INTRODUCTION

INTRODUCTION

I am very honoured and thankful that the VBA Journal invited me to contribute to its special 150th edition. In this article, I will share my personal perspective on the responsible investing phenomenon. I will first look back at the past two decades in which responsible investing transformed from a niche product to a hyped set of investment solution services. I will then highlight several implicit trade-offs and conflicts of interest that materialize in the many manifestations of responsible investing such as divestment, engagement, and ESG-integration strategies. Moreover, I will encourage asset owners and asset managers to discuss more openly their financial and nonfinancial objectives. Greater transparency on this matter would possibly strengthen institutional investors’ legitimacy in society.

MY OBSERVATIONS

“Responsible investing: beyond the hype?” was the title of my inaugural speech when I started my “Institutional Investors” chair at Maastricht University (Bauer, 2008). The speech back then summarized my view on the responsible investment hype in the prior decade (the 1990s) and gave a preview for the years to come. At the time, I expected this hype to end soon – like any hype does by definition – and predicted a gradual integration of its relevant parts into mainstream investment practice. Responsible investing as such would become archaic if not obsolete.

How wrong I was back then. Challenging the theories on the rise and fall of hypes, the responsible investing movement evolved into an almost sacred utterance with magical and spiritual powers that promised high returns and low risks. At the same time, these investments were set up to save the people and the planet. Observing this movement today, I wonder whether it was largely induced by smart marketers who, riding the waves of civil society’s multifaceted concerns, created a plethora of responsible (investment) products. Moreover, many of those products have fuelled a conspicuous consumption pattern: consumers have used the spending on luxury goods (e.g., buying an expensive electric car) and services (e.g., responsible investing products) as a public display or signalling device which has helped them attain or maintain a certain social status (Riedl and Smeets, 2017).

Alternatively, and certainly a less cynical observation, the hype becoming a trend may also have been consistent with a sincere and authentic awakening of those who had prudently watched over large sums of money that the people had entrusted to them. These agents increasingly started realizing that certain risks and opportunities related to environmental and social challenges that companies were facing could impact investors’ long-term bottom lines in material ways. Additionally motivated by explicit demands put forward by civil society, asset managers and asset owners started building a multifaceted set of responsible investment products and services. While exclusion and divestment were buzzwords in the previous century (as a matter of fact, both still are highly in the money), the first two decades of the twenty-first century can be characterized by the introduction and implementation of many new investment concepts. The explicit integration of environmental and social information into investment decision-making, active ownership strategies, and impact investments made its appearance.

Alternatively, and certainly a less cynical observation, the hype becoming a trend may also have been consistent with a sincere and authentic awakening of those who had prudently watched over large sums of money that the people had entrusted to them. These agents increasingly started realizing that certain risks and opportunities related to environmental and social challenges that companies were facing could impact investors’ long-term bottom lines in material ways. Additionally motivated by explicit demands put forward by civil society, asset managers and asset owners started building a multifaceted set of responsible investment products and services. While exclusion and divestment were buzzwords in the previous century (as a matter of fact, both still are highly in the money), the first two decades of the twenty-first century can be characterized by the introduction and implementation of many new investment concepts. The explicit integration of environmental and social information into investment decision-making, active ownership strategies, and impact investments made its appearance.

