INTRODUCTION

Dutch listed companies have, over the past decades, become increasingly engaged with the social and environmental footprints of their activities. This engagement has varied in intensity, with some companies leading international sustainability rankings while others are just getting started. Despite these efforts, it is clear that governments, investors, customers and society at large are demanding more corporate responsibility for global issues such as climate change, biodiversity loss and human rights abuses. This is not only evident from European legislation on sustainability, including the European Green Deal, the Taxonomy Regulation, the Sustainable Finance Disclosure Regulation and the Sustainable Corporate Governance initiative. It is also apparent in Dutch legal actions such as the Shell climate cases and the proposal for responsible and sustainable international entrepreneurship (Wetsvoorstel verantwoord en duurzaam internationaal ondernemen). These developments leave little doubt that sustainability is becoming more and more important. It is against this backdrop that we, a team of researchers from Maastricht University,1 investigated the current sustainability embedding practices of 35 Dutch listed companies, with a special focus on the management and supervisory boards. Our work culminated in a research report, ‘The Sustainability Embedding Practices of Dutch Listed Companies’, which was commissioned by Eumedion and published in October 2021.2 In this piece we present our methodology, summarise the findings of our desk research and interviews, share our recommendations for companies, and reflect on the relevance of our results for institutional investors.3 In terms of structure, we first describe how we developed our company sample, which sources we used, and which questions we investigated. Second, we present a selection of our findings for key areas of sustainability embedding. These include planetary boundaries, the risk / opportunity attitude of interviewees, corporate purpose, sustainability strategies, sustainability objectives and targets, the presence of sustainability in management and supervisory board task allocations and profiles, and sustainability-related remuneration. Third, we provide four recommendations for how companies can improve their sustainability embedding. In general, these relate to company action on planetary boundaries, the formulation of company purposes, the link between sustainability and leadership, and the interaction of companies with stakeholders. We conclude with a reflection on the relevance of our results for institutional investors.

Dutch listed companies have, over the past decades, become increasingly engaged with the social and environmental footprints of their activities. This engagement has varied in intensity, with some companies leading international sustainability rankings while others are just getting started. Despite these efforts, it is clear that governments, investors, customers and society at large are demanding more corporate responsibility for global issues such as climate change, biodiversity loss and human rights abuses. This is not only evident from European legislation on sustainability, including the European Green Deal, the Taxonomy Regulation, the Sustainable Finance Disclosure Regulation and the Sustainable Corporate Governance initiative. It is also apparent in Dutch legal actions such as the Shell climate cases and the proposal for responsible and sustainable international entrepreneurship (Wetsvoorstel verantwoord en duurzaam internationaal ondernemen). These developments leave little doubt that sustainability is becoming more and more important. It is against this backdrop that we, a team of researchers from Maastricht University,1 investigated the current sustainability embedding practices of 35 Dutch listed companies, with a special focus on the management and supervisory boards. Our work culminated in a research report, ‘The Sustainability Embedding Practices of Dutch Listed Companies’, which was commissioned by Eumedion and published in October 2021.2 In this piece we present our methodology, summarise the findings of our desk research and interviews, share our recommendations for companies, and reflect on the relevance of our results for institutional investors.3 In terms of structure, we first describe how we developed our company sample, which sources we used, and which questions we investigated. Second, we present a selection of our findings for key areas of sustainability embedding. These include planetary boundaries, the risk / opportunity attitude of interviewees, corporate purpose, sustainability strategies, sustainability objectives and targets, the presence of sustainability in management and supervisory board task allocations and profiles, and sustainability-related remuneration. Third, we provide four recommendations for how companies can improve their sustainability embedding. In general, these relate to company action on planetary boundaries, the formulation of company purposes, the link between sustainability and leadership, and the interaction of companies with stakeholders. We conclude with a reflection on the relevance of our results for institutional investors.

METHODOLOGY

To create our sample, the research team and Eumedion sent a joint letter of invitation to all companies listed on the Amsterdam Euronext AEX, AMX and AScX stock indices with a statutory seat in the Netherlands, asking them to participate in the research project. 35 out of the 66 contacted companies, shown in Figure 1, ultimately accepted the invitation (a response rate of 53 percent).

To create our sample, the research team and Eumedion sent a joint letter of invitation to all companies listed on the Amsterdam Euronext AEX, AMX and AScX stock indices with a statutory seat in the Netherlands, asking them to participate in the research project. 35 out of the 66 contacted companies, shown in Figure 1, ultimately accepted the invitation (a response rate of 53 percent).

