credit crisis, society goes through a painful deleveraging process. While this painful experience is still fresh in people’s memories, strict credit regulation is maintained and debt levels are low. Debt levels slowly increase as memories of the credit crisis fade. Economic growth increases and this is followed by financial market deregulation. When the collective memory of the credit crisis is gone, debt can increase to speculative levels, leading to a new credit bubble forming. Eventually there will be a credit crisis, followed by painful deleveraging and the cycle continues. When the end of the long-term credit cycle coincides with a financial bubble and business cycle recession, this might indicate that a more serious storm is approaching.

Weather warning – Indicators

Academics and practitioners have been investigating indicators of business cycles and financial bubbles that lead to crises. Most of the commonly used business cycle indicators are based on economic growth, inflation, interest rates, P/E levels, credits spreads, under/over-capacity and unemployment.

Academics and practitioners have been investigating indicators of business cycles and financial bubbles that lead to crises. Most of the commonly used business cycle indicators are based on economic growth, inflation, interest rates, P/E levels, credits spreads, under/over-capacity and unemployment.

Lestano, Jacobs and Kuper (2003), studied crises covering six Asian countries. They identified three common types of local financial crises: currency crises, banking crises and debt crises. According to their research, effective indicators for a typical banking crisis are: growth rate of money supply, bank deposits, GDP per capita and national savings. They also found that the ratio of money supply to foreign reserves, the growth of foreign reserves, the domestic real interest rate and inflation all played an additional role in banking crises and some of the currency crises.

We might be facing more than just a business cycle winter

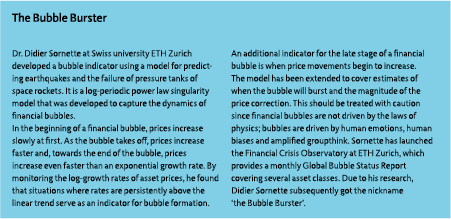

Frankel and Saravelos (2011) collected empirical findings from more than 80 academic papers on early warning indicators. They found that international reserves and real exchange rate overvaluation stood out as leading indicators for more recent financial crises. Also they found that lower historical credit growth, larger current accounts/savings rate and lower external and short-term debt were strongly associated with lower possibility for crises. Sornette (2015) developed early warning indicators inspired by a model used for earthquakes (see the boxed text for more information).

Frankel and Saravelos (2011) collected empirical findings from more than 80 academic papers on early warning indicators. They found that international reserves and real exchange rate overvaluation stood out as leading indicators for more recent financial crises. Also they found that lower historical credit growth, larger current accounts/savings rate and lower external and short-term debt were strongly associated with lower possibility for crises. Sornette (2015) developed early warning indicators inspired by a model used for earthquakes (see the boxed text for more information).

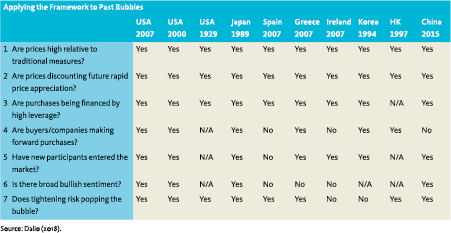

Central banks and regulators try to manage the systemic risk of a fragile market. But this only buys some time as risk will inevitably manifest somewhere else in the system. In his 2018 book, Dalio analyses debt cycles and applies that analysis to historical financial crises. Dalio argues that it is a mistake to think that any single metric can serve as an indicator of an impending perfect storm that is fuelled by a global debt crisis. He proposes to ask the following questions:

A Perfect Storm?

So what if all indicators signal “red” and simultaneously we are at the end of a long-term credit cycle? In meteorology, ‘the perfect storm’ describes a situation where different meteorological phenomena amplify each other. This does not happen often, but when it does, the consequences are dire. A perfect storm in financial markets means that the system is growing increasingly fragile and the bursting of a seemingly harmless local bubble could trigger a chain of events that lead to a perfect financial storm.

This perfect storm could take the shape of a deep and prolonged global economic depression that would affect almost all countries, sectors and asset classes. Trust in major currencies could deteriorate, some sovereigns might default on their debt and geopolitical conflicts could arise. In such a perfect storm, investors look to safe havens to protect their capital, but the liquidity constraints will make it difficult to change the investment portfolio. The deep recession following the stock market crash in 1929 is a historical example of a perfect storm called ‘The Great Depression’.

For an investor it is central to assess how fragile the financial system is, rather than trying to identify which potential event could be the catalyst for a perfect storm. An early warning system for the perfect storm can only be indicative. It requires identifying dominant and infrequent risks in a complex world that is dynamically changing and evolving over time. It will not tell us anything about when the storm could hit or how large it could become.

How does your portfolio weather the seasonal winter, natural disasters or even the perfect storm?

To assess systemic risk we need a qualitative approach to identify potential system-wide instabilities that could cause knock-on effects to the global economy. Today, the massive debt build-up, incredibly low interest rates and taxation levels, regulation that’s pushing financial institutions to hold similar types of assets, increasing global trade conflicts and protectionism are all signs of increasing instability. Inspiration for such instability indicators can be found in the risk dashboard of the European Systemic Risk Board (ESRB), which focuses on links between banks, sovereigns and the public and private sectors. ESRB’s composite indicator of systemic stress is currently low in comparison with 2008 and 2011, but it is rising.

Several commentators and investors argue that we are near the end of the current business cycle. Recently, Ray Dalio – founder of Bridgewater – recommended in a CNBC interview that investors should be “more defensive” in the stock market since the business cycle is on its “seventh inning”. He sees the risks increasing “as time progresses” suggesting that we might be facing more than just a business cycle winter.