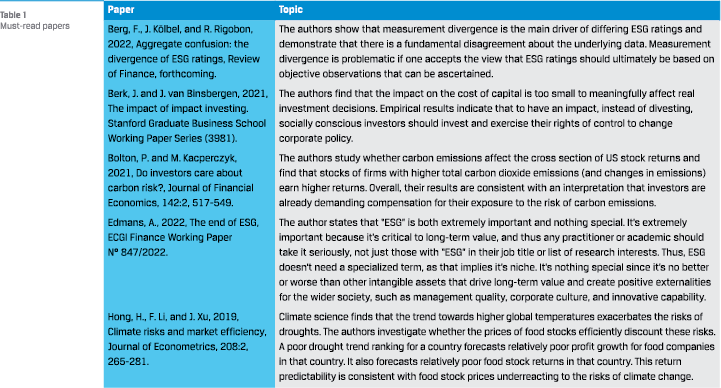

These two sides of the same coin are consistent with how I prepared my frequent interactions as an academic with the responsible investment industry in this period. In the first decade of this century, I was confronted with many sceptical views on the integration of nonfinancial information into investment decision-making. In frequent interactions with the investment community, I tried to show the other side of the coin backed by objective evidence of an increasing number of high-quality academic studies that had emerged in the meantime. Table 1 lists my current top five of must-reads. However, the last few years I have been regularly confronted with proponents of responsible investing who seem to follow a mantra that deems all activities in this space valuable, worthwhile, return-enhancing, and risk-reducing. This mantra again spurred me to increasingly challenge their opinions by again being inspired by sound academic contributions in the field.

WHAT DRIVES RESPONSIBLE INVESTING?

Why do we expect retail and institutional investors to wholeheartedly embrace responsible investing? This question is not easy to answer. Investors operate in certain legal and societal contexts that are the key drivers in accounting for differences in their sustainable investments. Laws relevant to, for instance, pension funds; the laws’ interpretations; and subsequent trajectories differ markedly per jurisdiction, as do regulatory bodies’ attitudes towards the responsible investment topic. When browsing legal scholars’ contributions to this discussion, references to the prudent person rule often occur (also known as prudent man, prudent investor, or prudent expert) in which prudence and loyalty play important roles. In general, pension fund boards must manage their capital with the care, caution, expertise, and competence that beneficiaries expect from a reasonably competent and reasonably acting pension fund (Maatman and Huijzer, 2019). The loyalty principle requires trustees to give priority to the beneficiaries’ interests under all circumstances. If trustees fail to do so and thereby harm their beneficiaries, then they are liable in principle. Failing to investigate the impact of climate change on the risk to investment portfolios, and not acting on obtained insights, could be an example in some jurisdictions (e.g., the EU) of not following the prudent person rule.

Now the question is: what exactly are the best interests of beneficiaries? Is it merely the financial best interest as is the case in (the interpretation of) many Anglo-Saxon law contexts? Or is it also linked to other nonfinancial interests such as the ability to enjoy retirement in a world worth living? Inspired and convinced by recent developments, such as the emergence of the Planetary Boundaries Concept in 2009 (Rockström, 2009) and the launch of the United Nations Sustainable Development Goals (SDGs) in 2015, many institutional investors have started shifting gears in integrating environmental and social information into their objective functions.2 Contributing to a better world has become part of the mission and vision of many asset owners and, consequently, service providers in the asset management industry. This involvement increased the intensity by which the global financial industry developed new products and services in this domain.

Opponents of this development often claim that investors have no direct role in solving societal problems (US Department of Labor during the Trump administration, 2018 and 2020). They argue that the people allocate this role to parliaments and governments in a well-functioning democracy. In such a context, laws and regulations would make sure that the will of the people – all of us are investors in some way – would be represented adequately in the long term. This logic may apply to some local or national challenges, but which government represents the planet and which environmental laws are truly applied and enforced globally? Moreover, does the average politician have a truly long-term mindset? Probably not. Nonetheless, I agree with these words of caution voiced by opponents, but in another dimension. Having more objectives than instruments is a wellknown problem that was put forward by Jan Tinbergen, the first Nobel Prize winner in economics (Tinbergen, 1952). Analogously, investors do encounter many trade-offs in decision-making, but these are rarely made explicit. Having both financial (e.g., adequate pensions) and nonfinancial objectives (enjoying retirement in a world worth living) may be hard to accomplish with just one instrument: the investment portfolio. At the very minimum, objectives need to be prioritized to avoid confusion or stalemates in investment management (Bauer, Christiansen, and Doskeland, 2022). Additionally, we may search for other instruments, such as better-functioning democracies that make nonfinancial objectives in the investment strategy obsolete.3