The desk research and interviews of our research project focused on this sub-set of Dutch listed companies. To collect our data, we reviewed the 2020 annual reports and the latest information and documents from company websites. In addition, we conducted 88 interviews with 97 interviewees including 14 CEOs, five CFOs, 19 supervisory board members and 31 sustainability managers. Throughout the investigation, we adopted a broad definition of sustainability in order to impartially investigate the full range of company practices, and concentrated on two questions:

- Why are companies embedding sustainability?

- How are companies embedding sustainability?

Using this approach, we explored the main drivers and motivations for why company leadership sets goals and targets for sustainability embedding. We also examined how companies integrate sustainability into their purpose statements and strategies; how they organise their governance structures to implement and oversee the sustainability embedding process; and how they manage their supply chain, sustainability reporting, employees, and culture as a response to the growing societal demand for transparency in sustainability embedding.

RESEARCH FINDINGS

In this section, we present part of the findings of our desk research and interviews and discuss them together with literature from academic, practitioner, and institutional sources. In general, we found that our sample of Dutch listed companies is responding unevenly to various environmental, social, and legal drivers. Responses are uneven between companies, and also differ depending on the sustainability topic. For example, commitments to reducing CO2 emissions and increasing (gender) diversity are more concrete and ambitious than those made in relation to circularity or biodiversity.

In this section, we present part of the findings of our desk research and interviews and discuss them together with literature from academic, practitioner, and institutional sources. In general, we found that our sample of Dutch listed companies is responding unevenly to various environmental, social, and legal drivers. Responses are uneven between companies, and also differ depending on the sustainability topic. For example, commitments to reducing CO2 emissions and increasing (gender) diversity are more concrete and ambitious than those made in relation to circularity or biodiversity.

PLANETARY BOUNDARIES

There is an intensifying global effort to remain within the planetary boundaries which have been identified by earth systems science (Steffen et al. in 2015; EEA 2020; UNEP 2019).

For this reason, we investigated the sustainability practices of our company sample in relation to CO2 neutrality, circularity and biodiversity.

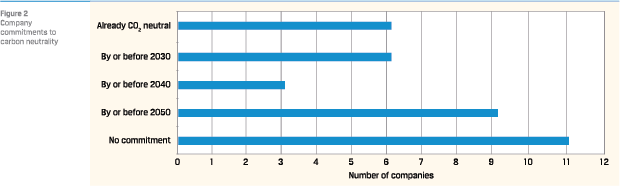

We found that 24 out of 35 companies have a commitment to CO2 neutrality (Figure 2), while only five companies are committed to becoming fully circular, and only nine companies have in place some type of organisational policy or project regarding biodiversity.

IS SUSTAINABILITY A RISK OR AN OPPORTUNITY?

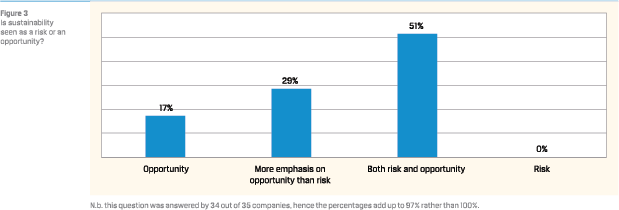

We also asked company interviewees whether they view sustainability as a risk, an opportunity or both given the attention that these different stances have received in the literature (Porter and Kramer 2011; Fiedler et al. 2021; Ilhan et al. 2020; Sautner et al. 2020; Pankratz and Schiller 2021). Interviewees from half of the companies responded that it is both:

“If there are incidents, it’s a huge risk of course. The care for the safety and the health of the people and the environment should always be the first priority. Also you can get fines, your permission could be withheld by governments. So, that is a risk. It’s also an opportunity to be best in class. Then you can also win new clients and you can show the world: we’re doing an excellent job, you better give your work to us” [Supervisory board member, industrial company]29 percent responded that while they do consider elements of sustainability-related risks in their discussions, the opportunity perspective was much more prevalent. Interestingly, 17 percent viewed sustainability almost exclusively as an opportunity.

Overall, we found that there are more companies of which the interviewees emphasise the opportunity rather than risk side of sustainability. None of the interviewees responded that sustainability is predominantly a source of risk.

