SUSTAINABLE INVESTING AND WATER RISKS

INTRODUCTION

INTRODUCTION

In a world grappling with escalating water stress, prioritizing water as a strategic business imperative has never been more critical. Companies must accurately assess the growing challenges posed by water scarcity, understand how they could impact their business activities and navigate them accordingly. But harnessing the power of water is not just a necessity; it is also a transformative opportunity that can propel businesses towards a sustainable and prosperous future.

This can have significant repercussions for investors and their portfolios, too. In fact, investors seeking to reduce the sustainability risks that can affect the value of their holdings, to mitigate their investments’ impact on the environment, and to identify and take advantage of sustainability-related opportunities, will be looking to understand how companies are exposed to and manage water-related issues.

This is particularly important when investing in the utilities sector, which is heavily dependent on water resources for electricity generation. As water stress intensifies, the sector finds itself on the frontline of a battle against mounting water scarcity, which poses significant threats to energy security. From hydroelectric plants to thermal power facilities and nuclear power stations, water is an indispensable resource for the utilities sector. These inherent risks must be addressed head-on and taken into account in the decarbonization scenarios of countries and companies.

In this article, we propose an analytical approach for assessing water dependency of power generation companies. We illustrate this approach using the examples of three European hydroelectric companies with significant exposure to this type of physical risk. Using our in-house Biodiversity Assessment Model, we shed light on the operational and strategic risks linked to the evolution of the water cycle. Further, we show the importance of contextual assessment for integrating water-related issues in a relevant manner in an investment context.

Finally, we highlight the current challenges associated with data quality and availability, and illustrate a solution to integrate physical water-related risks into the investment decision process.

By recognizing water as a strategic business priority and investment theme, companies and investors can position themselves at the vanguard of sustainable development, working towards long-term resilience of business activities and investment portfolios.

WATER: A STRATEGIC BUSINESS PRIORITY AND A KEY INVESTMENT ISSUE

Water is a crucial resource for businesses across many sectors. 69% percent of listed equities reporting via the Carbon Disclosure Project (CDP) in 2022, state that they are exposed to water risks that could generate substantive changes in their business.

The utilities sector heavily depends on water resources for electricity generation, making it particularly exposed to changing water patterns. Escalating risks associated with water scarcity and mounting water shortages in dry regions pose a substantial threat to energy security. This applies across various forms of power generation activities:

- Hydroelectric power accounted for approximately 15% of global electricity generation in 2021 (International Energy Agency – IEA, World Energy Outlook 2022). Thus, hydroelectric power has a significant position in the global energy mix, as source of power and storage. Hydroelectric plants are particularly vulnerable to changing precipitation patterns and reduced water availability. Droughts can reduce water levels, limiting their power generation capacity. Conversely, increased rainfall and runoff can lead to flooding, causing damage to infrastructure, hence affecting power generation.

- Thermal power plants rely heavily on water for cooling purposes. They accounted for about 40% of total freshwater withdrawals for energy production in 2021 (IEA, World Energy Outlook 2022), which highlights the substantial water needs associated with cooling processes in power generation and the risks that limited water availability ultimately represent for electricity generation capacity.

- Nuclear power plants also require large amounts of water for cooling purposes. Cooling systems in nuclear power plants play a critical role in maintaining safe operating temperatures. The water used for cooling is typically drawn from nearby water bodies, such as rivers, lakes, or more rarely oceans, and then returned to the source at a higher temperature. This dependence on water represents a serious risk, as illustrated by the record output cuts in 2022 at French operator EDF due in part to severe droughts that reduced the amount of surface water available for cooling. In France, the cooling of nuclear reactors accounts for about one third of total water consumption, behind agriculture (45%), but ahead of drinking water (21%) and industrial use (4%) (French Ministry of Environmental Transition). Given the significant operational concerns that changing patterns in water availability can create, it is crucial that water availability and quality be considered in the planning, construction, and operation of nuclear power plants to ensure their long-term sustainability

