Introduction

Investments in alternative assets have the potential to substantially improve expected returns and downside risk of an investor. However, this potential is constrained by the need to manage the risk from asset and liability mismatches (“ALM Mismatch”). We have chosen to focus on four of the more mainstream alternative asset classes: commodities, property, private equity and hedge funds. We have selected these asset classes on the premise that they are widely accepted by the investor community to offer value. A brief discussion of each asset class is contained in Appendix A.

Investments in alternative assets have the potential to substantially improve expected returns and downside risk of an investor. However, this potential is constrained by the need to manage the risk from asset and liability mismatches (“ALM Mismatch”). We have chosen to focus on four of the more mainstream alternative asset classes: commodities, property, private equity and hedge funds. We have selected these asset classes on the premise that they are widely accepted by the investor community to offer value. A brief discussion of each asset class is contained in Appendix A.

In this article will examine the role of alternative assets in an investment portfolio of an institutional investor over a medium term investment horizon:

- We explore the tension between two sources of risk reduction: diversification benefits provided by alternative asset classes and reducing ALM Mismatch.

- We demonstrate an effective means of managing ALM Mismatch by using derivatives to exchange ALM Mismatch risk for a funding risk. We use a Euribor funded portfolio as a simple proxy for an LDI strategy (liability driven investment).

- We show how the effective management of ALM mismatch risk frees up risk budget to permit higher expected returns for less risk, and frees up cash assets for alternative investments to maximise returns.

- We show the dramatic impact of the choice of two specific risk metrics on asset allocation. We contrast an absolute downside measure of risk with a dispersion measure. The difference between the risk measures demonstrates how the available risk budget for using alternative assets to enhance expected return is heavily constrained by the ALM Mismatch risk

- Finally, we examine an optimal long-term asset allocation for a Euribor funded portfolio.

The majority of discussions on alternative assets either focuses on each asset class on a stand-alone basis, or in terms of portfolio construction from an asset only perspective. However, the majority of institutions invest, either directly or indirectly, to fund future liability commitments. We examine the impact of investment in alternative assets from the perspective of investors with different liabilities. We will consider four types of investors, who are managing assets against the following liabilities:

- No liabilities (asset only)

- Nominal liabilities

- Inflation-linked or real liabilities

- Euribor liabilities, i.e. after hedging ALM Mismatch risk

We evaluate the impact of including alternative asset classes in portfolios previously constrained to more traditional asset classes, e.g. liquid equities, government bonds, corporate credit, inflation-linked bonds and cash. A conflict is demonstrated between ALM Mismatch risk and alternative asset diversification and we investigate how such a conflict can be managed by reducing ALM Mismatch risk.

Over a 5-year horizon, we have generated 1000 capital markets scenarios describing the evolution of key market variables such as; inflation, nominal and real interest rate yield curves, GDP and asset returns. Using these scenarios, we test the performance of a range of asset allocations. For each expected return, we define the efficient frontier as the asset allocation with the minimum risk.

In order to capture the full complexity of the interrelationship between different asset classes we simulate the asset and liability returns within a MonteCarlo framework. Morgan Stanley’s Asset Liability Management Group has developed a sophisticated economic cycle based “regime-switching” capital markets model. We use historic data to calibrate the model, which describes the behaviour of a wide range of asset classes across the economic cycle. The resulting values for returns, volatilities and correlations will vary over the economic cycle. The model is able to accommodate realistic asset behaviour, modelling asymmetric and fat tailed characteristics of return distributions that a more traditional Markowitz mean-variance approach to portfolio construction would neglect. Additional background information on the economic model is contained in Appendix B.

Risk Measurement

The choice of risk metrics is of crucial importance in assessing the impact of alternative asset classes in portfolio construction.

Whilst dispersion risk measures, such as standard deviation, tend to be the most used in practice, we believe that absolute downside risk measures often relate better to investors risk preferences. For example, the risk of achieving a low return is often closer to investors primary risk concerns than return volatility.

Downside risk measures take into account the impact of a higher expected return on reducing downside risk. We should therefore expect to find higher expected returns from portfolios selected using downside risk compared with dispersion risk, even for risk averse investors.

