The power of public filings cannot be overstated. They possess immense information on companies, their financial performance, their current standing, and where they are headed. Many are aware of prominent SEC filings such as 10-Ks and 10-Qs. However, few are aware of some of the “lesser-known” company filings, which typically fly under the radar despite containing material information that is relevant for investment professionals. This article elaborates on the theme of “lesser-known” public filings, and contributes several examples of US and UK filings for real-world applicability.

THE “WELL-KNOWN” COMPANY FILINGS

For investment professionals, the most accessible and frequentlyread SEC company filings are:

For investment professionals, the most accessible and frequentlyread SEC company filings are:

- 10-Ks – an annual report containing audited financial statements and other company information (e.g. risk factors, business operations);

- 10-Qs – a less exhaustive version of a 10-K that is submitted quarterly;

- 8-Ks – a report filed to announce major material events to shareholders (e.g. bankruptcy, M&A);

- And perhaps S-1s, for those more involved in IPOs – a form containing business and financial information on a soon-tobe-public company

From these four filings alone, one can obtain a comprehensive picture of a company’s:

- Past and current financial performance;

- Expected financial performance for the upcoming fiscal year;

- Current and future risks – be it for the company or the industry/market they operate in;

- Management decisions and corporate governance; and

- Corporate events and changes

Some investment professionals consume these 400-page filings manually – for instance, investment managers at firms such as Berkshire Hathaway, Fidelity Investments, and Vanguard Group have publicly admitted to reading through company filings manually, including the minutiae hidden in footnotes (MacBride, 2014). However, this approach can be tedious and time-consuming, especially if a large investment universe is involved.

With the emergence of natural language processing (NLP) over the past two decades, some investment professionals have begun taking a more automated approach to consuming company filings. Through NLP-powered text extraction and analysis, one can now filter the most relevant portions of these filings and come to their respective conclusions in a fraction of the time.

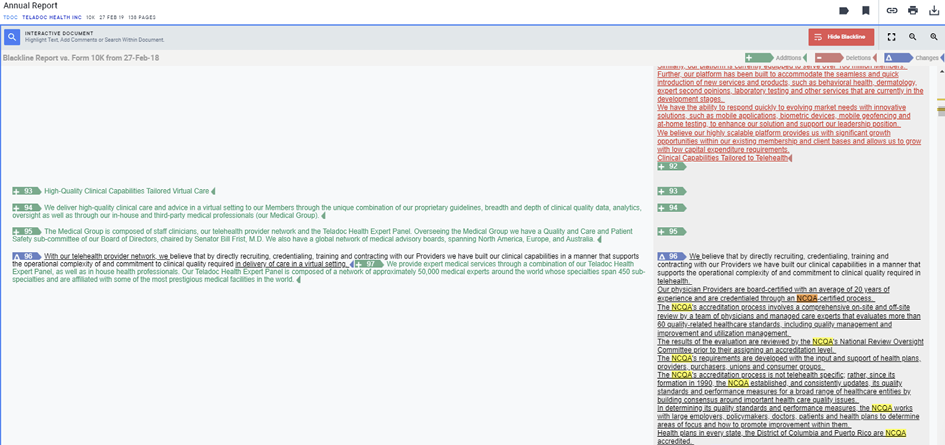

Take the 2019 10-K of Teladoc as a case in point. At the time, the telemedicine giant were in the midst of their NCQA certification review, an important healthcare accreditation. Through automated text analysis, investment professionals would have been able to easily (and quickly) notice that all mentions regarding this certification were suddenly dropped in their February 2019 filing (Figure 1).

Take the 2019 10-K of Teladoc as a case in point. At the time, the telemedicine giant were in the midst of their NCQA certification review, an important healthcare accreditation. Through automated text analysis, investment professionals would have been able to easily (and quickly) notice that all mentions regarding this certification were suddenly dropped in their February 2019 filing (Figure 1).

Through NLP, an equity researcher would have been able to swiftly deduce that this sudden avoidance of discussing Teladoc’s NCQA certification may mean that the firm are encountering delays or, at worst, not receiving their certification again. And, as was the case, the group were placed under “corrective action” by the NCQA three months after the 10-K was published.