A related concern is that many asset managers and asset owners focus heavily on “doing good” in their investment strategies. Private investments in energy transition initiatives are good examples. This relatively small subset of investments draws a lot of attention but does not suffer short-term pressures on returns and risks from the public market. It is related to several key SDGs (although the impact cannot always be precisely measured) and often contributes to the reputation of the institutional investors who are involved in it. However, these investors, in my observation, pay much less attention to “doingno-harm” in such matters: solving the climate crisis will not necessarily remove injustices related to human rights abuses, inequality, workers’ rights, and many other topics that fall under SDGs. You simply cannot do it all. This observation is in fact another trade-off which investors must deal with and communicate about. Moreover, budgets for managing the products and services of responsible investments are constrained as well. Diligently checking all portfolio companies for whether they are involved in severe human rights issues in the supply chain is a tedious and costly task. Also, data quality and consistency are not necessarily a given (Berg, Kölbel, and Rigobon, 2022). The same holds for assessing whether these companies adequately compensate stakeholders for the costs and damage occurred. In other words, living up to the promises made in the OECD guidelines or upcoming EU regulation is a difficult task for companies and for those who invest in them. Given these challenges, it is understandable that many investors highlight salient and easy-to-communicate “doing good” investments.

MANAGING THE INHERENT TRADE-OFFS

Agents, including asset owners and asset managers, who supply the products and services of responsible investment increasingly receive guidance and direction from the evolution of hard and soft law in this field. Moreover, civil society organizations (such as NGOs but also beyond) exert influence on both companies and investors. Asset management organizations, insurance companies, and especially pension funds are increasingly being directly targeted on topics related to the environmental and the social challenges of society. Many pension funds in the Netherlands even go one step further. They send surveys to beneficiaries, the “ultimate” asset owners, to elicit their sustainability preferences. Subsequently, the output of these surveys informs boards on the direction and intensity of the responsible investment strategy and how to manage some of the aforementioned trade-offs.

Interestingly, upcoming EU-law (European Commission, 2022) will require investment firms that provide advice and portfolio management services to retail investors to not just inquire about their risk and time preferences but also about their sustainability preferences. The last iteration of this delegated EU regulation, understandably, aims at making sure that financial objectives are not dwarfed by sustainability objectives. Nonetheless, eliciting sustainability preferences may still be associated with some looming risks for retail investors as the measurement of any preferences is not an easy task. Simple survey techniques are prone to potential biases such as misrepresentation and most prominently social desirability (Bauer and Smeets, 2021, and Bauer, Ruof and Smeets, 2021) that subsequently leads to wrongly informed management about clients’ preferences. Moreover, commercial service providers may have perverse incentives. From their perspective, guiding retail investors into high-cost sustainable private equity funds may be commercially attractive while it may not necessarily be a proper solution from the perspective of a client’s financial objectives. The quality and analysis of surveys need to be checked carefully and independently. Self-regulation by the sector will not be the ultimate answer.

MANY INVESTORS HAVE BEEN FORMULATING AXIOMS DISGUISED AS INVESTMENT BELIEFS STATING THAT RESPONSIBLE INVESTMENTS WILL LEAD TO HIGHER RETURNS AND LOWER RISKS

However, a strong focus on clients or beneficiaries in the management of trade-offs may reduce the attention to other stakeholders, most notably those that are negatively and directly affected by the companies that these investors have in their portfolio. Balancing these interests between clients and stakeholders, and among stakeholder groups, is another example of the inherent trade-offs in institutional investment decisionmaking. For some reason, institutional investors’ communication strategies do not very often explicitly mention this balancing act. Instead, they have been formulating axioms disguised as optimistic investment beliefs stating that responsible investments will lead to higher returns and lower risks in the long term. These beliefs cannot be true in equilibrium. And, more importantly, financial service providers in the broadest sense must communicate transparently about how they deal with these trade-offs and how they may affect clients and other stakeholder groups.

DIVESTMENT, ENGAGEMENT, OR BEYOND? ANOTHER TRADE OFF

Fuelled by newly stated responsible investment beliefs, institutional investors have developed many different responsible investment products and services. Most of these can be attributed to either divestment strategies, active ownership strategies (including proxy voting and engagement), and integration strategies.4