Out of the 1000 generated scenarios, we can observe the 50 scenarios with the worst outcome for asset returns, or funding ratio. Taking the average of these 50 worst outcomes, we get the “Mean of the worst 5% of outcomes”. We focus on two types of risk metrics based on this measure of portfolio tail risk:

- Downside risk: “Mean of the worst 5% of outcomes” This risk metric is a measure of downside risk to the portfolio. As such, it provides a better assessment of the economic risk exposure of the investor to low returns than a dispersion or volatility measure.

- Dispersion risk: ‘Mean of all outcomes’ minus ‘Mean of the worst 5% of outcomes’ This risk metric is similar to that of standard deviation as it measures the dispersion of returns around the expected return. However, we focus only on asymmetric downside tail performance, thereby ensuring that high return scenarios are not regarded as risky.

In order to provide a reference assessment of the impact of alternative asset classes in portfolio construction, we will consider the allocation of these alternative asset classes from two different points of view:

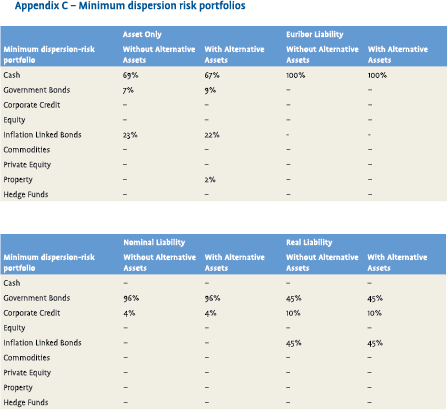

- Minimum dispersion risk portfolio This is the portfolio that is closest to a “liability matching portfolio” that can be achieved given the available selection of assets. These portfolios represent an asset mix that will minimise the uncertainty to the funding ratio or total return. The asset allocation breakdown of the minimum dispersion risk portfolio is contained in Appendix C.

- Reference portfolio Most investors are not solely seeking to minimise risk. Provided the associated extra risk is reasonable, many investors prefer to seek excess return. The reference portfolio’s asset mix has a one-for-one trade-off between the improvement in expected funding ratio or returns and the increase in dispersion/downside risk, i.e. the reference portfolio is the point whereby an improvement of the expected return equals an increase in the risk measure:

Expected return/‘Mean of the Worst 5% of outcomes’ = 1

or

Expected return/(‘Mean’ – ‘Mean of the worst 5%’) = 1

Neither of these portfolios are suggested as a recommendation to the investor, but rather they are identified as aids to the discussion. For example, the more the reference portfolio’s asset mix resembles that of the minimum dispersion risk, the more ALM Mismatch risk is dominating alternative asset diversification risk.

Portfolio Optimisation

We perform the optimisations in the following sections over a 5-year investment horizon, which has been chosen as a medium-term investment horizon. A shorter time horizon such as a year will fail to capture the risk premia that tends to develop over time; eg credit spread in excess of cumulative default.

Throughout the discussion, we make comparisons between efficient frontiers for optimisations including traditional asset classes only and optimisations that include both traditional and alternative asset classes. The traditional asset classes are taken to be: cash; government bonds (bond index with 6 year duration); corporate credit (single A average rated bond index with 6 year duration); inflationlinked bonds (bond index with 6 year duration); and equities.

We use proprietary numerical portfolio optimisation techniques to derive the efficient frontier. Numerical techniques are required since the capital markets model used here is a sophisticated Monte Carlo simulation process for which no closed form optimisation techniques apply.

We explore how the optimal asset allocation varies against a range of liability profiles and observe achievable levels of risk and return.

Asset Only Investor

Asset Only Investor

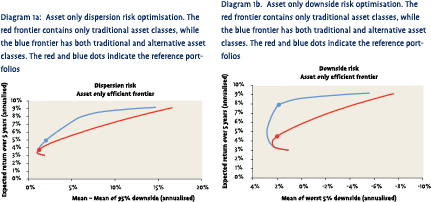

From an asset only perspective, the benefits of investment in alternative assets are clear. Diagrams 1a and 1b show the relative impact of including alternative assets from both a dispersion risk and downside risk perspective. ‘Return’ is defined here as the compound annual return over a 5 year horizon.

