A TECHNICAL DECOMPOSITION OF THE INFLATION-LINKED SWAP RATE

Dirk Broeders, Gavin Goy, Annelie Petersen and Nander de VetteCentral banks and investors critically monitor market-based inflation measures as key indicators for medium-term inflation expectations. Market-based measures of inflation expectations have experienced a sharp decline over 2019. The euro 5y5y inflation-linked swap rate has fallen from 1.8 percent at the beginning of 2019 to a level of around 1.2 percent at year’s end. This sharp decline raises the question what drives the low market-based inflation measures. We show that a large part of this decline is likely to be attributed to a fall in the inflation risk premium. This implies that nominal bonds are no longer an ‘inflation bet’ but rather a ‘deflation hedge’.

Inflation erodes purchasing power while deflation adds purchasing power over time. Because future inflation is unknown, investors face purchasing power risk which is also called inflation risk. An inflation-linked swap is a financial contract that transfers this inflation risk from one market participant to another. The swap entails that one market participant pays a fixed rate cash flow on a notional principal amount while the other participant pays a floating rate that is linked to an inflation index. Inflation-linked swap prices are therefore useful for deriving market-based measures of inflation expectations. This swap price is the fixed rate of the inflationlinked swap. The euro 5y5y inflation-linked swap rate (henceforth ‘5y5y’) is the standard metric for expressing medium-term inflation expectations. It measures current fiveyear inflation expectations five years ahead in time by taking a long position in a ten year inflation-linked swap contract and a short position in a five year contract. As a result, factors that drive the price of medium term inflation-linked swap contracts impact the 5y5y.

INFLATION-LINKED SWAP RATES CAN BE DECOMPOSED IN AN EXPECTATION AND A RISK COMPONENT

An important caveat is that the price of an inflation-linked swap is not exactly equal to the expected inflation. In fact, the price of an inflation-linked swap contract is decomposed into two parts: an inflation expectation component and an inflation risk premium. The expectations component reflects the expected inflation, while the risk premium is the compensation investors demand for uncertainty surrounding the expectation. If, for instance, investors believe there is a probability that inflation will be much higher in the future, e.g. due to an oil price shock, then the risk premium will be high. Contrary, if the uncertainty surrounding the average forecast is low, the risk premium is small. In certain cases the inflation risk premium can even become negative. The economic intuition behind this flip of the sign is as follows. In an inflationary regime nominal bonds are an inflation bet and investors demand compensation for inflation risk. In a deflationary regime nominal bonds are a deflation hedge and investors are willing to accept a lower return resulting in a negative inflation risk premium. A negative inflation risk premium is not controversial in the literature and described by, e.g., Fischer (1975), Hordähl and Tristani (2007), and Campbell, Sunderam and Viceira (2017).

An important caveat is that the price of an inflation-linked swap is not exactly equal to the expected inflation. In fact, the price of an inflation-linked swap contract is decomposed into two parts: an inflation expectation component and an inflation risk premium. The expectations component reflects the expected inflation, while the risk premium is the compensation investors demand for uncertainty surrounding the expectation. If, for instance, investors believe there is a probability that inflation will be much higher in the future, e.g. due to an oil price shock, then the risk premium will be high. Contrary, if the uncertainty surrounding the average forecast is low, the risk premium is small. In certain cases the inflation risk premium can even become negative. The economic intuition behind this flip of the sign is as follows. In an inflationary regime nominal bonds are an inflation bet and investors demand compensation for inflation risk. In a deflationary regime nominal bonds are a deflation hedge and investors are willing to accept a lower return resulting in a negative inflation risk premium. A negative inflation risk premium is not controversial in the literature and described by, e.g., Fischer (1975), Hordähl and Tristani (2007), and Campbell, Sunderam and Viceira (2017).