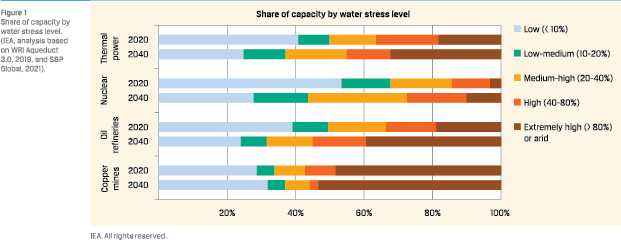

Critically, the share of energy supply infrastructure in high water stress areas is set to increase over the coming years, as illustrated in figure 1 below. Around one-third of global refining capacity is currently located in high water stress areas. The IEA forecasts an increase up to 55% by 2040. Over 40% of freshwater-cooled thermal and nuclear fleets are projected to be in high-risk areas by 2040. (IEA, analysis based on WRI Aqueduct 3.0, 2019, and S&P Global, 2021).

Critically, the share of energy supply infrastructure in high water stress areas is set to increase over the coming years, as illustrated in figure 1 below. Around one-third of global refining capacity is currently located in high water stress areas. The IEA forecasts an increase up to 55% by 2040. Over 40% of freshwater-cooled thermal and nuclear fleets are projected to be in high-risk areas by 2040. (IEA, analysis based on WRI Aqueduct 3.0, 2019, and S&P Global, 2021).

TRANSITIONING TO MORE WATER-RESILIENT BUSINESS MODELS IS ABSOLUTELY CRUCIAL IN THE CONTEXT OF THE UNPRECEDENTED WATER CRISIS THAT OUR WORLD IS FACING

Figures are unequivocal. In May 2022, an international team of researchers led by the Stockholm Resilience Centre and Potsdam Institute for Climate Impact Research found that the planetary boundary for freshwater has been “considerably transgressed” due to human activity. The United Nations predicts a 40% global shortfall in water supply by 2030 if current consumption and production patterns do not change. The latest report from the Global Drought Observatory shows that 47% of Europe is in “warning” conditions and 17% in “alert” conditions. According to the latest Global Water Report, the summer of 2022 saw Europe’s worst drought in 500 years. The IEA reports that about two-thirds of the world’s population experience severe water scarcity for at least one month each year. Climate change will only make water flows more erratic.

COMPANIES MUST CONSIDER AND MANAGE WATER AS THE LONG-TERM STRATEGIC AND OPERATIONAL RISK IT CAN REPRESENT

The operational and financial impacts of water-related risks are already materializing. In 2022, depleted and contaminated water supplies led to USD 13.5 billion of stranded assets across the very water-intensive industries of electric utilities, oil and gas, coal, and metals and mining. (CDP, 2022).

Therefore, companies must consider and manage water as the long-term strategic and operational risk it can represent. Resilience to changing water availability patterns must be a top priority for executives in their strategic planning and capital allocation. With high risks also comes growing opportunity for companies that can anticipate these changes. In fact, companies that integrate water into long-term business and financial planning realize four times more opportunities (CDP, Global Water Report 2022).

WATER RISK ASSESSMENT: COMPLEX BUT CRUCIAL FOR COMPANIES AND INVESTORS ALIKE

As water risk has become a material issue for companies and investors, it is critical to properly assess it. Investors need to understand companies’ exposure to water risks and how such risks can potentially impact their portfolios. Companies must identify these risks and develop appropriate strategies to address them, including oversight at the highest governance level. Such strategies should include in-depth risk assessment, comprehensive water footprinting (assessment of water impacts and dependencies) and contextual target-setting and reporting.

However, assessing water-related risks remains very complex, due to the lack of relevant data and the fact that many companies have so far failed to adopt an adequate approach to water management and disclosure. It can therefore be complex to integrate water-related risks into investment decisions, beyond proven cases of mismanagement.

While there was an 85% rise in corporate water disclosure through CDP over the past five years, with a 16% increase in 2022 alone, the level of disclosure is still insufficient. Even among companies disclosing via CDP, very few have adopted a contextual approach to water management, with identification and adequate disclosure regarding water hotspots. Many companies limit their approach to general principles and grouplevel objectives.