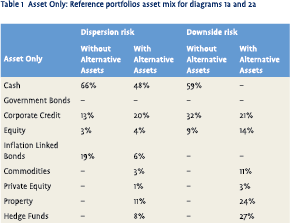

Diagram 1a shows the asset allocation efficient frontiers under the dispersion risk measure, with and without alternative assets. Alternative assets do improve risk-return characteristics. Both with and without alternative assets the minimum dispersion risk portfolio is mostly cash, with some inflation-linked bonds (see Appendix C). The proportional benefit of alternative assets increases the higher the level of risk the investor is prepared to take. The reference dispersion portfolio has a 23% allocation to alternative assets, primarily split between property and hedge funds.

Diagram 1b shows the asset allocation efficient frontiers under the downside risk measure, with and without alternative assets. From the perspective of downside risk, the case for holding a high proportion of alternative assets becomes extremely strong. With allocations of up to 40% alternative assets, it is possible to increase expected return while maintaining a level of downside risk that is comparable to the minimum downside risk for optimisation without alternative assets. The reference downside portfolio has 65% alternative assets, again primarily split between property and hedge funds.

Diagram 1b shows the asset allocation efficient frontiers under the downside risk measure, with and without alternative assets. From the perspective of downside risk, the case for holding a high proportion of alternative assets becomes extremely strong. With allocations of up to 40% alternative assets, it is possible to increase expected return while maintaining a level of downside risk that is comparable to the minimum downside risk for optimisation without alternative assets. The reference downside portfolio has 65% alternative assets, again primarily split between property and hedge funds.

Asset and Liability Investors

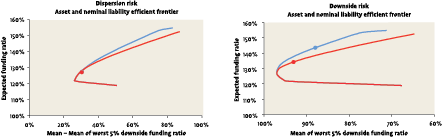

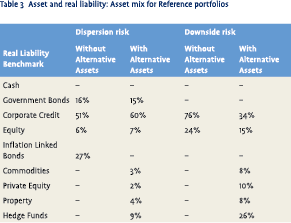

Moving away from ‘asset only’, towards an asset and liability investor, the ALM Mismatch will often be the primary source of risk to the portfolio value. For an investor such as a pension fund or an insurer, we explore the extent to which the ALM Mismatch risk dominates over the diversification benefits of investing in alternative assets.

We assume an initial funding ratio of 120%, both for the case of the nominal liability and the real liability investor and examine investors with a) nominal, b) real or c) Euribor swapped liabilities. We then examine the risk to the funding ratio over a fiveyear investment horizon. Nominal or real liabilities are modelled as constant maturity 15-year duration zero-coupon bonds. Euribor liabilities are modelled as AAA rolling 3-month cash.

We assume an initial funding ratio of 120%, both for the case of the nominal liability and the real liability investor and examine investors with a) nominal, b) real or c) Euribor swapped liabilities. We then examine the risk to the funding ratio over a fiveyear investment horizon. Nominal or real liabilities are modelled as constant maturity 15-year duration zero-coupon bonds. Euribor liabilities are modelled as AAA rolling 3-month cash.

Nominal Liabilities

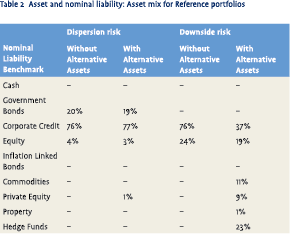

For the case of an investor with nominal liabilities, the minimum dispersion risk portfolio is mostly government bonds with some corporate credit (see Appendix C). As the target funding ratio is increased above the minimum risk portfolio, the proportion of government bonds declines and the proportion of corporate credit increases. Government bonds give way to corporate credit due to the higher yield expected on corporate credit.

For the case of an investor with nominal liabilities, the minimum dispersion risk portfolio is mostly government bonds with some corporate credit (see Appendix C). As the target funding ratio is increased above the minimum risk portfolio, the proportion of government bonds declines and the proportion of corporate credit increases. Government bonds give way to corporate credit due to the higher yield expected on corporate credit.

Alternative assets constitute a much lower proportion of the dispersion risk reference portfolio than for the asset only investor. This is due to a combination of two factors. Firstly, the size of the ALM Mismatch risk reduces available risk budget for diversification. Secondly, the yield pick-up from corporate credit allows an additional return over government bonds with some liability hedging properties, limiting the relative utility of alternative assets.