CORPORATE PURPOSE, SUSTAINABILITY STRATEGIES, OBJECTIVES AND TARGETS

Recent literature has extensively discussed that one way of embedding sustainability is by means of defining a specific corporate purpose (Mayer 2018; Edmans 2020; Sjåfjell 2020; Mayer et al. 2020). The shareholder model is perceived by many as too short-termist and is widely considered to pay insufficient attention to the social and environmental consequences of corporate activities (Sjåfjell et al. 2015; EY 2020). The stakeholder model is often also viewed as problematic insofar as it is difficult to operationalise and organise in terms of oversight and accountability (Bebchuk and Tallarita 2020). One of the proposed solutions in the literature is to define more clearly what the company wants to achieve, to clarify what different stakeholders can contribute to that goal, and what their interests are while ensuring that the company does not profit from activities which destroy social or environmental value (Mayer 2020).

Recent literature has extensively discussed that one way of embedding sustainability is by means of defining a specific corporate purpose (Mayer 2018; Edmans 2020; Sjåfjell 2020; Mayer et al. 2020). The shareholder model is perceived by many as too short-termist and is widely considered to pay insufficient attention to the social and environmental consequences of corporate activities (Sjåfjell et al. 2015; EY 2020). The stakeholder model is often also viewed as problematic insofar as it is difficult to operationalise and organise in terms of oversight and accountability (Bebchuk and Tallarita 2020). One of the proposed solutions in the literature is to define more clearly what the company wants to achieve, to clarify what different stakeholders can contribute to that goal, and what their interests are while ensuring that the company does not profit from activities which destroy social or environmental value (Mayer 2020).

In general, we found that 83 percent of the companies in our sample have a reference to sustainability in their corporate purpose,5 and that 71 percent have a purpose which is externally oriented (i.e., towards the improvement of society rather than the company). However, our analysis in the published report also shows that many of these statements are very broadly and vaguely formulated, suggesting that there is room for improvement.

The literature also identifies that the corporate strategy is essential for embedding sustainability (Eccles et al. 2014), and emphasises that the corporate purpose and strategy should be connected. As Edmans explains, “A purpose statement is meaningless unless it translates into action… A company’s purpose should shape the activities it’s involved in” (2020: 208). In this regard, we identified a wide variety of approaches that companies use to organise their sustainability strategies, objectives, and targets. 97 percent of the companies in our sample have strategic objectives related to sustainability, but they often place them in different parts of their annual report. 63 percent place these objectives in their central strategy, while 34 percent place them in a separate sustainability strategy.

When it comes to sustainability targets, we identified that just over half of our sample has specific deadlines for their sustainability targets, and that they report on recent performance for these targets for two or more years. In general, we found that companies have wide discretion to decide on their ambitions, on when they want to achieve these ambitions, and whether and how they translate their sustainability strategies into actual targets.

We also examined the use of sustainable development goals, stakeholder materiality consultations, and sustainability risks as sources of inspiration for company sustainability embedding. These findings are outlined in the report, together with an overview of key sustainability issues faced by companies.

MANAGEMENT AND SUPERVISORY TASK ALLOCATION AND BOARD PROFILES

The management board is generally responsible for managing the business, including setting and executing the (sustainability) strategy. In doing so, the Dutch Corporate Governance Code establishes that the board should also pay attention to “any other aspects relevant to the company and its affiliated enterprise, such as the environment, social and employee-related matters, the chain within which the enterprise operates, respect for human rights, and fighting corruption and bribery”. The supervisory board provides advice and supervises, which includes oversight on (sustainability) strategy execution. In general, it is important for both boards to have sufficient knowledge on sustainability topics that are material to the company (EY study 2020: 122).

The management board is generally responsible for managing the business, including setting and executing the (sustainability) strategy. In doing so, the Dutch Corporate Governance Code establishes that the board should also pay attention to “any other aspects relevant to the company and its affiliated enterprise, such as the environment, social and employee-related matters, the chain within which the enterprise operates, respect for human rights, and fighting corruption and bribery”. The supervisory board provides advice and supervises, which includes oversight on (sustainability) strategy execution. In general, it is important for both boards to have sufficient knowledge on sustainability topics that are material to the company (EY study 2020: 122).

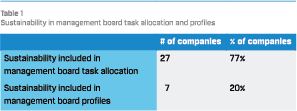

Our desk research (Table 1) found that 27 out of 29 companies that publish their management board regulations have allocated sustainability as one of the tasks of the board or top management team; six companies do not publish these regulations.