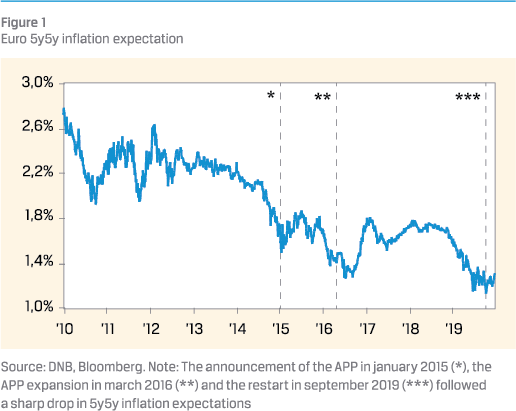

Figure 1 shows the 5y5y has been steadily declining over the recent 10 years, with a sharp decline that took off in the fourth quarter of 2018. The recent decline in the 5y5y could be driven by both the inflation expectation and the inflation risk premium. In this article we do a deep dive on which of these two components is more crucial in explaining the low market-based inflation measure.1 Disentangling this effect is important to understand whether inflation rates are below, but close to, 2 percent over the medium-term. Further, investors may want to know if uncertainty about future inflation is high or low.

MEASURING INFLATION EXPECTATIONS AND THE INFLATION RISK PREMIUM

The market for inflation swaps is very liquid and inflation-linked swap (ILS) rates are observable continuously.2 However, neither the expected inflation nor the inflation risk premium are directly observable, and hence need to be estimated using a model. We follow Camba-Mendez and Werner (2017) who propose an affine term structure model for modeling the inflation-linked swap curve. This curve contains the fixed rates for all maturities. For ease of notation from now on we refer to this model as the CMW-model. An affine term structure model assumes that interest rates, or in this case inflation-linked swap rates, at any point in time, are a linear function of a small set of common factors. According to the CMW-model, the first three principal components of the inflation swap curve explain the majority of the variability of the ILS rates.

The market for inflation swaps is very liquid and inflation-linked swap (ILS) rates are observable continuously.2 However, neither the expected inflation nor the inflation risk premium are directly observable, and hence need to be estimated using a model. We follow Camba-Mendez and Werner (2017) who propose an affine term structure model for modeling the inflation-linked swap curve. This curve contains the fixed rates for all maturities. For ease of notation from now on we refer to this model as the CMW-model. An affine term structure model assumes that interest rates, or in this case inflation-linked swap rates, at any point in time, are a linear function of a small set of common factors. According to the CMW-model, the first three principal components of the inflation swap curve explain the majority of the variability of the ILS rates.