Again, the decision on which of these strategies to follow is associated with many inherent trade-offs. The recent divestment wave in oil and gas companies by pension funds is an example. Last year, several pension funds (across the globe) announced that they would divest from oil and gas companies. The accompanying communication often stated that this decision would not negatively impact long-term risk-adjusted returns but would positively contribute to solving the climate crisis. Moreover, these investors claimed that this course of action was in line with their beneficiaries’ preferences (e.g., ABP, 2021). Generally, these communication statements did not provide enough detail on the assumptions which these decisions were based on, nor on the wide confidence intervals surrounding many of the parameters driving this direction. For instance, does divestment from the oil and gas sector have a negative impact on the diversification and efficiency of a portfolio? What is the impact of the fact that these companies most likely would be increasingly owned by investors who do not care too much about climate change? Subsequently, will this development influence the speed of the global energy transition? Will it affect the cost of capital for fossil fuel firms (see also Berk and van Binsbergen, 2021)? These are questions which are not easy to answer and all of which may be associated with trade-offs between financial and nonfinancial objectives. Many investors shy away from explicitly raising or even answering these questions, or they more aggressively choose to formulate beliefs that make these concerns irrelevant or redundant.5

INSTITUTIONAL INVESTORS MUST CLEARLY STATE THE OBJECTIVES OF THE RESPONSIBLE INVESTMENT STRATEGY INCLUDING THE TRADE-OFFS THAT COME WITH IT

One alternative to divestment is to set up an active ownership “program”. In the past decade, many institutional investors have started public and private dialogues with companies on matters related to sustainability and governance in the broadest sense. They have often used external agencies to assist them in managing this process and providing the knowledge and experience necessary for success. In my view (Bauer, 2008), potentially, shareholder engagement can be deemed one of the more sustainable, in the old-fashioned meaning of the word “sustainable”, courses of responsible investment action. If investors collaborate (e.g., Climate Action 100+) in targeting companies on financially material sustainability issues, it may well be that companies’ trajectories will be positively influenced.6 However, in this context, there are substantial trade-offs. Which topics should institutional investors focus on? Do clients or beneficiaries play an explicit role in this decision, and if they do, how do other stakeholders’ interests weigh in? How successful is engagement in bringing change? And if so, do engagement benefits exceed engagement costs? How are these benefits measured properly and communicated?

We can learn quite a bit on the effectiveness of engagement from the albeit scarce academic literature. For instance, the filing of shareholder proposals with companies in which there is more concentrated institutional ownership is more likely to be successful (Bauer, Moers, and Viehs, 2015). Private engagement on financially material topics has more potential for getting a positive response from targeted companies, although engagement is not successful in most cases (Bauer, Derwall, and Tissen, 2022). Relatedly, collaboration between investors makes engagement on these topics more effective (Dimson, Karakaş, and Li, 2021). There is an abundance of collaborative engagement efforts, nationally and internationally, but which ones to join? Again, several trade-offs do appear. As an asset owner, for instance, the decision to team up with commercial asset managers who may be conflicted because of commercial motives or strictly financial objectives, or who simply may have different intentions and views, is challenging. BlackRock’s recent decision (May 2022) to support fewer climate shareholder proposals probably is a good example of how these trade-offs can influence decision-making.7

It is also worthwhile to mention that civil society’s engagement with companies sometimes may be consistent with investors’ objective functions. A good example is the recent engagement effort by Follow This in the oil and gas sector. Since 2015, this Dutch civil society initiative has been pushing oil and gas companies across the globe to follow Paris-aligned decarbonization strategies. It has recently been very successful in influencing several US oil companies to commit to transition paths that are consistent with “Paris” (Follow This, 2022). Interestingly though, in the past few years, I have observed quite often that engagement successes are claimed simultaneously by many institutional investors. As soon as some of the engagement triumphs became apparent, many public statements from asset owners and managers followed rapidly, while many of these investors were not necessarily “ahead of the curve” when Follow This started the engagement program. Some, even now, vote very conservatively on climate-related proposals.

The above shows that divestments and engagement strategies are associated with many trade-offs and uncertainties for decisionmakers. Is simply buying companies with a high sustainability score maybe the ultimate answer?