Some sophisticated investment professionals also apply sentiment analysis to 10-Ks and 10-Qs, in addition to the techniques discussed above. Sentiment analysis comprises an automated algorithm that can methodically peruse sentences, sub-sentences, and even the lexicon utilised in a company filing, to produce various insights on a company. These insights can vary from straightforward bullish/bearish indicators (e.g. a 10-K with frequent mentions of “we are confident” will be assigned a bullish score), to the detection of specific emotions (e.g. distress, joy, sadness) depending on the NLP’s intricacy.

Key providers of such analysis include:

- InsiderScore – produce “similarity scores” that look at the year-over-year textual difference in a company’s 10-K and 10-Q filings. The score is based on the Harvard Lazy Prices study (Cohen, Malloy, and Nguyen, 2019), which states that significant textual differences in a company’s filings yearover-year can be indicative of future financial distress.

- Brain – produce several sentiment metrics for US stocks based on the language utilised in their 10-Ks and 10-Qs. An example metric calculated by Brain examines the percentage of words in a filing with language classified as “constraining”, “interesting”, “litigious”, and “uncertainty”. These metrics are provided for the full filing, as well as separately for the Risk Factors and Management Discussion and Analysis sections.

- Amenity Analytics – produce two sentiment scores based on company SEC filings. The first is a general sentiment score between -100 to +100, indicating negative and positive sentiment, respectively. The other investigates “key drivers and relevant trends” mentioned in the filing – for instance, the group extract mentions of “new products” from a filing, and subsequently classifies them by positive or negative sentiment. Amenity also offer isolated sentiment signals (e.g. number of “deceptive phrases” per earning statement per company).

THE “LESSER-KNOWN” COMPANY FILINGS

10-Ks and 10-Qs are not the only company filings that can offer material information to investment professionals. There are dozens of public filings submitted by companies that can provide similar signals – and, on some occasions, superior ones – but they are not as popularised in the financial services industry.

FORM 5500

Form 5500s are legally required to be submitted by US companies under the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code. Simply put, it is an annual document submitted by both private and public companies in the US to the Department of Labor, containing detailed information on the benefits and welfare plans offered by the company to their employees.

Aspects reported in the Form include:

- The number of employees participating in a company pension or benefit plan;

- Pension contributions by both the employee and employer;

- Payroll and medical insurance offered, and their payment schedules; and

- General firmographic information, such as employee counts

For investment professionals, Form 5500s can offer several insights into a company. Short-sellers can analyse employee benefit contributions to determine if deceleration is occurring at a company – if deceleration is indeed observed, it can signal payment delinquency and potential future weakness in the stock. ESG investors can analyse employee benefit plans across companies and industries to understand the overall treatment of employees and corporate governance. In insurance and underwriting, the occurrences of cutbacks in payroll and benefits can signal credit risk and distressed financial health.

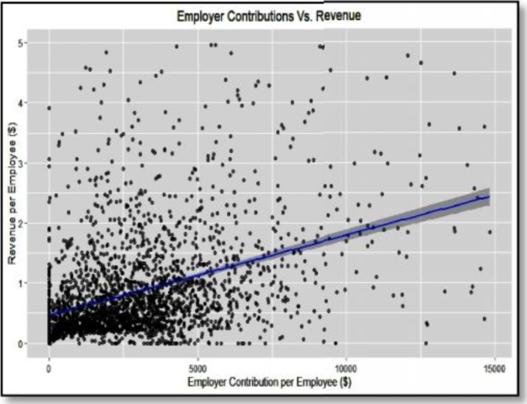

The applicability of Form 5500s for investment professionals has also been confirmed by external research. For instance, Cussatt and Demere (2019) discovered that markets do, in fact, react to disclosures released by companies through their Form 5500, particularly regarding their pension contributions and expenses. Similarly, a recent paper by T.Rowe Price (2018) found that employer contributions were positively correlated with company financial performance. Likewise, a 2020 whitepaper by a provider of Form 5500 data, Axiomatic Data, uncovered statistically significant correlations between pension plan contributions and corporate financial performance for Russell 3000 companies (Figure 2).