NEITHER THE INFLATION EXPECTATION NOR THE INFLATION RISK PREMIUM COMPONENT ARE DIRECTLY OBSERVABLE

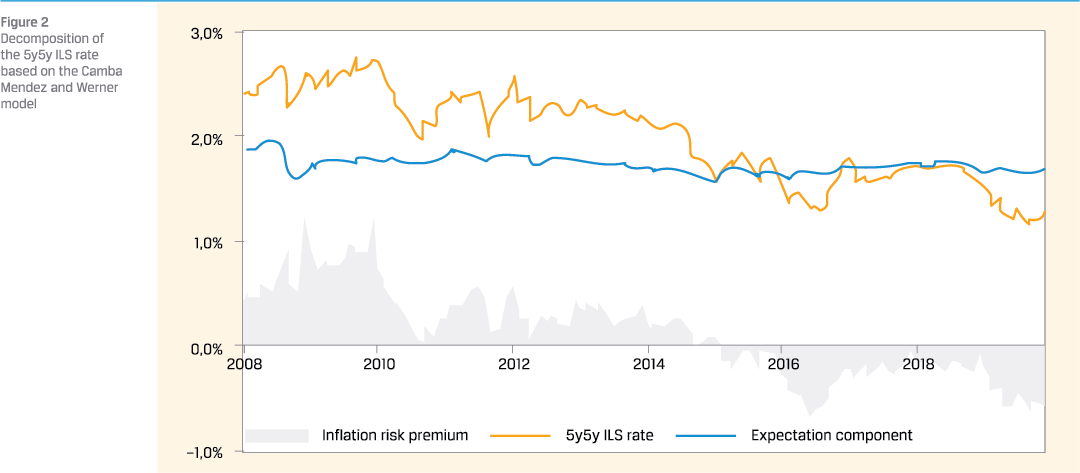

The CMW-model is estimated using maximum likelihood on observed monthly ILS rates data. Formally, the inflation risk premium is then defined as the difference between the expected value of future inflation under the risk-neutral measure and the expected value of future inflation under the physical measure (see the box). We replicate the estimation procedure of Camba-Mendez and Werner (2017). Figure 2 plots the decomposition of the 5y5y into the expectations component and the inflation risk premium. According to this figure, the substantial decline in the 5y5y is mainly driven by a decline in the inflation risk premium rather than the expectations component. The figure indicates that the expected inflation remained fairly stable at around 1.7 percent, while the inflation risk premium (grey area) declined sharply. In fact, the inflation risk premium turned negative in 2018. Currently, the market based inflation risk premium is –0.6 percent.

WHAT EXPLAINS A NEGATIVE INFLATION RISK PREMIUM?

At first glance, a negative inflation risk premium may appear counterintuitive. The sign of the inflation risk premium however depends on the market perceived balance of risks surrounding inflation outcomes. If, on the one hand, market participants agree that there is a risk of high inflation, the inflation risk premium will be positive because investors want to be compensated for inflation that will “eat up” real returns. On the other hand, if market participants agree that the main risk is that of a deflationary recession, the inflation risk premium can be negative. Because deflation adds purchasing power, investors do not have to be compensated for that. The current negative inflation risk premium thus suggests that investors are more worried about low inflation outcomes (or even deflation) compared to high inflation outcomes.

HOW PLAUSIBLE ARE THE CMW-MODEL ESTIMATES?

Like any other model-based approach also the CMW estimates are vulnerable to model and parameter uncertainty. The inflation expectation and the inflation risk premium estimates vary largely both in terms of the level but also their dynamics depending on the model and estimation assumptions. In particular the estimation window is critical in the CMW-model. The length of the estimation window is an expert judgement call. In order to gauge the expert judgment underlying the CMW-model, we perform three cross-checks to assess its plausibility.

THE DECLINE IN THE 5Y5Y IS MAINLY DRIVEN BY THE INFLATION RISK PREMIUM

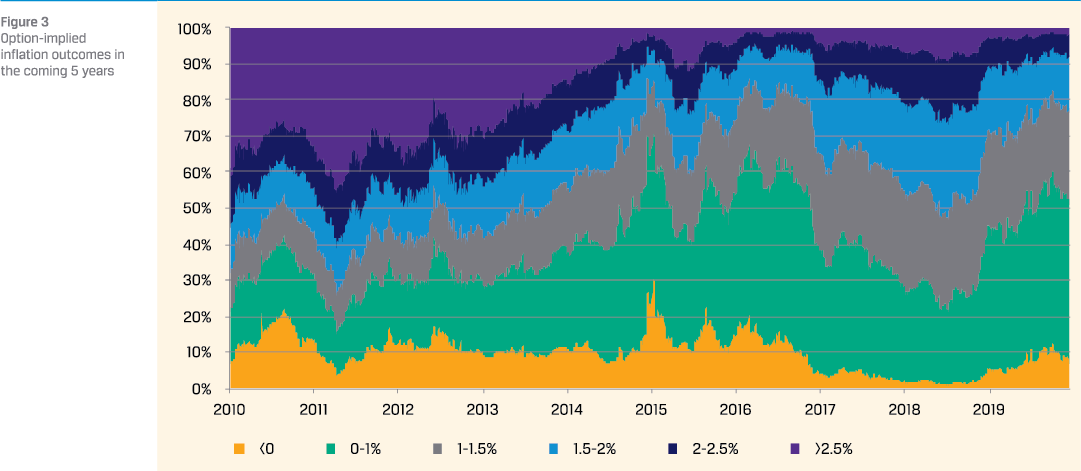

First, to compare the balance of risk surrounding inflationlinked swap rates, we use inflation-linked option market prices to derive the (risk neutral) probability distribution of future inflations. Figure 3 shows a historical time series of the probability density functions implied by five year inflationlinked options. The distribution divides the inflation outcomes in six buckets. The distribution shows that investors are currently indeed more worried about a low inflation environment instead of higher-than-expected inflation.

