INTRODUCTION

Accountancy is one of the oldest branches of economics and finance. Originally used to help run a business, it has rapidly allowed other functionalities such as raising taxes for monarchies and gradually enabling compliance controls, providing investors, boards, management, and regulators with quantitative supervisory or decision-making information, also exploited in making business or investment decisions.

Accountancy is one of the oldest branches of economics and finance. Originally used to help run a business, it has rapidly allowed other functionalities such as raising taxes for monarchies and gradually enabling compliance controls, providing investors, boards, management, and regulators with quantitative supervisory or decision-making information, also exploited in making business or investment decisions.

In this article, we are focusing on the evolution of modern accounting-based valuation methodologies used to make investment decisions and we explain how intangibles’ predominant importance in valuations lead to alternative methods. As modern integrated reporting attempts to include all sources of capital beyond financial capital (notably human, natural, societal, manufactured, and intellectual, see International Integrated Reporting Council (IIRC), the Global Reporting Initiative (GRI) and International Federation of Accountants (IFAC)), reporting is evolving towards a more evolved narrative that requires new tools of analysis. We illustrate these with natural language analysis and explain why this leads to stronger analytics in a modern world.

With the recent technological innovations & societal developments many assets in a company cannot be valued traditionally. The issue goes beyond traditional intangible assets valuation. In addition to the technological “options” held and executed by a company (think intellectual property or business model adaptation), other aspects are impacting the valuation of a company. Among them, an important one is taking more and more importance: the culture of a company

With the recent technological innovations & societal developments many assets in a company cannot be valued traditionally. The issue goes beyond traditional intangible assets valuation. In addition to the technological “options” held and executed by a company (think intellectual property or business model adaptation), other aspects are impacting the valuation of a company. Among them, an important one is taking more and more importance: the culture of a company

It has been well known for long and demonstrated in several researches over the last 10 years that a good culture creates value. For example Edmans (2011), showed that the 100 best companies to work for outperformed their peers in terms of stock returns by more than 2% a year over 1984–2009. Also, these companies delivered earnings that systematically exceeded analyst expectations.

In this context, the important developments in ESG (Environment, Social and Governance) aspects will be determinant in adding to the value of the company and as demonstrated in this paper, the quality of the governance within a company will be the central driver of the overall company intangible value.

In this article, we first review the link between accounting-based valuation and market valuation of companies to highlight the important gap that has widened over the last years. Then we introduce the concept of culture and how it is driven by the governance of a company and show how this culture adds significant value to the company. We conclude with some views on current and forthcoming practices in the governance area.

ACCOUNTING-BASED VALUATION METHODOLOGIES ERODE

Overtime, accounting financial data has been at the origin of corporate valuation. Today, this is much less representative of a corporate valuation. Many new drivers of valuation have appeared and are partly or not part of the classical financial balance sheet. Often, we speak of the valuation of tangible assets vs the valuation of intangible assets, the sum of the two making the true corporate valuation.

TANGIBLE ASSETS

Generally, the tangible assets (buildings, production capacity, land, equipment, furniture, inventory, securities, bitcoins, etc.) come in physical form, which means they can be identified and have an exchange value. The advantage of these assets are multiple: they can be depreciated; they are liquid and help a company to free cash if needs be; and they can be used as collateral to build leverage

TRADITIONAL INTANGIBLE ASSETS

In comparison, intangible assets (goodwill, patents, brands, copyrights, etc.) come within a hypothetical form, which means they can also be identified but remain non-monetary assets without physical substance. The valuation of these intangible assets is linked to future economic returns for the company generated by these assets. The valuations of these assets are based on multiple assumptions, that are in general conservative to avoid too much tax exposure to a company. These assets are considered as a long-term asset that can be valued as these latter can be sold by the company. As an example, patents or software can be sold or monetized through licenses.

CORPORATE CULTURE AS A NEW INTANGIBLE ASSET: THE INTANGIBLE CULTURE VALUE

In complement to traditional intangible assets, other components of a company valuation are hidden, which we qualify as the company’s culture. By company culture, we mean values, objectives, attitudes and practices that characterize an organization at all its levels. Culture will thus include elements such as attitude towards ESG of an organization or agility towards technological reinvention. From a backward-looking standpoint, culture can be linked to branding or reputation. As an example, a brand recognition and reputation should generate additional economic returns for the company in the future, which is typically captured in the image of companies such as Coca-Cola or Apple. From a forward-looking perspective a good culture, adding collegial and societal values or enabling fast and prudent transformation can create future value. We fundamentally believe that these cultural aspects are becoming a dominant part of the intangible value of assets and thus of the overall value of a corporation or an investment.