Along the efficient frontier, as we explore portfolios with expected return above the reference portfolio, alternative assets provide some risk-return improvement over traditional assets alone. However, the improvement is small as compared to the benefit provided to the asset only investor.

From a downside risk perspective, the impact of alternative investments is more pronounced. The higher risk adjusted returns provided by alternative assets compete with corporate credit to raise the expected funding level, while minimising total ALM Mismatch risk.

Here 44% of the assets in the reference portfolio is dedicated to alternative assets. Hedge funds feature prominently due to their high risk adjusted returns. Commodities also feature strongly due to the diversification benefits they provide. Property features weakly due to the positive relationship between rental income and the level of inflation and nominal rates, meaning that property will on average produce low returns in a low yield environment when nominal liabilities have a high value.

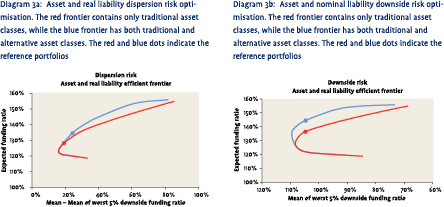

Inflation-linked Liabilities

For the case of the investor with inflation-linked liabilities, the minimum dispersion risk portfolio, both with and without alternative assets, is split between inflation-linked and government bonds (see Appendix C). These bond assets provide a hedge for the duration and inflation sensitivity of the liabilities. However due to the substantial ALM Mismatch they are only able to provide a partial hedge of liabilities, leaving considerable residual risk, and then only at the cost of committing to a low return investment strategy. This is particularly the case for inflationlinked bonds, which will typically yield less than government bonds.

For the case of the investor with inflation-linked liabilities, the minimum dispersion risk portfolio, both with and without alternative assets, is split between inflation-linked and government bonds (see Appendix C). These bond assets provide a hedge for the duration and inflation sensitivity of the liabilities. However due to the substantial ALM Mismatch they are only able to provide a partial hedge of liabilities, leaving considerable residual risk, and then only at the cost of committing to a low return investment strategy. This is particularly the case for inflationlinked bonds, which will typically yield less than government bonds.

There are two major differences between the nominal and real dispersion risk optimisations. There are two major differences between the nominal and real dispersion risk optimizations. Firstly, high inflation expectation scenarios tend to be associated with higher rather than lower nominal rates. Based on this observation, the inflation component within the total real liabilities will on average show an increase in value with rising nominal rates, the increase in the nominal discount factor damps the impact of the increase in inflation expectations. Therefore the resulting ALM Mismatch risk is lower for real liability investors than for nominal liability investor, all else being equal.

Secondly, the absence of an inflation-linked credit asset in this analysis means that real ALM matching with bonds reduces expected returns considerably. (In practice, we can use derivatives to create synthetic inflation-linked credit assets.)

Secondly, the absence of an inflation-linked credit asset in this analysis means that real ALM matching with bonds reduces expected returns considerably. (In practice, we can use derivatives to create synthetic inflation-linked credit assets.)

As a result, alternative assets displace inflationlinked bonds from the reference portfolio. This is because, by first improving the asset-side risk-return profile, alternative assets also provide a more effective approach to total portfolio risk reduction than an incomplete hedge of ALM Mismatch risk with low yielding inflation-linked bonds. Alternative assets make up 18% of the dispersion risk reference portfolio.

From a downside risk perspective, the impact of alternative investments is more pronounced. The higher risk adjusted returns provided by alternative assets compete with corporate credit to raise the expected funding level while minimising total portfolio risk.

For the reference portfolio, 52% of the asset portfolio is dedicated to alternative assets. As with the nominal liabilities, hedge funds feature prominently. Property also makes up 8% of the reference portfolio; this differs from the nominal downside risk optimisation. The greater proportion of property is a reflection of the link between rental income growth and inflation.

It is interesting to compare the level of private equity in the downside risk reference portfolio from the asset-only optimisation with that of the optimisation for investors with nominal and real liabilities. The proportion of private equity is very small (3%) for an asset only optimisation, while higher (between 9-10%) for the nominal and real investor. The higher proportion of private equity is a reflection of the higher level of risk for the portfolio as a whole, making the marginal contribution of the risky private equity to the total portfolio risk smaller, and thus more easily accommodated.