Preparing for bad weather

To understand the consequences of bad weather, we need to apply a diverse set of tools including scenario thinking, stress tests and pre-mortems to help us illustrate what could happen to our portfolio when faced with winter, natural disasters and perfect storms. This will then allow us to consider alternative strategies or adjustments to improve the robustness of our investment portfolios when the indicators show that clouds are gathering on the horizon.

How could the portfolio weather a business cycle winter?

To create a robust portfolio, we could work with a set of economic scenarios related to the different phases of a business cycle. A robust portfolio should have a sufficient expected return and be able to weather all seasons of the business cycle. The allweather portfolio concept, introduced by Ray Dalio’s Bridgewater in the 1990s, is one example of this. Combining the asset packages for the different seasons creates a portfolio with an acceptable return over a business cycle without too much downside. If we are confident about our business cycle indicators, we could even overweight those assets that will do well in the seasonal recession.

How would the portfolio weather an occasional financial crisis or local bubble?

The way to deal with this is similar to natural disasters. We know that we can’t prevent them and we must accept that they will occur with some regularity, but we do not know when and where. These financial crises are more localised to specific geographies, sectors or asset classes. A pension fund could protect itself against these disasters by diversifying across asset classes, sectors and geographies and be aware of interlinkages. We can use carefully developed stress-scenarios to test the true diversity of our portfolios. If the portfolio does not pass some of the stress-tests, one could consider purchasing portfolio protection or (dynamically) changing the portfolio composition.

How to weather a perfect storm?

This extreme tail-risk is unlikely, but the consequences are dire. We need to assess whether we can survive it if it happens. One technique to examine this is to conduct a ‘pre-mortem’ analysis. The starting point is to imagine your investment portfolio completely collapsing in the coming years. We did not survive the perfect storm and then we work backwards through the chain of events leading up to the imagined failure. Another technique is to work with extreme stress-scenarios where we try to outline how a perfect storm could unfold and how that would affect the investment portfolio. In a perfect storm, the safe havens are likely to be real or tangible assets that can preserve value. Credit and equity derivatives can create convexity against market meltdowns and serve as protection, but only as long as counterparties can live up to their financial contracts and thus collateral management should be well designed. A pension fund could hold these distressed hedging positions in a designated ‘stress allocation’ within the portfolio.

Bad times don’t last for ever

As investors it is easy to get carried away by collective greed and fear, so it is good practice to develop a pre-commitment strategy when there are clouds on the horizon. This will help us overcome our greed and nudge us to de-risk as the storm approaches and, more importantly, deal with our fear so that we (as an organisation) are mentally able to re-risk when the time is ready. In the middle of a financial storm, when forced sellers are creating panic in the market, it will be possible to pick up quality assets at a fire-sale price. Baron Rothschild famously illustrated this contrarian approach by saying “buy when there’s blood in the streets, even if the blood is your own”. By re-risking during a crisis, the ‘opportunity’ losses of de-risking too early can be greatly compensated for.

But beware and judge each crisis on its own as re-risking in pure speculative bubbles – where the price can actually go to zero – won’t serve anybody. There was no value in re-risking during Holland’s tulip mania in the 17th century, the South Sea Bubble in 18th century England and perhaps the cryptocurrency bubble of the 21st century.

Looking ahead

In the current financial markets, it is not clear if we are just facing a business cycle winter or if this bad weather could become a perfect storm through interaction with a Minsky credit crisis. Long-term institutional investors should approach these challenges with a diverse mindset. Early warning systems and indicators help to create awareness, but, more importantly, we must apply tried-and-tested risk management tools to make our investment portfolio more robust against financial storms. A good start is to ask simple self-reflective questions:

- Business cycle winter: How am I positioned for a recession at the end of the cycle? What will happen if I am wrong?

- Bubbles and local disasters: Which indicators do I use to identify potential financial bubbles? Am I diversified enough to withstand local disasters?

- The perfect storm: What are my contingency plans if faced with a perfect storm? Do I have enough convexity and liquidity to re-risk during a perfect storm?

References

- Dalio, R., 2018, A template for understanding big debt crises, Greenleaf Book Group, Austin, Texas.

- European System Risk Board (ESRB), 2018, ESRB risk dashboard June 2018 (nr. 24), ECB, Frankfurt. Report https://www.esrb.europa.eu/pub/pdf/ dashboard/esrb.risk_dashboard180705_24. en.pdf

- Frankel, J. and G. Saravelos, 2011, Can leading indicators assess country vulnerability? Evidence from the 2008-09 Global Financial Crisis, HKS Faculty Research Working Paper Series RWP11-024, John F. Kennedy School of Government, Harvard University.

- Lestano, N. V., J. Jacobs, and G. H. Kuper, 2003, Indicators of financial crises do work!: an early-warning system for six Asian countries, Working Paper, University of Groningen.

- Minsky, H., 1992, The financial instability hypothesis, The Jerome Levy Economics Institute Working Paper 74, New York.

- Sornette, D. and P. Cauwels, 2015, Financial bubbles: mechanisms and diagnostics, Review of Behavioral Economics, vol. 2 nr. 3: 279- 305.

Note

- Pim van Diepen is Business Development & Strategic Advice bij Cardano. Stefan Lundbergh is Directeur Cardano Insights

in VBA Journaal door Pim van Diepen (l), Stefan Lundbergh (r)1