MARKET OBSERVATIONS OF INTANGIBLES

MARKET OBSERVATIONS OF INTANGIBLES

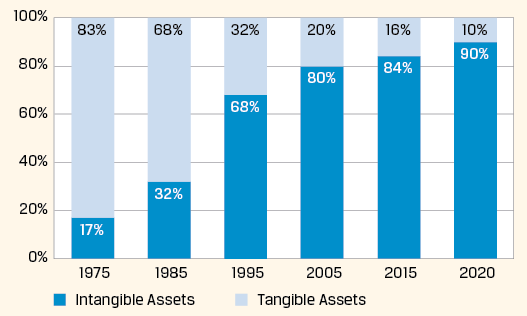

Figure 1 illustrates our assumptions that intangibles are representing most of the value of a company. This study of the valuation of the S&P500 market value by Ocean Tomo (2020) highlights the growing share of Intangible Asset Value within the overall S&P 500 value, demonstrating the importance and shift of intangible values taking a predominant place in today’s corporate valuations. The first observation is that over the last 20 years, the part of intangible assets have been representing more than 80% of the market value of S&P500 companies. The second observation is that the trend is significant and leads to assume that intangible assets represent almost all the market valuation of a company.

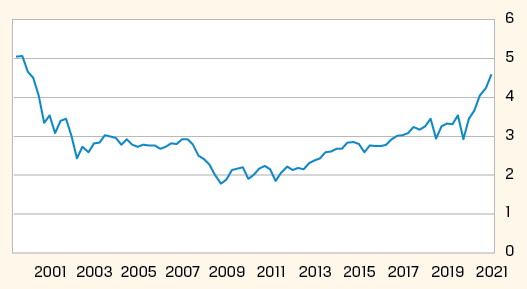

One could argue that growth in market value could be explained by the recent technological revolution, which is reflected in the growth of the Price-to-Book ratio. This is true as depicted on Figure 2, which highlights the evolution of the ratio over the last 20 years, demonstrating the importance and shift of intangible values taking a predominant place in today’s corporate valuations. However, in the case of a major technological development, we believe that the ratio should have steadily increased over the last 20 years, which is not the evolution we have observed. We believe that an additional element – the Intangible Culture Value – should be considered and explain some of the difference.

One could argue that growth in market value could be explained by the recent technological revolution, which is reflected in the growth of the Price-to-Book ratio. This is true as depicted on Figure 2, which highlights the evolution of the ratio over the last 20 years, demonstrating the importance and shift of intangible values taking a predominant place in today’s corporate valuations. However, in the case of a major technological development, we believe that the ratio should have steadily increased over the last 20 years, which is not the evolution we have observed. We believe that an additional element – the Intangible Culture Value – should be considered and explain some of the difference.

In summary, market valuation aspects are driven today by intangible valuation elements. We believe that corporate valuation relies less and less on financial accounting-based valuation techniques. Over the last 30 years reality in terms of valuation has diverted from book values with market values of companies massively and growingly exceeding book values. Accounting-based valuation will remain more control data allowing compliance controls and will become more a check rather than a pilot engine for company analysts. The essence of market-based valuation will be based on intangible assets, where corporate culture will be one of the most significant intangible assets.

INTANGIBLE CULTURE VALUE IS BECOMING MAINSTREAM IN CORPORATE VALUATION

As defined in the previous section, the corporate culture is becoming a key driver of a company value. It is hidden, not in the numbers, but at the same time when it is strong, it provides resilience, stability and flexibility to a company. As part of this, it is interesting to see that corporate culture is one of the major drivers chosen by millennials when they choose an employer (Gallup Survey, 2021). In particular and to support the growing importance of corporate culture, the survey highlights that millennials are prioritizing a sense of meaning to compensation when choosing a job. In this context, having a strong company brand and culture helps attract millennials and will keep them engaged.