The applicability of Form 5500s for investment professionals has also been confirmed by external research. For instance, Cussatt and Demere (2019) discovered that markets do, in fact, react to disclosures released by companies through their Form 5500, particularly regarding their pension contributions and expenses. Similarly, a recent paper by T.Rowe Price (2018) found that employer contributions were positively correlated with company financial performance. Likewise, a 2020 whitepaper by a provider of Form 5500 data, Axiomatic Data, uncovered statistically significant correlations between pension plan contributions and corporate financial performance for Russell 3000 companies (Figure 2).

Form 5500s are publicly accessible to investment professionals via the US Department of Labor. Those interested in utilising the Form should be aware of one caveat though: the low reporting frequency. As mentioned earlier, the filing frequency of Form 5500s for individual companies is typically annual, meaning that longitudinal company-level insights will be relatively slow-moving.

WARN ACT

Perhaps one of the more “well-known” of the “lesser-known” filings, WARN notices have become a frequently used filing to identify companies in distress.

In simple terms, the Worker Adjustment and Retraining Notification (WARN) Act is a US federal law that requires companies to give advance notice to the government if they are intending to lay off more than 50 employees at a single plant and/or close a plant entirely. When such activity is expected to be carried out, companies submit WARN notices to the Department of Labor, and list information such as:

- The name of the company;

- The layoff/closure date;

- The number of employees impacted; and

- The reason behind the layoff/closure

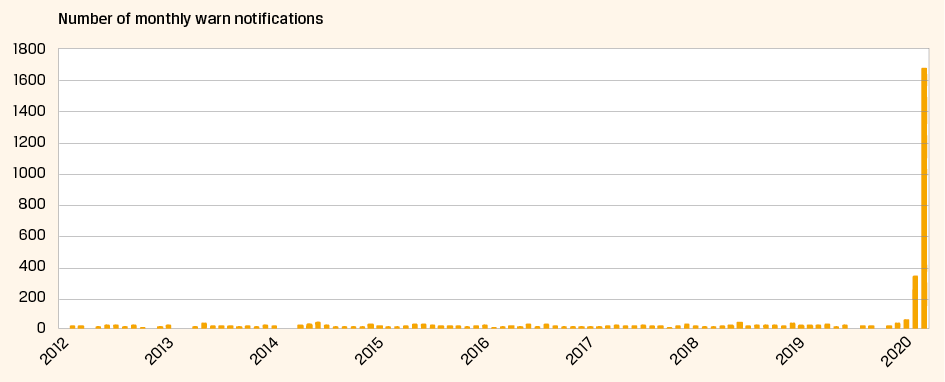

Perhaps the most obvious use case of WARN Act notices is distinguishing at-risk businesses ahead of time. WARN Act notices can also be leveraged as a barometer for the health of certain industries, geographies, and US businesses in general. For instance, during COVID-19, the US observed record numbers of WARN Act notifications (Figure 3), signalling the severity of the pandemic to investment professionals before official economic statistics were released:

Perhaps the most obvious use case of WARN Act notices is distinguishing at-risk businesses ahead of time. WARN Act notices can also be leveraged as a barometer for the health of certain industries, geographies, and US businesses in general. For instance, during COVID-19, the US observed record numbers of WARN Act notifications (Figure 3), signalling the severity of the pandemic to investment professionals before official economic statistics were released:

International equivalents to the WARN Act are also available for investment professionals to utilise – HR1 Forms are one such equivalent. Like their US counterpart, the UK require companies that intend to make 20 or more of their employees redundant to provide a 90-day notice to the Secretary of State.

However, unlike the WARN Act, HR1 Forms have two limitations:

- The Form is deemed “commercially confidential” – as such, company names are not disclosed by the government, restricting company-level insights.

- The UK do not make HR1 Form data easily available to the public – information on HR1 submissions can currently only be retrieved through Freedom of Information Act requests, which may be too resource-intensive for investment professionals. WARN Act notices, on the other hand, are publicly accessible through the Department of Labor.