Various regulatory initiatives are supporting greater and more homogeneous disclosure, such as the EU’s Corporate Sustainability Reporting Directive (CSRD), which requires large, listed companies to report on a range of ESG data including water use and biodiversity loss; and the Sustainable Finance Disclosure Regulation (SFDR), which introduces mandatory reporting for financial market participants. Yet there is still significant room for improvement.

When assessing companies’ water risks exposure and water stewardship strategy, investors can draw on certain internationally recognized initiatives that provide reporting frameworks, guidelines and recommendations. Examples include the CDP Water Security Questionnaire, the Global Reporting Initiative (GRI), the guidelines for freshwater of Science-Based Targets Network, which were released in May s2023, and the framework of the Climate Disclosure Standards Board (CDSB).

Both the TNFD’s and CDSB’s guidance for water-related disclosure provide significant steps in the right direction, by requiring contextualized and localized water reporting that include asset-level data on hotspots. This will be crucial for companies and investors to develop adequate water-risk assessment and management approaches. Importantly, investors have a key role to play in engaging with companies to push for more transparency and improved data.

DEVELOPING A WATER ASSESSMENT FRAMEWORK

Comprehensive and accurate data are crucial for investors to make informed decisions, assess risk, and identify investment opportunities. Against the backdrop of the lack of quality data on water, a solution is for investors to develop their own water framework or to work with asset managers that have developed such methodologies.

We have developed our own internal proprietary Water Framework. It is based on the CDSB framework, relies on data from our in-house Biodiversity Assessment Model and uses the WWF Water Risk Filter Suite to identify and evaluate water risks around the world.

Importantly, our framework applies a materiality risk approach. Its underlying philosophy is that a company’s water risk should be contextualized and should include both water stress (availability, quality, access) and scarcity (water use/demand compared to water availability). These risks are the result of both (1) the company’s specific business and the water dependencies and impacts of its operations or value chain and (2) the context in which its activities are located.

The framework is structured around four pillars:

- 1. Adequate governance and water disclosure. Only 31% of companies in high-impact sectors have established incentives for C-Suite executives on water-related issues (CDP, 2019). Most of them still fail to provide contextualized water disclosure, and only very few disclose their water hotspots. We use our in-house tool to compare hotspot areas identified by companies on the one hand with, on the other hand, our own water stress analysis of their sites of operation. Where inconsistencies are uncovered, it can then make sense to engage with companies.

- Comprehensive water strategy based on specific quantitative targets and clear KPIs. Water dependencies, impacts, risks and opportunities are sitespecific, whether they occur in a company’s operations or along its value chain. As such, having context-driven targets is central.

- Integration of risks and opportunities into the long-term strategy.

- Company performance and progress disclosure, with historical data.

Each of these pillars includes several sub-pillars with specific minimum requirements and best practices. This framework is then integrated into our ESG framework and is used in order to guide our engagement efforts.

CASE STUDIES: IMPACT OF WATER RISKS ON UTILITIES COMPANIES ACTIVE IN HYDROPOWER GENERATION

In a context of global climate change and unprecedented, recurring droughts in Europe, the tension on European hydroelectric power plants keeps increasing. In addition to production losses, hydropower generation has become less predictable, thus creating risks on the overall electricity system, as hydropower is often used to balance demand and supply

Water is a contextual issue that needs to be assessed locally, at basin level. This means that corporates and investors need to develop asset-level tools to monitor and report on water issues. In fact, hydrological situations vary depending on the geographical location, even within a same country, underlining the importance of using a contextual approach. As such, a utility company often faces different water supply issues, and an analysis focusing on the global perspective only could miss local tensions and hide actual risks. Taking into account the contextual dimension is one of the key recommendations of the latest Taskforce for Nature-Related Disclosure guidance on reporting on nature-related risks and opportunities, based on the so-called LEAP approach (Locate, Evaluate, Assess, Prepare).

The following three case studies illustrate this approach and show the past, current and future impacts of water dependency on hydropower generation in Europe. We use our in-house Biodiversity Assessment Model to analyze the water stress situation of European hydro plants companies that are amongst the most exposed to physical water-related risk: Iberdrola in Spain, Enel in Italy and EDP in Portugal.