As part of the cultural appreciation of a company, we can certainly mention three major drivers, where employees and stakeholders attached to a company identify themselves:

- Purpose – why a business exists, how it develops its long-term vision and business models to grow and develop its savoirfaire. This is a strong identity that every stakeholder of the company will link this to his/her emotional view of the company

- Values – how does the company shares fundamental values across all employees and its stakeholders; how the company defines, shares and lives the values is embedded within the supply chain of the company

- People – how does the company looks after its people to create a good environment, thus encouraging creativity, motivation and positive life; collegiality aspects and social values are fundamental to achieve this

These three drivers form the corporate culture, which depends on the quality of the governance of the company. Governance is the ultimate driver of culture, as it steers and monitors the organization towards the culture it wants to reach. This is very clear in family businesses but real all over.

GOVERNANCE AS THE SOURCE OF THE CORPORATE CULTURE

Governance is the art of decision making at the very top of organizations. It is a complex matter, involving different parties and organizational structures (board, exec com, owners, stakeholders) as well as leveraging many fields (law, economics, behavioral psychology, moral philosophy, control, regulatory policy, leadership, etc.). If this decision-making works well, with a good balance of power among all involved parties, it will result in a clear firm strategy development and execution, a good management of the people, and optimal stakeholder management. This will benefit the company but also will result in a market over-performance in the long term, i.e. the cultural intangible value. As an observation many technological companies have re-enforced their technological edge with cultural elements – as a representative example Google has been leading it by endorsing a cultural identity with free meals, employee social gatherings, financial bonuses and open presentations by high-level executives. Other quirks include gyms, a dog-friendly environment, and parks, all culture defining elements. Employees are thought to be driven, talented and among the cream of the crop. As summarized by Richard Branson “Care about your employees and they will care for you”.

When governance is not efficient or simply does not work, it becomes very visible (think Boeing, Volkswagen, or FIFA scandals). A good governance is rarely publicly rewarded as scandals focus exclusively on negative news. Poor governance is penalized by markets. Very often, this penalty is triggered alongside other larger issues such as the 2008 or Covid-19 crises, where weak governance become more visible. We can show it also leads to continuous underperformance and not only during strong events. This penalty is measurable during the crisis and lasts post the crisis as governance issues are not solved in the middle or right after a market crisis. In now classical words, “You only find out who is swimming naked when the tide goes out,” as Warren Buffett has passed along to Berkshire Hathaway investors.

THE QUALITY OF GOVERNANCE AS THE SOURCE OF THE INTANGIBLE CULTURE VALUATION

To evaluate the quality of governance and thereof the ability for the organization to steer towards its ideal culture, we can identify and measure the indicators of a good governance. Modern advances have given us new views of what truly creates good governance away from the mechanics of governance as assessed by MSCI, Bloomberg and proxy advisory. One of the authors’ work with many different organizations across the world has led him to a practical model of governance based on 4 pillars (Cossin, 2020):

- People Quality, Diversity, Focus and Dedication that translates into members being accountable, strategic, focused, knowledgeable, and dedicated for a good management and development of the people

- Information Architecture that is gathered and compiles in a structured manner to ensure the decision-making can be executed efficiently. By information, we comprise both informal and informal information coming from a broad range of sources

- Structures and Processes in place that are here to ensure a disciplined and effective management of the company and its bodies (audit, risk, strategy, performance review, culture oversight, etc.)

- Group Dynamics allowing everyone to provide inputs in a collegial manner to ensure a rich and constructive dialogue among all members and parties.

This practical model helps organizations achieve better governance. It requires intimate work in several dimensions and discipline around this work, a bit like health improvement takes multiple dimensions. Nonetheless, when seen from the outside, and rather than trying to improve, but trying simply to diagnose or assess, there are fundamental tenets to governance. At the very base is character and values. A sense of accountability and responsibility combined with integrity and moral authority are marks of the character required to execute good governance. This leads to other drivers in order to achieve materially, a view of the long term weighted by short term efficiency, an ability to build resilience, often a combination of financial conservatism and innovation, of stability and agility, of passion, purpose and compassion, so essential to true success, and of course of open mindedness and constructive dissent based on diversity of views, at the heart of the dynamics. This is the basis towards handling to the next generation something better than we received, towards positive environmental and social impacts, in brief, towards stewardship, the hallmark of quality governance.

From an intangible valuation perspective, applying the above to investments, will result in identifying companies that have strategies involving long-term, resilience, prudence, innovation, stability, agility and all other characters are fundamental elements of a successful robust business. In this context, shareholders will take hold of better governed companies despite market volatility. In other terms and theoretically, governance becomes a key differentiator (in generating returns) for shareholder and well governed companies should become core in investor’s portfolio allocations. We are demonstrating below that it verifies in practice. In summary, the roots of a quality corporate culture that is generating significant corporate value will come from the quality of the governance and how it is applied within a company.