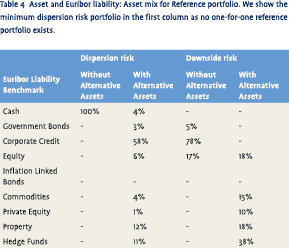

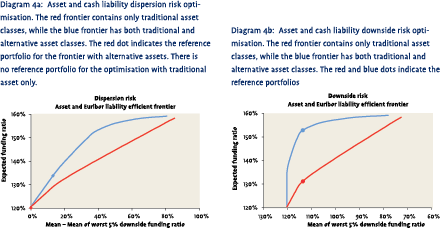

Euribor Liabilities

As we have seen, alternative assets make a positive diversification contribution to investors with both real and nominal liabilities. However, we have seen that the benefits appeared more striking for an asset only investor. In order to maximise the benefits from alternative investments, the ALM Mismatch should be reduced.

As we have seen, alternative assets make a positive diversification contribution to investors with both real and nominal liabilities. However, we have seen that the benefits appeared more striking for an asset only investor. In order to maximise the benefits from alternative investments, the ALM Mismatch should be reduced.

For an investor like a Dutch pension fund the liabilities are either long-dated nominal or real cashflows. Since the universe of nominal and real bonds is mostly of short to medium duration, it is cumbersome to eliminate ALM Mismatch using physical assets, and even a partial hedge of liabilities will require accepting a significantly reduced expected return on the asset portfolio.

Hedging with derivative overlays, such as interest rate and inflation swaps, allows the investor to swap a significant proportion of their ALM Mismatch risk to a floating rate risk. This approach is taken as a theoretical exercise rather than as a portfolio management recommendation, considering that there are several other instruments and strategies available to reduce the ALM Mismatch risk which do not necessarily transform your pension liabilities to a Euribor benchmark

In this section, we examine a portfolio that has had all of the ALM Mismatch risk transformed to Euribor. A floating rate benchmark such as Euribor makes the problem of portfolio construction closer to that of an asset only investor. This is because using derivative overlays to manage ALM Mismatch has the additional advantage of freeing up cash assets for investment in assets with higher expected returns.

Diagrams 4a and 4b show the efficient frontiers for a Euribor benchmarked liability. Cash and floating rate credit provide a highly effective hedge of the liabilities. (Corporate credit for the Euribor liability optimisation is modelled as floating rate notes, or FRNs.) This allows the investor to adjust asset allocation and risk to target a spread over Euribor commensurate with their funding objectives.

Diagrams 4a and 4b show the efficient frontiers for a Euribor benchmarked liability. Cash and floating rate credit provide a highly effective hedge of the liabilities. (Corporate credit for the Euribor liability optimisation is modelled as floating rate notes, or FRNs.) This allows the investor to adjust asset allocation and risk to target a spread over Euribor commensurate with their funding objectives.

The proportion of alternative assets in the downside risk reference portfolio for Euribor liabilities is higher than for any of the other three categories of investors examined, with 81% of the portfolio dedicated to alternative assets. This is a reflection of a combination of two factors. Firstly, hedge funds and real estate returns are broadly linked to the general level of interest rates/inflation and hedge funds will often have “cash plus” return targets. In this regard, economic environments with rising rates causing a greater burden from Euribor liabilities are likely to be accompanied by good performances from hedge funds and real estate. Secondly, the reference point occurs at the funding level where cash and FRNs have just been removed from the portfolio in favour of the higher returning assets.

Conclusion

The available risk budget for using alternative assets to enhance expected return can be heavily constrained by ALM Mismatch risk. By contrast, the use of a derivative overlay to control ALM Mismatch risk frees up risk budget to permit higher expected returns for less risk, and frees up cash assets for investment to maximise returns.

We have explored the role of four alternative asset classes in efficient portfolio construction for different types of investors, finding that:

- For the asset only investor the diversification benefits of alternative assets are considerable, particularly from a downside risk perspective.

- For the nominal liability investor the need to manage ALM Mismatch risk is greater than the benefits provided by alternative asset diversification. As a result, the diversification benefits of alternative assets are much smaller than for an asset only investor.