Using GIS tools and data from different sources, we match each asset of a company with relevant information about the current water situation in its area. The main indicators used in this analysis come from the WWF Water Risk Filter Suite, recommended by EU (ESRS-E4 recommendation), and from the TNFD, notably the Water Scarcity Index, the Drought Frequency Probability and the Projected Change in Drought Occurrence.

IBERDROLA

Iberdrola is one of the largest electric utility companies in Europe and has significant hydro capacities, with many of those in high water stress areas. We have limited our analysis here to Spain, where Iberdrola has the majority of its hydro capacity. According to the company’s latest public data, it has 135 hydroelectric and mini-hydroelectric plants in Spain, generating about 11 GW (Factbook 2023). Hydro represents 35% of the company’s total renewables capacity.

INVESTORS HAVE A KEY ROLE TO PLAY IN ENGAGING WITH COMPANIES TO PUSH FOR MORE TRANSPARENCY AND IMPROVED DATA

According to the European Commission’s Joint Research Centre, a quarter of the European Union territory is in a state of drought, and Spain is one of the most affected countries. Rainfall has been declining by 5-10mm a year since 1950, with a further 10-20% drop in winter rains anticipated by the end of the century.

According to the European Commission’s Joint Research Centre, a quarter of the European Union territory is in a state of drought, and Spain is one of the most affected countries. Rainfall has been declining by 5-10mm a year since 1950, with a further 10-20% drop in winter rains anticipated by the end of the century.

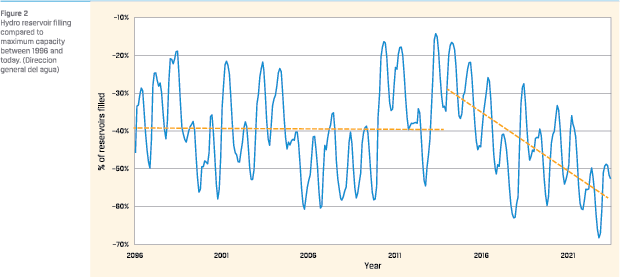

There has been a consistent decline in the overall capacity of Spain’s reservoirs since 2013, when reservoirs reached a peak at 85% of their total capacity (Dirección General del Agua – Ministerio para la Transición Ecológica y el Reto Demográfico, 2023). Subsequent years saw a sustained downward trend, with an acceleration from 2015 onwards, as shown in figure 2.

Capacity dropped to 70% in 2018, 65% in 2020, 60% in 2021, and plummeted to 50% in 2022.

As defined by the WWF Water Risk tool, we use the Water Scarcity Indicator which quantifies the relative abundance or lack of freshwater resources significantly impacting businesses through production/supply chain disruptions, higher operating costs, and growth constraints. This scarcity is primarily humandriven but can be exacerbated by natural conditions such as aridity and periods of drought. The Water Scarcity Indicator is typically calculated as a function of the volume of water use/ demand in relation to the volume of available water within a given area.

As defined by the WWF Water Risk tool, we use the Water Scarcity Indicator which quantifies the relative abundance or lack of freshwater resources significantly impacting businesses through production/supply chain disruptions, higher operating costs, and growth constraints. This scarcity is primarily humandriven but can be exacerbated by natural conditions such as aridity and periods of drought. The Water Scarcity Indicator is typically calculated as a function of the volume of water use/ demand in relation to the volume of available water within a given area.

In order to accurately represent the reality of the company’s operations, the percentage of MW installed that are exposed to water stress are used as indicator.

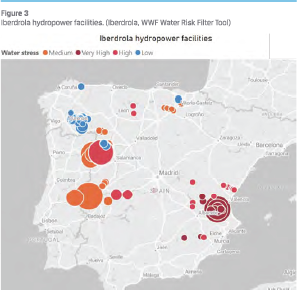

As illustrated on the above map (the wider the dot, the higher the installed capacity of the hydroelectric plant), an important part of Iberdrola’s hydro installations are already in high or very-high water stress areas. More specifically, according to the WWF Water Screening risk, in 2020, 48% of the company’s installed hydro capacity was located in high or very high water stress areas, 35% in medium water stress areas, 17% being in low or very low water stress areas.