INTANGIBLE CULTURE VALUE MEASURED THROUGH GOVERNANCE QUALITY

Many economic and financial theories find their roots in psychology. This is the same here, where the study of the language of patients gives a lot of indications on their pathologies. A company is simply another patient and studying its communication is rich in information. Recent advances in computer processing and artificial intelligence have made it possible (Balsmeier & al., 2018). We use content analysis to measure the personality of organizations, i.e. how well it is governed. Natural language processing (NLP) identifies companies that are materially different across a number of dimensions reflected within a word dictionary (Li, 2010 & Loughran and McDonald, 2016). This dictionary reflects the values expressed above. The process itself is a subfield of deep learning or machine learning techniques. It starts by identifying forward-looking messages embedded in company’s texts. Each text is analyzed sentence by sentence computationally to reveal elements that relate to corporate culture, behaviors and actions. We lever our experience for the selection of the words in a proprietary way but many dictionaries around the different sub dimensions are available in academic research. Implied lists and not only explicit ones are used, and word lists adapt to changes in business languages.

In this framework, the key is how to cluster the words and combination of words to extract the fundamental elements of quality governance. This language analysis leads to identify the personality of an organization in the same way psychologists pose a diagnostic on their patients. We look at numerous components such as long-term orientation, human capital management, and stakeholder management as part of a broader review involving numerous clusters. Table 1 highlights some words used by well-governed vs less governed companies. The appearance and associated frequency of these words is a good indicator of the corporate governance quality. These are implied words using a methodology available in the reference underneath. This broad analysis is composed today of a proprietary dictionary of more than 8000 words, which is the body of our governance scorings applied to the reading of companies’ annual reports. This review allows us to pose a diagnostic on the governance quality of every company, and also allows us to rank and compare them.

Our methodology puts in evidence important differences between better-governed companies and their peers. On the basis of the words they use, we find that well governed companies are financially more conservative (controlling for size and industry), have less debt and higher liquidity, and that they invest more in innovation, that they are less prone to mass layoffs. Table 2 confirms these differences and provides an analysis of 236 companies of the S&P 500 (April 2009 – March 2014, with sales over $10B) divided in four quartiles (1st quartile being the 59 best-governed companies of the sample).