UCC FILINGS

Uniform Commercial Code (UCC) filings, specifically UCC-1 filings, are legal notices that are submitted by lenders in the US during the provision of a loan. The notice is required for various business loans under the Uniform Commercial Code in the US, and establishes that creditors have the right to the asset(s) used as collateral by the debtor, should they default on their loan.

UCC-1 filings detail the lien, the name of the debtor, and the name of the creditor. Therefore, the document can be pertinent during due diligence/KYC, as one can uncover the percentage of a company’s assets that is held as collateral and determine whether their operations are largely underpinned by liabilities.

UCC filings can be used to monitor a company’s financial health over time as well. Currently, UCC-1 filings are valid for up to five years from its submission – should a debtor be required to continue their loan, they must file a UCC-3 requesting a further five-year extension. As such, investment professionals can use UCC-1 filings in conjunction with UCC-3 filings to obtain a more complete picture of a company’s financial standing.

UCC-1 filings can also be used to investigate the lender, not just the debtor. For instance, by aggregating UCC-1 filings, one can answer questions such as:

- How many loans have Wells Fargo extended to H&M?

- In dollar amounts, how much have Wells Fargo loaned H&M?

- Can Wells Fargo recoup their losses by recovering H&M’s assets, should the retailer default on their loan(s) due to the challenging economic climate set by COVID-19?

There are also international equivalents of UCC-1 filings, making this type of filing relevant to investment professionals with a non-US interest as well.

For instance, in England and Wales, Form MR01s offer similar insights into debtors and creditors as a UCC filing – when a company use an asset to secure a loan, they must register their “charge” via a Form MR01 within 21 days. And, like the UCC-1 filing, Form MR01s can be submitted on various business loans such as mortgages and debentures, capturing material liabilities for a company.

FORM 144

Many are familiar with Form 4s, the SEC filing that legally requires the public disclosure of any security transactions completed by corporate insiders. However, few are aware of its lesser-known companion: Form 144. While Form 4s report insider transactions after-the-fact, Form 144s require that insiders provide up to a 90-day notice of a proposed sale of 5k or more shares and/or $50k or more worth of shares.

Many are familiar with Form 4s, the SEC filing that legally requires the public disclosure of any security transactions completed by corporate insiders. However, few are aware of its lesser-known companion: Form 144. While Form 4s report insider transactions after-the-fact, Form 144s require that insiders provide up to a 90-day notice of a proposed sale of 5k or more shares and/or $50k or more worth of shares.

For investment professionals, utilising Form 144s offer three advantages.

Firstly, insiders of foreign companies traded in the US are not legally required to file a Form 4. However, they are required to file a Form 144, making the document one of the few sources of insider buys/sells that investment professionals can possess for these companies.

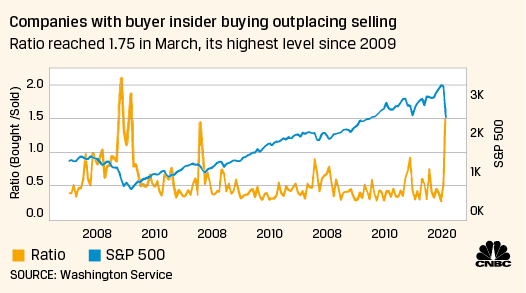

Secondly, the Form can be used to gauge the outlooks of executives/insiders. For example, in 2020, the US stock market was seeing one of the highest levels of insider buys (Figure 4), signalling corporate optimism and a general bullish view of the economy despite the ongoing COVID-19 pandemic.

Finally, Form 144s are one of the rare filings in circulation that are still filed as a paper document – in fact, it is currently only accessible through a reading room in Washington DC. Therefore, very few investment professionals have the ability to easily get their hands on Form 144s.

It should, however, be noted that most insiders exploit the notice period set by the SEC – since the Form allows the sale within 90-days of filing, insiders typically complete their transactions the same day that their Form 144 is filed (Chakrabarty and Shkilko, 2012). Academic research has also found that Form 144s are nearly always reported after Form 4 disclosures due to the effects of the Sarbanes-Oxley Act (SOX), inadvertently counteracting the original purpose of the filing being timelier than Form 4s (Franzen, Li, and Vargus, 2013).