Investors currently see almost no probability for a high inflation scenario. In fact, they only attach a probability of 8 percent to an inflation above 2 percent. On the contrary, investors currently attach the highest probability (of approximately 50 percent) to a low inflation environment (between 0 and 1 percent). Also, the probability given to a deflation scenario is sizeable (roughly 10 percent). The balance of risks thus suggests market participants find that inflation risks are more skewed to the downside than to the upside. This implies that a low, or negative, inflation risk premium is associated with deflation risk rather than low inflation uncertainty (Camba, Mendez and Werner, 2017). This supports the CMW-model estimates.

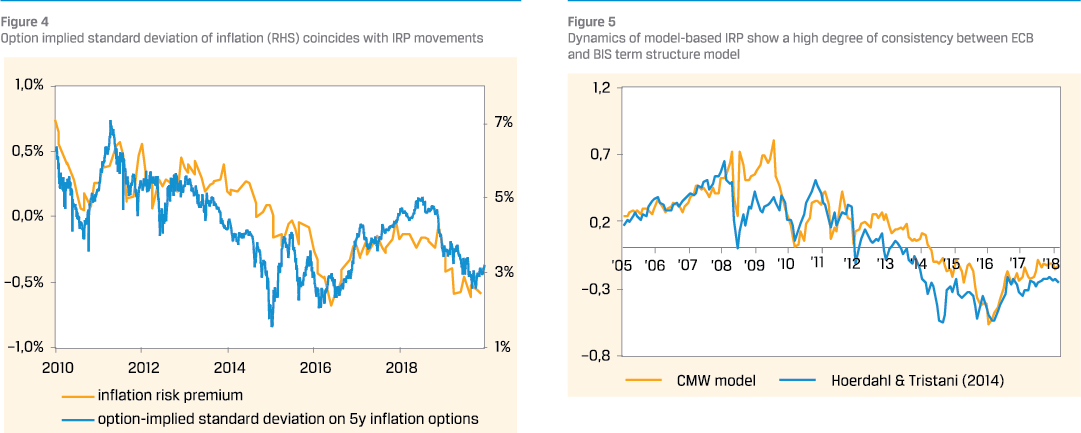

Second, we compare the output of the CMW-model with the standard deviation of market-based inflation inferred by inflation options. Figure 4 shows that there is a large co-movement between the model-based inflation risk premium and the option implied standard deviation, suggesting that the assumptions of the CMW model are plausible. A decline in the standard deviation means lower uncertainty surrounding future inflation, such that the compensation or premium for deviations from the expected inflation is low.

Third, we compare the inflation risk premium of the 10-year inflation-linked swap rates with the widely-used model from Hördahl and Tristani (2014) in Figure 5. Despite a level difference, which increases towards the sample end, the dynamics in both inflation risk premium estimates show a high degree of consistency, corroborating the plausibility of the assumptions underlying the CMW-model.

TECHNICAL EVALUATION OF THE CMW-MODEL

The three robustness checks suggest that the CMW-model indeed seems plausible. There are, however, two notable drawbacks of CMW in applying an affine term structure model on the inflation swap curve.

First, a key input of the model is a reliable measure of the shortterm inflation-linked swap rate. This short term measure determines the risk-free return on inflation-linked swaps. Because one-month inflation-linked swaps are illiquid, CambaMendez and Werner (2017) construct a 1-month ILS rate using past HICP inflation. This proxy is crucial. Using different measures, for instance constructed from survey-based inflation expectations, can lead to notably different inflation risk premium estimates.