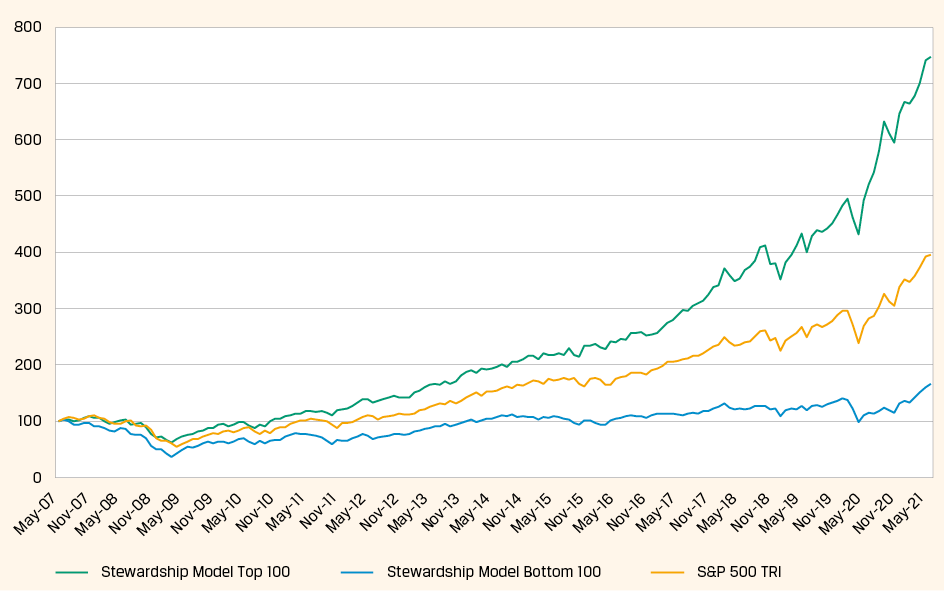

A crisis like 2008 has demonstrated that well-governed companies are better rewarded by the market as it is recognized that long term wise management triggered by governance helps better navigate all type of situations. We observed first, that well governed companies protected better during the correction and then thanks to their agility and better positioning, rebounded better and for the long term (In this context, Figure 3 and Table 3 highlight the continuing challenge to recover of poorlygoverned companies. It suggests the 2008 penalty to the shareholder value of the companies that not well-governed is still there after 12 years. Pushing the analysis further, when looking at the composition of the 100 better-governed companies in Figure 3, we observe two types of governance influence (Cossin, Botteron, Lu, 2020). Well-governed companies tend to outperform their own sector overtime and also create sectors over-weights and sectors under-weights, which gives a reflection of the overall governance quality of the sectors themselves.

A crisis like 2008 has demonstrated that well-governed companies are better rewarded by the market as it is recognized that long term wise management triggered by governance helps better navigate all type of situations. We observed first, that well governed companies protected better during the correction and then thanks to their agility and better positioning, rebounded better and for the long term (In this context, Figure 3 and Table 3 highlight the continuing challenge to recover of poorlygoverned companies. It suggests the 2008 penalty to the shareholder value of the companies that not well-governed is still there after 12 years. Pushing the analysis further, when looking at the composition of the 100 better-governed companies in Figure 3, we observe two types of governance influence (Cossin, Botteron, Lu, 2020). Well-governed companies tend to outperform their own sector overtime and also create sectors over-weights and sectors under-weights, which gives a reflection of the overall governance quality of the sectors themselves.

This demonstrates how the governance pilots the organization and develops a culture bringing resilience and agility in an organization. In well governed organizations, the board will be more engaged to prepare crises, adopt long term strategies, and incorporate risk management. Good governance drives agility in the view that the all organization will adapt to both growth, recession and unexpected shocks. Also, the stability of board members and employees ensure a transmission of knowledge in the human capital, that prepares better the company to nonpredictable future shocks. And indeed, as illustrated underneath, during the 2020 drawdown, well governed companies according to our methodology decreased 9% less than the market.

Interestingly, it is similar to what happened in 2008 as seen underneath. The companies with lower governance scores suffer the most. The companies with good governance, to the opposite to companies with poor governance are characterized as such:

- Better shock absorption in down market as these companies are recognized as more agile and better prepared for crises

- Faster recovery as faster in rebuilding the business thanks to better processes and policies, stronger balance sheets, and ultimately stronger acquisition and sales power.

- Higher long-term performance potential as concentrated on growth while poorly-governed companies still blocked in solving recurring issues preventing them to reconstruct faster.

In summary, there is a premia rewarded by the market on the good governance, which triggers a healthy culture in the company. As per our observations, this premia represents approximately 5% annual outperformance versus the index for the 100 best governed companies of the S&P500.

CAN WE UNLOCK GOVERNANCE VALUE? WITH RESILIENCE AND AGILITY

Governance brings all the mechanisms and cultural elements to absorb shocks, which means that when a crisis occurs, a wellgoverned company absorbs the shock better. This absorption is not the only strength of the good culture, it is also a force that positions better a company for the rebound. Governance creates the type of agility and sense of responsibility that let an organization handle efficiently whatever disturbances or chaos happens. It also drives grounded decisions in difficult situations. And well governed companies have more engaged employees protected by a more caring perspective from the hierarchy.

As Figure 3 puts in evidence, Better governance positions the company for a stronger rebound post crises such as 2008 or more recently the Covid crisis. A good governance will result in

- Faster recovery of its sales process

- Faster decision-making overall

- Ability to gain market share vs weakened competition

- Faster strategic hiring from weakened competitors

- Potential cheap strategic acquisitions

Having defined what we believe to be the benchmark framework for governance, we should address the question on how to get there. Based on multiple research (Loughran and McDonald, 2011, 2014), many companies are starting to embrace the change to an improved governance through their language. Shareholder engagement is an important trigger to this. In several publications, it has been highlighted that the personalities of the board influence the outcome of the change (or not). Observing communication of these companies, we can observe two major categories: first, the ones that are sincerely engaging to the change, where collegiality, actions, and fundamental strategic changes manifest themselves and second, the ones that will try to mask the “no-change” with adapted reports trying to depict a change that does not necessarily occurs we can define as ‘cheap talk’ (Cossin, Smulowitz, and Lu, 2020) or long sentences (Purda and Skillicorn, 2015). From these observations, companies with poor governance can fundamentally improve by changing and evolving the strong personalities of their board members, structures or dynamics. With good processes in place, the board will be able to define the strategy of the company, select the appropriate CEO and support the CEO to execute it (Gow & al, 2016).