Nevertheless, the Form does possess other information advantages – providing visibility on non-US company insider transactions, gauging executive outlook – making it a worthwhile filing for investment professionals in the grand scheme of things.

COUNTY COURT JUDGEMENTS

Many investment management practitioners take a view that company filings are mostly useful for providing insight into US companies – in particular, publicly-traded US companies. While there is a degree of veracity to this statement – after all, the US are perhaps one of the more transparent regions in the world – this is not always the case.

County Court Judgments (CCJ) are proof positive.

CCJs are a legal submission filed by creditors in the UK when their debtors fail to repay the money they owe – it is often one of the first plans of action for creditors hoping to recoup their losses. The submissions are made as/when creditors encounter difficulties with their debtors (making it a filing that offers highfrequency data to users) and contain detailed information such as:

- The name of the debtor;

- The total sum of money that the judgement was filed for; and

- The total amount owed by the debtor

For investment professionals, CCJs can act as a useful warning sign for identifying which UK businesses can no longer manage to pay their debts – at least not on time – and are in financial distress. Moreover, given the nature of the filing itself, CCJs will be particularly pertinent for monitoring privately-owned smallto-medium sized businesses in the UK.

For investment professionals, CCJs can act as a useful warning sign for identifying which UK businesses can no longer manage to pay their debts – at least not on time – and are in financial distress. Moreover, given the nature of the filing itself, CCJs will be particularly pertinent for monitoring privately-owned smallto-medium sized businesses in the UK.

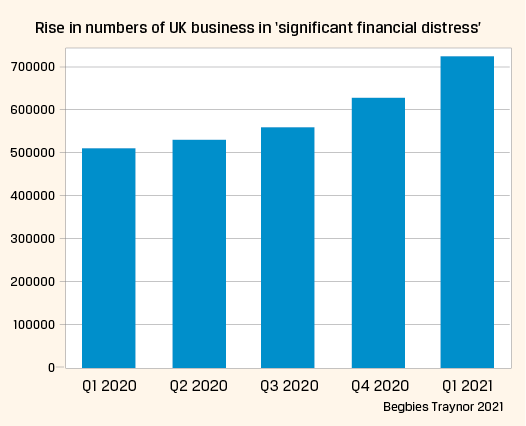

For macro investors, CCJs can also be leveraged as a broad gauge into the financial health of the UK economy before official statistics are released by authorities. For example, during the early days of the COVID-19 pandemic, the UK were observing an increasing number of CCJ submissions, implying that the region were heading into a period of poor credit health (Figure 5):

CCJs are currently retrievable through the Registry Trust, who maintain the official records on behalf of the Ministry of Justice.

STANDARD ESSENTIAL PATENTS

The use cases of company filings are not restricted to just finding early warning signs – there are several public filings that can help investment professionals identify the earnings/revenue potential for a company.

Standard Essential Patents are one such filing.

For those unfamiliar with the world of innovation, when standard-setting organisations (SSO) convene to discuss new standards, they produce official documents that detail the specific items, materials, systems, and technologies that must be followed to be standard-compliant. A Standard Essential Patent (SEP) is a patent filed by companies that claim that their invention(s) is “essential” in a standard’s use.

For the few companies that find their invention(s) to be “standard-essential”, this opportunity can lead to significant revenue generation, as all other firms that operate in the respective standardised industry would be legally required to license the patented invention and pay royalties to comply. Qualcomm, for instance, made news in 2017 when it was shared that smartphone manufacturers would be required to pay up to $16.25 in royalties for each 5G device they sold as the firm’s technologies were “essential” for the global 5G NR standard.

For the few companies that find their invention(s) to be “standard-essential”, this opportunity can lead to significant revenue generation, as all other firms that operate in the respective standardised industry would be legally required to license the patented invention and pay royalties to comply. Qualcomm, for instance, made news in 2017 when it was shared that smartphone manufacturers would be required to pay up to $16.25 in royalties for each 5G device they sold as the firm’s technologies were “essential” for the global 5G NR standard.