In Spain, the company’s hydro load factor, i.e. the ratio of average load to maximum demand during a given period of time, experienced a decrease from an estimated 22% in 2016 to only 10% in 2022. To put this into perspective, Iberdrola’s load factor for its hydro operations in Brazil was 36% in 2022. In 2022, profit fell by 14% as summer droughts hampered hydroelectric generation, which was almost 48% lower than in 2021, the company’s hydro load factor decreasing from 17% to 10% over this period.

Based on current data, the distribution of water stress across Iberdrola’s hydroelectric installations is not expected to change drastically in the near future. However, a concerning pattern has emerged: seasonal variations have intensified over the years, especially with regards to the frequency and intensity of droughts.

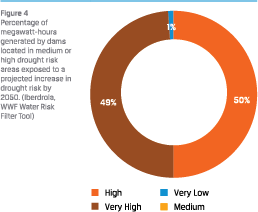

At present, Iberdrola’s hydro installations are highly vulnerable to drought risk. More than half of the installed capacity is located in areas with medium (21%) or high (31%) drought risk. And future forecasts project an unfavorable outlook. The frequency of droughts in these areas, which include 44 installations of the company, is expected to increase significantly by 2050 as shown in the graph below, posing a potential limitation to hydroelectric generation.

At present, Iberdrola’s hydro installations are highly vulnerable to drought risk. More than half of the installed capacity is located in areas with medium (21%) or high (31%) drought risk. And future forecasts project an unfavorable outlook. The frequency of droughts in these areas, which include 44 installations of the company, is expected to increase significantly by 2050 as shown in the graph below, posing a potential limitation to hydroelectric generation.

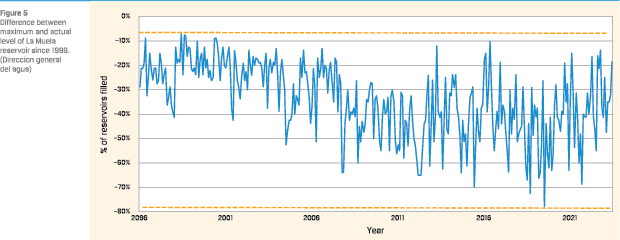

Local issues: Focus on La Muela:

Seasonal variation of water availability, i.e. variation of water availability from a given reservoir within a year, is also of concern. The case of La Muela, one of the most important reservoirs owned by Iberdrola, illustrates this.

The La Muela hydroelectric complex, located in the municipality of Cortes de Pallás (Valencia) in the Júcar river basin, has a total installed capacity of 1,762 MW and 1,293 MW of pumping capacity. With a total investment of more than €1.2 billion, La Muela is one of the largest pumped-storage hydroelectric plants in Europe and represents almost 20% of Iberdrola’s totaled installed capacity in Spain.

While analyzing the historic data of La Muela’s reservoir, it appears that, in addition to a reduction in available water resources, there has also been also an increased fluctuation between the annual maximum and minimum levels.

As can be seen in figure 5, the difference between maximum and actual capacity of the reservoir was approximately 18% in the early 2000s. This disparity grew to above 50% in 2021, and currently stands around 40% according to 2022 data. The highest reservoir fill level was achieved in 1998 and has not been matched since. Simultaneously, the minimum fill level has been persistently decreasing, culminating in a nearly 20% fill rate in 2019. The increased seasonal variation in terms of water availability can create significant operational issues and decrease optionality when operating hydro facilities.

As can be seen in figure 5, the difference between maximum and actual capacity of the reservoir was approximately 18% in the early 2000s. This disparity grew to above 50% in 2021, and currently stands around 40% according to 2022 data. The highest reservoir fill level was achieved in 1998 and has not been matched since. Simultaneously, the minimum fill level has been persistently decreasing, culminating in a nearly 20% fill rate in 2019. The increased seasonal variation in terms of water availability can create significant operational issues and decrease optionality when operating hydro facilities.