FROM GOVERNANCE TO ESG CULTURE

Climate and environmental issues are looming large in the current crisis. Both on the positive (improvements in environmental conditions due to lesser pollution) and the negative side (what will happen with drop in oil prices?). So do social sustainability issues: the crisis has affected social classes differently and inequality is also a health driver, with all the moral consequences thereof. The key principle though is this one: governance drives environmental and social choices. Good governance will drive the quality of an organization resilience and agility in environmental matters as well as in social matters. More importantly, it will drive the dynamics around the challenges by tackling the issues proactively and transformatively (Cossin, Smulowitz, Lu and Pfarrer, 2019). In the current environment, where society is demanding more ethics and more environmental awareness, there is no doubt that the governance of a company will be (one of) the driving force(s) of the change. A company with a board addressing sincerely these issues will naturally adopt faster these changes through a combination of board leadership and culture evolution (Cossin, Smulowitz, and Lu, 2019). Linking this evolution to the ESG context, G drives the E and the S. We can see this in our model, where well-governed companies are the ones that have the largest impact on environmental and social aspects. Table 4 supports this and shows that well-governed companies have superior Environmental and Social ratings according to Sustainalytics and Robeco SAM. The catalyst to a good ESG policy starts with the G that, in addition to trigger stock outperformance, enhance impactful E and S policies at the corporate level.

CONCLUSION

Today, intangible assets represent the vast majority of a company market valuation. While traditional intangibles are still significant, modern intangibles such as corporate culture represent an increasing part of the corporate market value. Financial accounting-based valuations remain important but are growingly used for financial compliance purposes and less for market valuation purposes. As integrated reporting becomes mainstream, reporting becomes a narrative that needs to be analysed as such. With the new trends on the way to manage a company and create a corporate culture, the quality of the governance becomes key to market valuation. In a fast transforming world, the quality of the governance drives the quality of the culture across dimensions. Pushing further the analysis we have also demonstrated that a good governance does not only triggers outperformance but also generates a solid ESG impact for the company and all its stakeholders. As illustrated historically, a top quintile better-governed company generates 10% outperformance in average vs. a bottom quintile less wellgoverned company, which in other words means that its value doubles in nearly 7 years vs. a less well- governed company.

Governance is at the root of the intangible culture value. Thanks to governance, corporates are more agile and adapt better to exogenous shocks while remaining prudent and secure. This impacts positively their results, their employees, their stakeholders and ultimately, their shareholder value.

At the corporate level, legacy structures and processes are challenged and more agile companies rebound better, hence making healthier investments both for the short term and for the long term. This is materialized in a long term outperformance of their stock prices in three steps: first an outperformance during the market shock corresponding to a the fact that well governed companies combine resilience and agility in such a way that they live through the crisis better; second a faster recovery corresponding to the fact that the capital markets differentiate the companies that will have a long-term gain vs the weakest that will have to cope with a longer reconstruction; and third a faster expansion corresponding to a stronger growth capacity coming from the relative quicker reconstruction of the sales process.

In this context, governance has become central to the world of ESG by being the driver behind true E and S improvements. A company with a good G will approach S and E better. This combination does not only add ethic but also contributes to superior performance for its shareholders in both positive and negative markets. We are today at the beginning of ESG investments with fund management companies essentially focusing on the E. We anticipate new developments in the midterm with asset managers starting to focus on reconciling ESG with performance, where a growing focus will be on the quality of governance on ESG dimensions. This is part of an overall context also initiated by European regulators with the EU-Action Plan SFDR regulation, that explicitly requires investors to conduct investments following good governance practices (Regulation (EU), 2019).

In terms of future, it is promising to see an acceleration of ESG criteria adoption at board levels, with a growing involvement of their members.

The results observed will not leave investors and shareholders indifferent both in terms of their investment decisions and their involvement and commitment. We expect higher focus and development towards improving governance of companies giving rise to a governance premia to shareholders. This premia or cultural intangible value will become both an indicator of high responsibility and of outperformance.