“ESG” INTEGRATION

In the recent past, an increasing number of institutional investors have started integrating sustainability information into their portfolio management, also dubbed “ESG integration”. Driven by investment beliefs that are not necessarily grounded in financial economic theory, many investors have created subtle or significant tilts based on financially material information on sustainability in these portfolios. But how sustainable is this course of action, really? If investors indeed have started pricing the risks and opportunities associated with this information (Hong, Li, and Xu, 2019, and Bolton and Kacperczyk, 2021), the expected returns of highly sustainable companies will be lower because their associated risks (ceteris paribus) are lower. Intangible sustainability information probably is less easy to interpret than financial information, although many of the corporate frauds (Enron is a good example) in the past decades indicate otherwise. Some investors may therefore face difficulties during price discovery which may from time to time provide opportunities for investors who have a deeper knowledge or an information advantage. However, investors will gradually learn, and more and higher quality information will become available that will make it very difficult to keep this advantage.

Interestingly, organizations that represent management and asset owner organizations group their investments by offering combinations of regular equity portfolios that do not use any significant sustainability-related screens and sustainability-tilted investments with varying intensities of ESG integration. This observation of a certain segregation shows that there are most likely other forces at work in these organizations. It is fair to assume that the financial sector attracts (and has attracted) human talent which is interested in allocating and making money. Any restrictions in the way portfolio managers can create portfolios will not be met with a lot of enthusiasm. This context could create tensions in these organizations in which management’s strategic decisions to prioritize sustainability objectives are not necessarily applauded by portfolio managers or traders. It will likely slow down achieving whatever objectives have been formulated and lead to inconsistencies in the products and services that are being offered to clients as well as the communication surrounding them.

ENGAGEMENT IS NOT SUCCESSFUL IN MOST CASES

These inherent conflicts of interest can be illustrated with an example (Bauer, Christiansen, and Doskeland, 2022). Targeting companies through active ownership strategies (engagement, proxy voting, threats of divestments, and more) has the objective of helping companies perform better, and as such focuses on the total return space, in contrast to beating a benchmark. For instance, if an investor engages with a chemical company to upgrade its environmental-management system to encourage the company to be better prepared for future legislative changes and to spur process innovations, this engagement may have a positive impact on the company’s stock price in the long run. If the engagement is successful in both sustainability and financial performance terms, all investors in that company, including those who did not engage (the free riders), will profit from the rise in the stock price.

Now, suppose that a portfolio manager has invested in this chemical company with a weight lower than the company’s benchmark weight. This investment might be the case when the portfolio manager has severe doubts on the viability of the company’s general business model. Successfully engaging with this company would increase the total return of the portfolio (ceteris paribus), but the active return versus the benchmark would be negatively affected as the weight versus the benchmark would be negative: if the engagement were successful and the market were to acknowledge that, it would hurt the “alpha” (active return). The target setting and incentive schemes in the asset management sector, to a large extent, are related to active returns versus benchmarks or reference portfolios. Thus, a conflict of interest between strategic objectives and portfolio managers’ objectives would be born.

HAVING BOTH FINANCIAL AND NONFINANCIAL OBJECTIVES MAY BE HARD TO ACCOMPLISH WITH JUST ONE INSTRUMENT: THE INVESTMENT PORTFOLIO

Similar examples of potentially conflicting goals can be framed for other active ownership strategies such as filing shareholder proposals, starting class-action lawsuits, and proxy voting. The example shows that the objective to intensify and extend the active ownership effort may be at odds with the objective to “harvest” active returns. It also asks the question: who decides which objective is prioritized in which context? In essence, this is another example of having one instrument (the investment portfolio) and two objectives (active ownership impact and active returns). Again, I wonder what Jan Tinbergen would think of this conflict.

ESG-integration is not the solution to avoid trade-offs and may even be associated with unexpected conflicts of interest. Moreover, it is not clear whether these strategies would in the end offer any superior investment results in the first place. So, what’s next (Edmans, 2022)?