ENEL

Our research further extends to Italy, focusing specifically on Enel S.p.A., the largest Italian power utility company. Power generation constitutes approximately half of the company’s activities (based on EBITDA), and hydroelectricity accounted for 33.5% of the company’s total net installed maximum capacity in 2022 (Enel annual report 2022). With about 16,586 MW of hydroelectric generation capacity in Europe, Enel is one of the region’s largest hydroelectric power producers.

Our research further extends to Italy, focusing specifically on Enel S.p.A., the largest Italian power utility company. Power generation constitutes approximately half of the company’s activities (based on EBITDA), and hydroelectricity accounted for 33.5% of the company’s total net installed maximum capacity in 2022 (Enel annual report 2022). With about 16,586 MW of hydroelectric generation capacity in Europe, Enel is one of the region’s largest hydroelectric power producers.

Like Iberdrola, we estimate that the load factor of Enel’s hydro operations in Italy has gone down from 17% in 2018 to 10% in 2022.

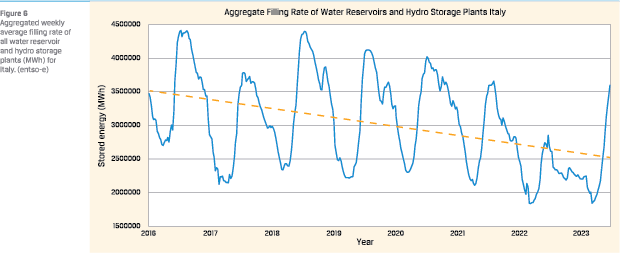

Publicly available water data in Italy goes back only to 2017, limiting the potential for extensive long-term analysis. Nevertheless, a decreasing trend can be observed based on the available data.

Figure 6 depicts the aggregated weekly average filling rate for all water reservoirs and hydroelectric storage plants in Italy, measured in megawatt-hours (MWh). This unit represents the amount of energy that can be generated from the stored water.

Figure 6 depicts the aggregated weekly average filling rate for all water reservoirs and hydroelectric storage plants in Italy, measured in megawatt-hours (MWh). This unit represents the amount of energy that can be generated from the stored water.

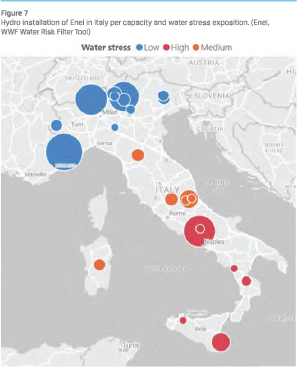

Over the course of the past seven years, the potential energy stored in Italy’s hydroelectric reservoirs has decreased by 29%, with a notable acceleration of this trend after 2018. However, it may be premature to draw definitive conclusions due to the limited duration of measurements. Furthermore, this national average obscures substantial regional disparities, as demonstrated by the map below, which illustrates the exposure to water stress of Enel’s hydroelectric plants across Italy

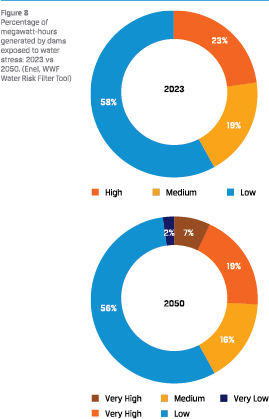

Southern Italy is particularly vulnerable to water stress, and this trend will continue to accelerate. Moreover, future projections suggest a stark divide between Northern and Southern Italy. While Northern Italy is not anticipated to see an increase in water scarcity, Southern installations – in red on the map above – show high exposure to drought risk with an increasing trend projected in the coming years. The situation is especially concerning in Sicily, notably at the Anapo and Guadalami sites. Figure 8 shows that in 2023, 23% of Enel’s installed capacity is located in areas of high water stress. In 2050, it is projected that 7% of the company’s installed capacity, notably the Sicilian operations, will then be in very high water stress areas while part of the medium water stress areas will become high water stress zones.