Our desk research (Table 1) found that 27 out of 29 companies that publish their management board regulations have allocated sustainability as one of the tasks of the board or top management team; six companies do not publish these regulations.

We also identified that 28 companies do not publish a profile for the desired competencies and characteristics of their management board. For the other seven companies that do publish a skills profile, we concluded that sustainability was included as a specific management board competency.

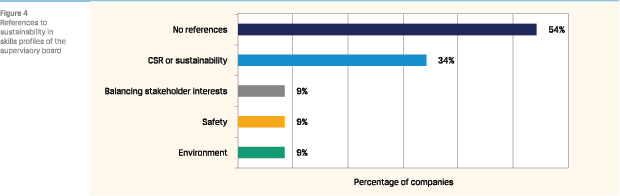

For the supervisory board, we found that all companies include sustainability oversight as one of their tasks (although eight companies only require these boards to formulate a diversity policy). Strikingly, more than half of the supervisory board skills profiles did not contain any references to sustainability competencies (Figure 4).

REMUNERATION AND SUSTAINABILITY

There is a recent trend for companies to link the management board’s remuneration to corporate sustainability objectives (Ikram et al. 2019; PWC 2020). Research has shown that this “leads to an increase in long-term orientation; ii) an increase in firm value; iii) an increase in social and environmental initiatives; iv) a reduction in emissions; and v) an increase in green innovations” (Flammer et al. 2019: 1). Moreover, it finds that companies with a stakeholder corporate governance model (such as the Netherlands) can benefit from a “large positive impact on human resources, environmental, and human rights performance” if they adopt sustainability-related remuneration (Cavaco et al. 2020: 240).

Our interview findings nevertheless showed that sustainabilityrelated remuneration targets are controversial, despite being favoured by interviewees from a majority of companies. The following comment was typical for proponents:

“People make decisions based on money, so having bonus pay that depends also on sustainability performance is an absolute must to fully embed the sustainability culture in the organisation. Otherwise it’s a very half-hearted commitment.” [Sustainability manager, industrial company]As for the serious doubts of a critical minority, these were often extended to variable rewards in general rather than specifically towards sustainability-related remuneration:

“My personal experience is that variable rewards just don’t work. It intensifies the wrong behaviour. As soon as people have targets on certain issues, their focus will be on those issues, and those become isolated from the whole strategy of the company… I rewarded a colleague with a certain bonus because he met his agreed targets and did the job well and he walked away happy. Next day he heard that his colleague got a reward that was slightly higher. From that moment he was unhappy with his bonus and he remained unhappy for months. So I’ve seen all the negative impacts of variable rewards.” [CEO, service company]Notwithstanding these controversies, the desk research showed that the vast majority of companies do integrate sustainability elements into their remuneration policies. However, sustainability is only a relatively small part of short-term and long-term incentives (only 11 percent and 22 percent of their total weight, respectively).

The full version of the report contains further information on company sustainability practices such as the size and hierarchical distribution of sustainability committees, key sustainability issues for investors and main company reporting standards. It also contains an evaluation of due diligence practices, an overview of non-financial auditing, reporting on employee diversity, metrics for GHG emissions, energy use, water use, waste management and travel reporting.

RECOMMENDATIONS

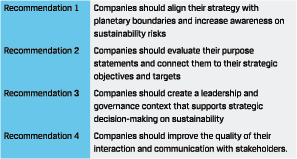

Based on our findings, we observed that there is scope for Dutch listed companies to align their strategy more formally with planetary boundaries, especially with regards to circularity and biodiversity. We identified a crucial role for company leadership to make sure that all management layers and employees are aware of associated sustainability risks. This awareness will help them to respond to risks, prepare for opportunities, and adequately contribute towards the transition to a climate neutral and circular economy. Our first recommendation was therefore that companies align their strategy with planetary boundaries and increase awareness on sustainability risks. We also considered that companies could benefit from an improved sustainability culture and decision-making process if they have a well-formulated corporate purpose that is clearly and meaningfully connected to corporate strategy. Our second recommendation was therefore that companies evaluate their purpose statements and connect them to their strategic objectives and targets.