THE WAY FORWARD

In my view, the institutional investment industry needs to regroup and rejuvenate in various ways. First, authenticity and a sincere interest in the responsible topic are critical. In too many cases, commercial motives play a central role at the expense of sincerity. Examples of greenwashing (or “cheap talk”) by companies and investors are still omnipresent.8 Clients and beneficiaries who value that their savings and pensions are deployed to support sustainability objectives should be able to trust that their financial service providers are truly interested in and knowledgeable about the sustainability dimension and that they execute the different manifestations of responsible investment strategies authentically and effectively. This execution requires leadership from financial institutions, not just by issuing fancy external communications by their CEOs, but also by:

stating clearly, consistently, and earnestly the objectives of the responsible investment strategy as well as making explicit the trade-offs that come with this decision; • stating explicitly the key beliefs that underpin the responsible investment strategy and the uncertainties that are associated with them; • evaluating regularly, transparently, and publicly the investment beliefs on which this strategy is based; • eliciting preferences of clients or beneficiaries by properly using modern elicitation techniques; • making sure that internal organizations are prepared for the challenge, which implies investing in human capital (including and beyond financial economics); • creating an organizational culture and compensation structure in which conflicts of interest (internal and external) are minimized, managed, and made transparent to the general public and major stakeholders.

This change in gears will help private and institutional clients to better select the organization they feel most comfortable with given their financial and nonfinancial objectives (Bauer and Smeets, 2015).

SIMPLY SWEEPING TRADE-OFFS UNDER THE RUG IS NOT A SUSTAINABLE SOLUTION

Asset owner organizations, who are the agents of plan participants, have a crucial role going forward. As intermediaries, they must challenge the asset management industry by demanding responsible investment products and services that fit their mission and purpose. Pension plan participants are generally illiterate in both financial and sustainability dimensions. Hence, there is an important role for the leadership of asset owners to elicit their participants’ sustainability preferences. Moreover, in the context of the Dutch pension sector, beneficiaries of collective defined benefit schemes are not (yet) able to switch their pension provider which implies that asset owner organizations have a strong responsibility to make sure that they act in the best interest of their beneficiaries. That responsibility requires having an open dialogue on what “the best interest” means, how this interest is going to be prioritized, and whether the strategy is associated with any (financial) trade-offs. A genuine interaction with the membership must exceed the survey instrument; it requires identifying and discussing openly the inherent trade-offs that come with responsible investments. Simply sweeping trade-offs under the carpet is not a sustainable solution.

References

- ABP Press Release, 2021, ABP stops investing in fossil fuel producers. Press Release, October 26, 2021.

- Aegon Asset Management, 2021. Responsible Investment Framework.

- Bauer R., 2008, Responsible Investments: beyond the hype? Inaugural speech Maastricht University School of Business and Economics.

- Bauer, R. and F. Moers, and M. Viehs, 2015, Who withdraws shareholder proposals and does it matter? An analysis of sponsor identity and pay practices, Corporate Governance, 23:6, 472-488.

- Bauer, R., C. Christiansen, and T. Doskeland, 2022, A review of the active management of Norway’s Government Pension Fund Global. Downloadable: https://papers.ssrn.com/sol3/papers. cfm?abstract_id=4003433

- Bauer, R., J. Derwall, and C. Tissen, 2022, Private shareholder engagements on material ESG issues. Downloadable: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4171496

- Bauer, R., T. Ruof and P. Smeets, 2021, Get real: Individuals prefer more sustainable investments, Review of Financial Studies, 34:8, 3976-4043.

- Bauer, R. and P. Smeets, 2015, Social identification and investment decisions, Journal of Economic Behavior and Organization, 117:C, 121-134.

- Bauer, R. and P. Smeets, 2021, Eliciting pension beneficiaries’ sustainability preferences, SSRN working paper. Downloadable: https://papers.ssrn.com/sol3/papers. cfm?abstract_id=3890879

- Berg, F., J. Kölbel, and R. Rigobon, 2022, Aggregate confusion: the divergence of ESG ratings, Review of Finance, forthcoming.

- Berk, J. and J. van Binsbergen, 2021, The Impact of Impact Investing. Stanford Graduate Business School Working Paper Series (3981).

- Berk, J. and J. van Binsbergen, 2022, Can investors effect social change? All else equal podcast. Episode 7 (on Spotify and Apple).

- Bolton, P. and M. Kacperczyk, 2021, Do investors care about carbon risk, Journal of Financial Economics, 142:2, pp. 517-549.

- Carbon Tracker, 2022, Still Flying Blind: The Absence of Climate Risk in Financial Reporting, https://carbontracker.org/reports/ still-flying-blind-the-absence-of-climate-risk-in-financialreporting/

- Climate Action 100+, 2021, Global Investors Driving Business Transition. https://www.climateaction100.org.