Literature

- Balsmeier, B., G. C. Li, T. Chesebro, G. Zang, G. Fierro, K. Johnson, A. Kaulagi, S. Lück, D. O’Reagan, B. Yeh and L. Fleming. 2018. “Machine Learning and Natural Language Processing on the Patent Corpus: Data, Tools, and New Measures.” Journal of Economics & Management Strategy, (27)3: 535-553.

- Cossin, D., P. Botteron and A. Lu, 2020. The Good Governance Crash Test: COVID-19. Working Paper, IMD.

- Cossin, D. 2020. High Performance Boards J. Wiley.

- Cossin, D. and O. B. Hwee. 2016. Inspiring Stewardship. Chichester: John Wiley & Sons.

- Cossin, D., S. Smulowitz and A. Lu. 2019. “Hidden In Plain View: Managerial Obfuscation, External Monitoring, and Their Effects on CSR.” Academy of Management Annual Meeting Proceedings.

- Cossin, D., S. Smulowitz and A. Lu. 2019. “Short-Termism, CEO Pay, Slack and Their Effects on Long-Term Investment: A Content Analysis Approach. Academy of Management Annual Meeting Proceedings.

- Cossin, D., S. Smulowitz and A. Lu. 2020. “The High Cost of Cheap Talk: How Disingenuous Ethical Language Can Reflect Agency Costs.” Working Paper. IMD.

- Cossin, D., S. Smulowitz and A. Lu. 2020. “What Do Managers Mean When They Talk about Ethics?” Working Paper. IMD.

- Cossin, D., S Smulowitz, A. Lu and M. Pfarrer. 2020. “Stewardship Orientation, CEO Pay, External Monitoring, Slack and Their Effects on CSR: A Content Analysis Approach.” Working Paper. IMD.

- Edmans, A. 2011. Does the stock market fully value intangibles? Employee satisfaction and equity prices, Journal of Financial Economics 101: 621-640.

- Regulation (EU) 2019/2088 of the European Parliament and of the Council. 2019. Report on https://eur-lex.europa.eu/eli/ reg/2019/2088/oj

- Gallup Survey in 2021, How Millennials Want to Work and Live. Report on https://www.gallup.com/workplace/238073/ millennials-work-live.aspx

- Gow, I. D., S. N. Kaplan, D. F. Larcker and A. A. Zakolyukina. 2016. “CEO Personality and Firm Policies.” NBER Working Paper 22435. National Bureau of Economic Research, Cambridge MA. Report on http://www.nber.org/papers/w22435

- Li, F. 2010. “Textual Analysis of Corporate Disclosures: A Survey of the Literature.” Journal of Accounting Literature 29: 143–165.

- Loughran T and B. McDonald. 2016. “Textual Analysis in Accounting and Finance: A Survey. Journal of Accounting Research, 54(4): 1187–1230.

- Loughran, T. and B. McDonald. 2014. “Measuring Readability in Financial Disclosures. The Journal of Finance, 69(4): 1643–1671.

- Loughran T. and B. McDonald. 2011. “When Is a Liability Not a Liability? Textual Analysis, Dictionaries, and 10-Ks.” The Journal of Finance, 66(1): 35–65.

- Ocean Tomo, 2020. Intangible Asset Market Value Study. Report on https://www.oceantomo.com/intangible-asset-marketvalue-study/

- Purda, L. and D. Skillicorn. 2015. “Accounting Variables, Deception, and a Bag of Words: Assessing the Tools of Fraud Detection.” Contemporary Accounting Research, 32(3): 1193-1223.

Notes

We would like to thank Isabelle Djian of Green Blue Invest and Ruurd W. Haan of RWH Investment Advisorsfor valuable and constructive comments and suggestions.

For Figure 3 and Table 3, the source of data comes from the IMD Global Board Center and Green Blue Invest. A more detailed overview is provided in Cossin, Botteron and Lu (2020). The Analysis of S&P 500 companies is conducted on an annual basis based on their 10-k reports language review. The portfolio of the 100 well-governed companies and 100 poorly-governed companies are virtually invested on May 1st each year. The weightings of the 100 companies in the portfolios are based on their market capitalization following the same construction methodology of the S&P 500 TRI. The portfolio allocation bears concentration limits that are readjusted every three month. Years 2007 to 2015 have been backtested on the basis of the dictionary established in 2015. The following years follow the same dictionary that is completed with additional words that appeared in the 10-k reports every year.

in VBA Journaal door Didier Cossin and Pascal Botteron