Based on our findings, we observed that there is scope for Dutch listed companies to align their strategy more formally with planetary boundaries, especially with regards to circularity and biodiversity. We identified a crucial role for company leadership to make sure that all management layers and employees are aware of associated sustainability risks. This awareness will help them to respond to risks, prepare for opportunities, and adequately contribute towards the transition to a climate neutral and circular economy. Our first recommendation was therefore that companies align their strategy with planetary boundaries and increase awareness on sustainability risks. We also considered that companies could benefit from an improved sustainability culture and decision-making process if they have a well-formulated corporate purpose that is clearly and meaningfully connected to corporate strategy. Our second recommendation was therefore that companies evaluate their purpose statements and connect them to their strategic objectives and targets.

In general, companies need to create a context in which the management and supervisory board are well prepared to formulate, execute and oversee a sustainability strategy with an appropriate level of ambition and understanding of their societal and environmental relevance and context. Signalling leadership on sustainability, especially when employees perceive top management as trustworthy and ethical, is key to creating an organisational culture that supports strategic sustainability objectives and financial performance. Our third recommendation was therefore that companies create a leadership and governance context that supports strategic decision-making on sustainability.

High-quality disclosures by companies lead to improved stakeholder feedback on company activities. Moreover, public information is necessary for external stakeholders, including investors, to exercise market pressure and reward sustainable companies. In this regard, we found that company-stakeholder relationships are only as good as the quality of the information and interaction between them. We therefore recommend that companies improve the quality of their interaction and communication with stakeholders.

Combined, the four recommendations can guide companies in stepping up and further developing their sustainability embedding. We expect that they will be better prepared for responding to sustainability opportunities and risks if their strategies are aligned with planetary boundaries and if their purposes are carefully formulated. The outcome of this process is that companies will be able to focus, for example, on relevant sustainability problems to be solved and / or specific stakeholder groups. In turn, this focus can serve as additional guidance for company decision-making, as inspiration for setting the company strategy, and for defining associated strategic (sustainability) objectives. Governance plays an important role in this process. Top management needs to be prepared and equipped for the job, and the supervisory board needs to have the knowledge and skills to exercise their oversight role in an effective and meaningful way. The importance of company leadership’s exemplary role in signaling to employees the importance of sustainability embedding cannot be overstated. Finally, improved interaction and communication with external stakeholders will enhance companies’ accountability to society and contribute towards a feedback loop which can boost further sustainability embedding and advance company strategic decision-making.

ROLE OF INSTITUTIONAL INVESTORS

Asset owners and asset managers are motivated by a similar set of drivers as discussed in the context of companies, and have also been integrating sustainability into their investment policies and portfolios. A first visible step has been to shift portfolios to a more sustainable profile by overweighting (underweighting) companies that score higher (lower) on the sustainability dimension. Many investors also exclude certain sectors and companies from the investment universe based on sustainability information or ethical considerations. A less observable response by investors has been an increased focus on individual or collaborative engagement, public and private, with companies on sustainability matters.

Our interviews shed light on how Dutch companies perceive the role of investors as drivers of sustainability. According to interviewees, “climate and emissions” and “governance and executive remuneration” are the topics most frequently raised in dialogues with shareholders.

The report also documents a considerable variation in the level and structure of institutional ownership of our sample (between 12 and 70 percent). This might be affecting how companies are responding to different kinds and levels of engagement pressure. Recent research shows, for example, that (concentrated) institutional ownership makes shareholder activism more likely to succeed (Dimson et al. 2015, 2021; Bauer et al. 2015). Next to this, we found that a majority of institutional owners in our sample are based in common law countries (US and UK). These countries have a different cultural and legal environment than the Netherlands and other European countries, and their investors might have a different stance on sustainability (Bauer and Smeets 2021) and fiduciary duties.

Interestingly, our analysis shows that Dutch institutional shareholders have an average combined stake of just 6 percent in the companies of our sample, whereas institutional investors from common law countries hold almost 24 percent. This might make shareholder engagement on sustainability a more challenging task, especially on topics that are not directly and measurably financially material to the company. Fortunately, the practices and topics reviewed in our report can provide some guidance to shareholders who are willing to enter into a dialogue with companies on sustainability matters.

CONCLUSION

Our research into the sustainability embedding practices of Dutch listed companies has shown that performance is uneven between companies, and that there is room for improvement for example in relation to planetary boundaries, awareness of sustainability risks, and in competency profiles for the selection of new leaders. In line with this, we provided several recommendations to improve long-term sustainability embedding.