EDP

EDP

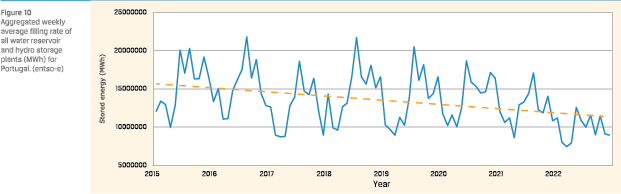

Finally, focusing on Portugal, there has been a decreasing trend in available water energy since 2018. According to data from ENTSO-E, the capacity declined by 30% between 2018 and 2022 as illustrated in figure 10.

We use EDP Energias de Portugal as a case study, to assess the operational impacts on Portuguese hydro operators.

EDP Energias de Portugal SA is a Portugal-based utility company now present in 28 markets across Europe, North America, Latin America and Asia-Pacific. Hydro represents about 30% of its totaled installed capacity, with a hydro portfolio of 5.5 GW in Iberia (45% of which with pumping capacity).

Like Iberdrola and Enel, the severe droughts of 2022 in Southern Europe have led to a persistence of the weak hydro resource. EDP saw its Iberian hydro generation more than halve in the first half of the year compared with the year before, translating into a Eur19 million loss of earnings after the unit recorded positive EBITDA of Eur281 million last year.

Nevertheless, the forecast scenario seems to be more optimistic for EDP considering the concentration of dams in the North of the country, where it is less likely to be exposed to water stress. Among the hydro installation, the situation looks homogeneous. This situation is explained by the geographic proximity of these installations and the similarities between the watersheds.

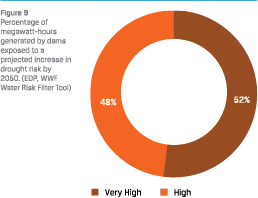

However, we underline that even if the drought risk is considered as low globally, the predicted increase in the drought occurrence and change in water availability will be a challenge for all installations as the level of drought risk will increase strongly or very strongly for all assets, illustrated in figure 9.

However, we underline that even if the drought risk is considered as low globally, the predicted increase in the drought occurrence and change in water availability will be a challenge for all installations as the level of drought risk will increase strongly or very strongly for all assets, illustrated in figure 9.

The case studies of Iberdrola, Enel and EDP show the extent of utility companies’ exposure to water-related issues and the risks emanating from structural trends, such as the decreasing trend in the filling of reservoirs, accelerated drought risks, and greater seasonal variability, impacting hydro production and therefore earnings.

INTEGRATING WATER RISKS INTO THE OVERALL ESG ANALYTICAL FRAMEWORK: IMPACTS ON PORTFOLIO CONSTRUCTION

Water scarcity, variations in water availability and other waterrelated risks impact not only utilities companies’ operations. Their effects extend to companies’ financial results and can affect the value of investors’ portfolios. Investors seeking to avoid such repercussions will look to integrate water risks into the overall ESG analytical framework and consider ESG factors in financial analysis and investment decision-making. This allows them not only to assess the long-term resilience of companies’ business models, but also to build a resilient portfolio.

In this section we outline how water risks fit into our overall ESG analytical framework and their resulting impacts on portfolio construction.

Our proprietary ESG analytical framework examines water risks through two angles:

Our proprietary ESG analytical framework examines water risks through two angles:

- Exposure of companies’ business activities to key sustainability challenges: This part of the framework integrates the analytical elements outlined in the case studies above pertaining to companies exposure to water risks.

- Stakeholder management: The framework also analyses how companies manage their key stakeholders, one of which is the environment. This is an important complement to the analysis of water risk exposure. Here we ask notably how companies address physical water risks. For example, in the case studies above we note that the companies are aware of water risks and have included them in their risk report for years. All companies all have put in place specific policies and tools to manage water stress and water scarcity. However, in periods of acute risk, they remain quite dependent on political arbitrage between various water usages (i.e. farming, drinking, power). The three companies have been reporting to CDP Water and have set ambitious objectives:

- Enel: 56% reduction of specific freshwater withdrawal by 2025 and 65% by 2030 (base year 2017);

- Iberdrola: 63% reduction of intensity of water use/ production by 2030 (base year 2021);

- EDP: 78% reduction of freshwater consumption by 2025 (base year 2015).

Despite these advances, the companies fail to disclose contextualized targets and basin/asset-level water information. This should be a key area of improvement for companies, and a key topic of engagement for investors.