- Dimson, E., O. Karakas, and X. Li 2015, Active Ownership, Review of Financial Studies, 28(12): 3225-68.

- Dimson, E., O. Karakaş, and X. Li 2021, Coordinated Engagements, ECGI Finance Series, 721/2021.

- Edmans, A., 2022, The end of ESG, ECGI Finance Series, 847/2022.

- European Commission, 2022, Amendments to Delegated Regulation (EU) 2017/565.

- Financial Times, 2022, Financial Times, 2022, BlackRock pulls back support for climate and social resolutions, May 10.

- Financial Times, 2022, BlackRock pulls back support for climate and social resolutions, July 26.

- Follow This, 2022, https://www.follow-this.org.

- Hong, H., F. Li, and J. Xu, 2019, Climate risks and market efficiency, Journal of Econometrics, 208:2, 265-281.

- Maatman, R. and E.M.T. Huijzer, 2019, 15 years of the Prudent Person Rule: Pension Funds, ESG factors and Sustainable Investing. In F.E.J. Beekhoven van den Boezem, C.J.H. Jansen and B.A. Schuijling eds., Sustainability and Financial Markets. Deventer, Netherlands: Wolters Kluwer, pp. 255-285.

- PGGM, 2022, Our mission. https://www.pggm.nl/en/about-us/ our-mission/

- Riedl, A. and P. Smeets, 2017, Why do investors hold socially responsible mutual funds?, Journal of Finance, 72:6, 2505-2550.

- Rockström J. et al., 2009, A safe operating space for humanity, Nature, 461, 472-475.

- Tinbergen, J., 1952, On the Theory of Economic Policy, North-Holland Publishing Company, Amsterdam.

- US Department of Labor 2018, Field Assistance Bulletin 2018-01.

- US Department of Labor 2020, Financial Factors in Selecting Plan Investments. 29 CFR Parts 2509 and 2550, RIN 1210-AB95: 72846-72885.

Notes

- This reminds me: the scientific society to which I belong myself also needs to realize that part of the resurgence or continuation of the hype can be attributed to the way academics are incentivized in their publication strategy. Top academic journals do not very likely accept empirical studies that show the absence of significant results when testing a certain hypothesis or research question. This lack of acceptance creates the so-called file drawer problem or bias. For instance, papers that genuinely show that there is no direct link between the diversity and financial performance of an organization are less likely to be published by these journals than papers that show either side of this coin.

- A good example is PGGM’s mission statement: “We work for good, affordable, and sustainable pensions for pension funds – our clients – and their participants. We also contribute towards a liveable world, occupational health and retaining vitality in old age”.

- The recent podcast by Berk and Binsbergen (2022) discusses a similar trade-off: “When it comes to what’s good for business and what’s good for society, …., people would like to have it both ways. …. It is unlikely that they can”.

- This category also includes impact investing. However, I do not include this topic as it has many different appearances and interpretations and, as such, falls outside the scope of this article.

- A good example (one of many) is this statement in the Responsible Investment Framework of AEGON Asset Management: “A growing body of academic research demonstrates that sound ESG practices can enhance corporate financial performance in the long term. This value can manifest itself in the form of lower cost of and access to capital, better operational performance, reduced reputational risks and, in turn, potentially superior long-term returns on investments.”

- However, a recent report by independent think tank Carbon Tracker (2022) shows that 134 highly carbon-exposed companies provided little evidence that they had considered the impacts of material climate-related matters in preparing their financial statements.https://carbontracker.org/reports/ still-flying-blind-the-absence-of-climate-risk-in-financialreporting/

- Financial Times (2022), May 10 and July 28: https://www.ft.com/content/4a538e2c-d4bb-4099-8f15- a28d0fefcea2 and https://www.ft.com/ content/48084b34-888a-48ff-8ff3-226f4e87af30

- See, for instance, the recent greenwashing accusation of DWS: https://www.ft.com/content/1094d5da-70bf-40b5-98f4- 725d50620a5a. Another example showing the ambivalent communication by some investors is Blackrock’s letter to Texan trade organizations in January 2021: https://www.tipro.org/UserFiles/BlackRock_Letter.pdf.

in VBA Journaal door Rob Bauer