In general, we advise investors to investigate whether portfolio companies are aligning their long-term strategies and operations in accordance with planetary boundaries. These companies should be best positioned to survive and thrive in the transition towards a sustainable society and economy. We also advise investors in their engagement with companies to push for more sustainability-related competencies and knowledge among company leadership, since it is unlikely that companies will be adequately prepared for this transition if they only have a limited understanding of the relevant sustainability issues.

As a final remark, we emphasise that it is not only companies but also investors who are being affected by changes in legal and societal expectations as a result of climate change, biodiversity loss and other problems with planetary boundaries. Investors, too, need adequate knowledge of sustainability issues and developments. Tools such as the EU Taxonomy and sustainability ratings can help in this regard, but they are by themselves not enough to paint a picture of what the transition to sustainability will and should look like. Without such an image to guide their decisions and understanding, it is unlikely that investors will be able to identify the full scope of opportunities and risks associated with the sustainability transition.

Literature

- Bauer, R., F. Moers and M. Viehs (2015), “Who Withdraws Shareholder Proposals and Does it Matter? An Analysis of Sponsor Identity and Pay Practices”, Corporate Governance: An International Review, 23(6), pp. 472-488.

- Bauer, R. and P. Smeets (2021). ‘Eliciting Pension Beneficiaries’ Sustainability Preferences: Why and How?’ Wharton Pension Research Council Working Paper No. 2021-12. Available at SSRN: https://papers.ssrn.com/sol3/papers. cfm?abstract_id=3890879

- Bebchuk, L. A. and R. Tallarita (2020). ‘The Illusory Promise of Stakeholder Governance.’ Cornell Law Review, 106: 91-178.

- Cavaco, S., P. Crifo, and A. Guidoux (2020). ‘Corporate Social Responsibility and Governance: The Role of Executive Compensation.’ Industrial Relations: A Journal of Economy and Society, 59(2): 240-274.

- Dimson, E., O. Karakas, and X. Li (2015). ‘Active Ownership.’ The Review of Financial Studies, 28(12): 3225-3268.

- Dimson, E., O. Karakas, and X. Li (2020). ‘Coordinated Engagements.’ European Corporate Governance Institute – Finance Working Paper No. 721/2021. Available at SSRN: https://papers.ssrn.com/sol3/papers. cfm?abstract_id=3209072

- Eccles, R. G., I. Ioannou, and G. Serafeim (2014). ‘The Impact of Corporate Sustainability on Organizational Processes and Performance.’ Management Science, 60(11): 2835-2857.

- Edmans, A. (2020). Grow the Pie. How Great Companies Deliver both Purpose and Profit, London, Cambridge University press.

- Ernst & Young (2020). ‘Study on directors’ duties and sustainable corporate governance.’ Publications Office of the European Union, https://op.europa.eu/en/publication-detail/-/ publication/e47928a2-d20b-11ea-adf7-01aa75ed71a1/ language-en

- EU Sustainable Corporate Governance initiative. https://ec.europa.eu/info/law/better-regulation/have-yoursay/initiatives/12548-Sustainable-corporate-governance_en

- European Environmental Agency (EEA) (2020). ‘Is Europe Living within the Limits of Our Planet?’ EEA Report No. 1/2020. https://www.eea.europa.eu/publications/ is-europe-living-within-the-planets-limits

- European Green Deal ‘Communication from the Commission to the European Parliament, the European Council, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions – The European Green Deal.’ COM/2019/640 final.

- Fiedler, T., A. J. Pitman, K. Mackenzie, N. Wood, C. Jakob, and S. E. Perkins-Kirkpatrick (2021). ‘Business Risk and the Emergence of Climate Analytics.’ Nature Climate Change, 11(2): 87-94.

- Flammer, C., B. Hong, and D. Minor (2019). ‘Corporate Governance and the Rise of Integrating Corporate Social Responsibility Criteria in Executive Compensation: Effectiveness and Implications for Firm Outcomes.’ Strategic Management Journal, 40(7): 1097-1122.

- Ikram, A., Z. F. Li, and D. Minor (2019). ‘CSR-contingent Executive Compensation Contracts.’ Journal of Banking & Finance, article 105655.

- Ilhan, E., P. Krüger, Z. Sautner, and L. T. Starks (2020). ‘Climate Risk Disclosure and Institutional Investors.’ European Corporate Governance Institute – Finance Working Paper No. 661/2020. Available at SSRN: https://papers.ssrn.com/sol3/papers. cfm?abstract_id=3437178

- Mayer, C. (2018). Prosperity: Better Business Makes the Greater Good, Oxford, UK, Oxford University Press.