NOMINAL BONDS ARE NO LONGER AN ‘INFLATION BET’ BUT RATHER A ‘DEFLATION HEDGE’

Second, the CMW-model only uses market prices. It does not take into account any macroeconomic data such as GDP, unemployment or survey information, which can improve the forecasting performance (see, e.g., Dewachter and Lyrio, 2006, and Rudebusch and Wu, 2008). A related concern with standard term structure models is that the imposed stationarity of the explanatory factors implies that the expected short rate far into the future always converges to its (unconditional) sample mean. As a result, the model’s predictions depend on the sample or estimation length (see Cochrane, 2007) and are unable to account for the fall in trend inflation (and the natural rate of interest, in the case of the nominal yield curve).

CONCLUSION

In the course of 2019, market-based measures of inflation expectations – most notably the 5y5y – have substantially declined and only recently seemed to have leveled out at around 1.2 percent. A large part of this decline can be attributed to a fall in the inflation risk premium. This suggests investors have adjusted their expectations to a low inflation environment, where the inflation risk is more to the downside (deflation) than to the upside (hyperinflation). This implies that nominal bonds are no longer an ‘inflation bet’ but rather a ‘deflation hedge’. While sensitive to its underlying estimation assumptions, the model-based measure of the inflation risk premium in CMW (2017) seems to align well with the option implied standard deviation and the balance of risks and other inflation risk premium estimates from the literature. Nonetheless, we identify some overarching drawbacks, including the lack of macroeconomic variables or the explicit formulations for stochastic inflation trends that require careful interpretation of the inflation risk premium estimates.

References

- Brand, C., G. Goy, G. and W. Lemke (2020), Natural rate chimera and bond pricing reality, forthcoming DNB working paper.

- Camba-Mendez, G. and T. Werner (2017), The inflation risk premium in the post-Lehman period, ECB Working Paper, no. 2033, https://www.ecb.europa.eu//pub/pdf/scpwps/ ecbwp2033.en.pdf.

- Campbell, J.Y., A. Sunderam and L.M. Viceira (2017), Inflation bets or deflation hedges? The changing risks of nominal bonds, Critical Finance Review,6, 263-301.

- Chen, A., E. Engstrom and O. Grishchenko (2016), Has the inflation risk premium fallen? Is it now negative?, FEDS Notes, Washington: Board of Governors of the Federal Reserve System, April 4, 2016, http://dx.doi.org/10.17016/2380-7172.1720.

- Cochrane, J. H. (2007). Comments on ‘Macroeconomic Implications of Changes in the Term Premium’by Glenn Rudebusch, Brian Sack, and Eric Swanson. Federal Reserve Bank of St. Louis Review, 89, 271-82.

- Dewachter, H. and M. Lyrio (2006), Macro factors and the term structure of interest rates. Journal of Money, Credit, and Banking, 38(1), 119-140.

- Fischer, S. (1975), The demand for index bonds, Journal of Political Economy, 83(3), 509-534.

- Hordähl, P. and O. Tristani (2007), Inflation risk premia in the term structure of interest rates, BIS Working Papers, no. 228.

- Hordähl, P. and Tristani, O. (2014), Inflation risk premia in the euro area and the United States, International Journal of Central Banking, 10(3), 1-47.

- Rudebusch, G. D. and T. Wu (2008), A macro-finance model of the term structure, monetary policy and the economy, The Economic Journal, 118(530), 906-926.

Notes

- 1 In theory also other factors may require compensation such as an illiquidity premium (Chen, Engstrom and Grishchenko,2016). We assume these other factors are negligible, because – except for ultra-short maturities – liquidity in inflationlinked derivatives is high.

- Note that we interchangeably use the price of an inflation-linked swap, the fixed rated of an inflation-linked swap and the ILS rate

- We find that changing the number of principal components does not notably change the inflation risk premium. By increasing the number of principal components the model becomes more accurate but also the risk of overfitting increases, and vice versa.

- A notable exception is Brand et al. (2020) where a term structure model is combined with a semi-structural macro-model which allows for secular macro trends in the natural rate of interest and core inflation to affect term premiums.

in VBA Journaal door Dirk Broeders, Gavin Goy, Annelie Petersen and Nander de Vette