In addition to a detailed analysis of risks, our overall ESG screening also considers opportunities resulting from companies’ ability to develop activities that benefit from long-term sustainability trends and to successfully integrate stakeholder interests into their strategy.

This detailed analysis of water-related risks and opportunities is then combined with the in-depth assessment of the risks and opportunities pertaining to other environmental issues. This results in an overall environmental rating for each issuer. This rating is in turn combined with the issuer’s social and governance ratings. Together, these form an overall ESG Rating, which fully integrates water-related risks and opportunities. These results of the ESG analytical framework can be applied in portfolios construction at two levels:

- To determine the ESG-eligible investment universe through exclusions and best-in-universe or best-in-class approaches;

- To enrich fundamental company analysis and valuations through integration approaches, for example by factoring ESG evaluations into the discounting rate of discounted cash flow models.

WATER: LIQUID GOLD FOR SUSTAINABLE BUSINESSES AND PORTFOLIOS

Water is a theme of utmost importance for corporates and investors, demanding increased attention from investors and strategic prioritization from businesses, notably when it comes to the utilities sector.

The dependencies of the utilities sector on water resources for energy generation, including hydroelectric power, cooling processes in thermal power plants and nuclear power stations, highlight the sector’s vulnerability to water risks. While these risks are currently mostly physical in nature, transition risks are looming on the horizon. It is imperative for the utilities sector to adopt proactive measures to enhance its resilience and sustainability in the face of these challenges. For investors, this also means that water-related risks, impacts and opportunities must be taken into account while analyzing countries and companies’ decarbonization strategies and commitments.

FOR INVESTORS, THIS ALSO MEANS THAT WATER-RELATED RISKS, IMPACTS AND OPPORTUNITIES MUST BE TAKEN INTO ACCOUNT WHILE ANALYZING COUNTRIES AND COMPANIES’ DECARBONIZATION STRATEGIES AND COMMITMENTS

By enhancing water disclosure and management, using a contextual approach supported by specific targets and metrics, utilities can enhance transparency, build resilience, and attract investments from stakeholders seeking to support sustainable business practices while minimizing financial risks. In the same vein, companies integrating those risks in their strategy and looking to adopt proactive measures – by upgrading infrastructure, investing in more efficient systems enabling water reuse and recycling, implementing operational best practices supported by technology and digital tools – represent key investment opportunities.

Investors have a pivotal role to play in this transformative journey. By incorporating water risk assessment into their portfolio management and engaging with companies to promote enhanced water disclosure, they can steer capital towards businesses with a comprehensive water stewardship strategy and encourage others to improve.

References

- International Energy Agency, (2022), World Energy Outlook 2022

- Carbon Disclosure Project, (2022), Setting the high water mark for mandatory disclosure

- Food and Water Watch, (2019), Thirsty Fossil Fuels: Potential for Huge Water Savings by Switching to Renewables

- Stockholm Resilience Centre, (2022), Freshwater boundary exceeds safe limits

- International Energy Agency, (2021), World Energy Outlook 2021

- Carbon Disclosure Project, (2022), Financial institutions deeply exposed to stranded assets caused by global water crisis

- Carbon Disclosure Project, (2022), Global Water Report 2022

- Climate Disclosure Standards Board, (2021), CDSB Framework: Application guidance for water-related disclosures

- Carbon Disclosure Project, (2019), World’s largest companies using more water despite rising risks

- Science Based Targets Network, (2023), Technical Guidance 2023 for Freshwater

- European Commission, (2023), European Drought Observatory – Interactive Mapviewer

- Spanish Government’s Ministry for the Ecological Transition and the Democratic Challenge, (2023), Report on the state of drought and water shortage

- World Energy Data, (2022), Spain and Portugal suffering driest climate for 1,200 years

- French Ministry of Environmental Transition, (2022), L’eau en France: ressource et utilisation – Synthèse des connaissances en 2021

- Direccion General del Agua, Ministerio para la Transicion Ecologica y el Reto Demografico, (2023), Boletin hidrologico peninsular

in VBA Journaal door Astrid Pierard