- Mayer, C., L. E. Strine Jr, and J. Winter (2020). ‘50 years later, Milton Friedman’s Shareholder Doctrine is Dead.’ Fortune, https://fortune.com/2020/09/13/ milton-friedman-anniversary-business-purpose/

- Pankratz, N., and C. Schiller (2021). ‘Climate Change and Adaptation in Global Supply-Chain Networks.’ European Corporate Governance Institute – Finance Working Paper No. 775/2021. https://ecgi.global/working-paper/climatechange-and-adaptation-global-supply-chain networks?mc_cid=5a442530f3&mc_eid=53712b131

- Porter, M.E. and M. R. Kramer (2011). ‘Creating Shared Value – How to Reinvent Capitalism – and Unleash a Wave of Innovation and Gorwth.’ Harvard Business Review, January-February 2011, 1-17. https://hbr.org/2011/01/ the-big-idea-creating-shared-value

- PWC (2020). ‘Executive and Non-executive Remuneration Survey 2020.’ PWC. https://www.pwc.nl/nl/actueel-publicaties/ assets/pdfs/pwc-executive-remuneration-survey-2020.pdf

- Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability – related disclosures in the financial services sector (‘Sustainable Finance Disclosure Regulation’).

- Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088 (‘Taxonomy regulation’).

- Sautner, Z., L. van Lent, G. Vilkov, and R. Zhang (2020). ‘Firm-Level Climate Change Exposure.’ European Corporate Governance Institute – Finance Working Paper No. 686/2020. Available at SSRN: https://ssrn.com/abstract=3853969

- Sjåfjell, B. (2020). ‘Sustainable Value Creation within Planetary Boundaries – Reforming Corporate Purpose and Duties of the Corporate Board.’ Sustainability 12(15): 6245.

- Steffen, W., K. Richardson, J. Rockström, S. E. Cornell, I. Fetzer, E. M. Bennett, et al. (2015). ‘Planetary Boundaries: Guiding Human Development on a Changing Planet.’ Science, 347(6223).

- The Hague District Court 26 May 2021, ECLI:NL:RBDHA:2021:5339 (The Shell climate case).

- United Nations Environment Programme (UNEP) (2019). ‘Global Resources Outlook’, International Resource Panel, https://www.resourcepanel.org/reports/ global-resources-outlook

- Wetsvoorstel verantwoord en duurzaam internationaal ondernemen, Kamerstukken II 2020/2021 35761.

Noten

- This project has received funding from the European Union’s Horizon 2020 research and innovation programme under the Marie Sklodowska-Curie grant agreement No 847596.

- The Elverding Chair on Sustainable Business, Culture and Corporate Regulation is funded among others by DSM, DNB, ING and Qpark.

- Eumedion represents the interests of institutional investors in the field of corporate governance and sustainability. Link to the published report: https://papers.ssrn.com/sol3/papers. cfm?abstract_id=3957250. Link to Eumedion Symposium on the report: https://www.eumedion.nl/actueel/nieuws/ duurzaamheid-geen-woorden-maar-daden-verslag-vanhet-eumedionsymposium-2021.html.

- To provide some background on the structure of our report, the first section discusses why companies are embedding sustainability. It outlines how structural and stakeholder drivers (such as environmental, social, and legal issues and stakeholder pressure) are generally affecting the embedding of sustainability in Dutch listed companies, and reflects on the attitudes of company leadership towards these drivers. The second section explores how companies are embedding sustainability. It looks first at purpose and strategy; second at leadership and governance; and third at supply chains, sustainability reporting, and employees and culture.

- The fact that companies were allowed to self-select their participation in this project introduced a potential bias into our sample. It is possible, for example, that the most sustainable companies in the AEX, AMX, and AScX indices could have decided to participate while less sustainable companies did not. We checked, using S-Ray data from Arabesque on environmental, social, and governance (ESG) metrics, whether there was a pro-sustainability selection bias in our sample of companies. We found no such bias using this data, although we must be careful with any statistical inferences as the sample is very small.

- This is out of 94% of companies which have a clear corporate purpose.

in VBA Journaal door Constantijn van Aartsen, Rob Bauer, Tereza Bauer and Mieke Olaerts