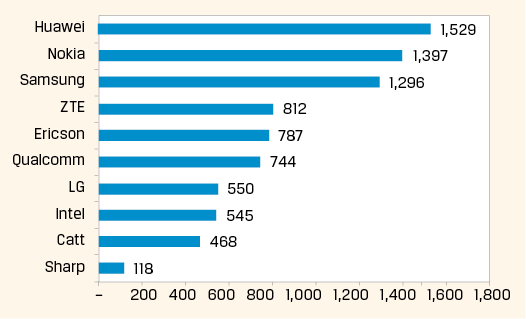

As such, by monitoring SEPs filed by companies, investment professionals can gauge the potential revenue that a firm is expected to earn (Pohlmann, Neuhausler, and Blind, 2015). For example, firms such as Huawei and Nokia have currently filed over 1k SEPs for their inventions (Figure 6) concerning 5G, indicating that the two tech giants stand to generate huge royalties as the technology rolls out globally:

Monitoring SEPs will be particularly relevant for investment professionals with a vested interest in heavily standardised industries such as telecommunications and materials, as these sectors are where SEPs strongly come into play. For those that fall within this research remit, SEP data can be obtained from the public online directories of various SSOs (e.g. ETSI for telecom SEPs, IEC for electronics SEPs).

FINAL REMARKS

As investment professionals continue to search for data that can pre-empt company performance, public filings can be a valuable source of material information. Particularly through the use of “lesser-known” filings, such as the brief selection discussed, investment professionals can ensure that they possess an information edge over peers that continue to solely rely on “well known” company filings.

As touched on above, these lesser-known filings are publicly available through various organisations, thereby making this information accessible to any and all interested investment professionals. The fact that these filings are free to access also highlights that extracting material information on a company does not have to be expensive – a common misconception in the financial services industry around the use of non-traditional data (Whyte, 2020).

Information accessibility has been further promoted by alternative data providers, who offer various commercial products on lesser-known filings, which investment professionals can subscribe to for a nominal fee. For instance:

- • Intellectual property data provider, PatSnap, collate Standard Essential Patents declared by major standardsetting organizations, including the ITU, ETSI, CEN, and IEEE.

- The Washington Service consolidate Form 4s and Form 144s on hundreds of thousands of public companies and corporate insiders.

- In 2020, public data aggregator, Enigma, launched a WARN Act notification database for US companies.

Therefore, alternative data providers can play a useful role in reducing barriers to entry for investment professionals hoping to incorporate these lesser-known filings into their research processes.

Finally, as filing analysis technologies become increasingly sophisticated, alternative data providers may venture beyond just simply collating these filings in a standardised manner, and begin producing derived insights/signals to be more valuerelevant. Such developments have already been gaining traction among Form 5500 data providers. For example, alternative data provider, Axiomatic Data, offer “Thrive Scores” – a proprietary score based on employee growth and benefit disclosures in Form 5500s, which claims to predict the likelihood of a company thriving financially.

REFERENCES

- How to read a 10-K like Warren Buffett. E MacBride (2014)

- How Investment Analysts Spot Critical Changes In SEC Filings. AlphaSense (2019)

- Lazy Prices. L Cohen, C Malloy, and Q Nguyen (2019)

- The Usefulness of Selective Tax Return Disclosure: Evidence from Form 5500. M Cussatt and P Demere (2019)

- Where 401(k) Design and Corporate Profitability Cross Paths. T.Rowe Price (2018)

- Pension Contributions and Corporate Financial Performance: Signals from Form 5500 Data February 2020. Axiomatic Data (2020)

- Information Leakages and Learning in Financial Markets. B Chakrabarty and A Shkilko (2012)

- The effect of Sarbanes-Oxley on the timely disclosure of restricted stock trading. L Franzen, X Li, and M Vargus (2013)

- Standard essential patents to boost financial returns. T Pohlmann, P Neuhausler, and K Blind (2015)

- How Much Are Managers Paying for Data? A Whyte (2020)

- Introducing WARN Act Notifications data. Enigma (2020)

- Axiomatic Data Creates and Releases ThriveScores™. Axiomatic Data (2021)

in VBA Journaal door Chashaka Wimalaweera and Daryl Smith