- Since high inflation scenarios tend to be associated with higher rather than lower nominal rates, ALM Mismatch risk is lower for real liability investors. This leaves greater capacity for alternative assets to contribute to portfolio risk diversification than for a nominal liability investor.

- For the case of an investor that has used a derivative overlay to swap nominal or real liabilities to Euribor, a Euribor benchmark provides more freedom in asset portfolio construction. The fact that many asset class returns have a positive relationship to the level of nominal interest rates and inflation means that the potential for alternative assets to improve portfolio performance is very strong.

We have also seen how using a downside risk measure allows for the fact that higher expected returns result in lower downside risks, given the same dispersion risk. Therefore, even for risk averse investors, we find that portfolios selected using downside risk measures have higher expected returns than those selected using dispersion risk measures.

Appendix A – A survey of the selected alternative assets

Professional investors are faced with a wide and rapidly growing selection of new asset classes and financial products. Recently, increased focus has been on asset classes such as infrastructure, structured credit and volatility related products. We have chosen to focus this article on four of the more mainstream alternative assets, namely: commodities; property; private equity and hedge funds.

Commodities

Based on their historic performance, commodity futures have shown behaviour that might be desirable for many investors. Commodities have exhibited risk and returns comparable to equity, whilst benefiting from having returns either negatively or weakly correlated with returns on equities and bonds. Additio nally, over longer time periods they have shown a positive correlation with inflation.

Portfolio construction is of key importance when investing in commodities. The desired risk characteristics of each individual commodity might be a reason to alter the individual commodity weights versus standard commodity indices. For example, the desired low or negative correlation with equities and bonds and higher correlation with inflation is mostly found within the energy related commodities rather than the (precious) metals and agriculture related commodities.

Property

When discussing investment in property, care must be taken to distinguish between the different types of investments opportunities that are available, since risk, return and liquidity characteristics can be very different.

For example, direct investments in property have shown returns that show low volatility and are weakly correlated to bond and equity markets, but more strongly correlated to inflation. Indirect investment via non-listed property funds combines these characteristics with greater liquidity and lower transaction cost. However, valuation still presents a problem. Investments in the public listed property funds are liquid, with transparent pricing, but have a higher correlation to equities, and so a reduced diversification benefit.

There is strong evidence of correlation between rental revenue and inflation, although the relationship may occur with a delay depending on the structure of the lease agreements. The link to inflation becomes most reliably apparent over long investment horizons.

Private Equity

Private equity makes itself attractive to investors seeking to enhance return. A well-diversified private equity portfolio may be expected to return in the order of at least 2% per annum over public equity. This is in part compensation for the poor liquidity of private equity investments. However, higher expected returns are accompanied by higher risks. The degree of correlation with the performance of other asset classes is unclear, and a desire for prudent portfolio construction would suggest a high correlation to public equity as a modelling assumption.

Private equity has a long investment horizon, and accurate assessment of returns can only be made once the investments have either been realised or have become publicly traded. Prior to this, returns are calculated on an internal rate-of-return basis. The distributions of private equity returns have “fat tails”, with some investments falling to zero value, while a few record significantly higher returns.

Hedge Funds

Hedge funds as an asset class have delivered high risk adjust returns with remarkable consistency. However, the idiosyncratic nature of hedge funds makes their classification difficult. Hedge fund managers pursue a wide range of trading strategies such as Long/Short Equity, Credit, Event Driven, Macro, Market Neutral, Systematic, Multi-Strategy and Arbitrage. The risk and return characteristics of different strategies and correlations with existing asset classes therefore differ.

It is the diversity of hedge funds that provides much of their risk advantages. The unique risk advantage for a hedge fund investor is the ability to diversify across trading strategies as well as asset classes. For example, a well-diversified fund of hedge funds can be expected to recorded returns slightly lower than equity, but with substantially lower volatility.

Appendix B – Morgan Stanley’s Cyclical Capital Markets Model

The analysis of asset diversification based on downside assets risk measures relies on the ability to credibly assess expected returns as well as the risk distribution around return expectations.

Morgan Stanley’s capital markets approach is particularly targeted at the distribution of excess returns and the relative attractiveness of asset classes and has the following unique characteristics:

- Morgan Stanley’s capital markets modelling approach is to simulate a real world evolution of key financial and economic variables with scenarios designed to reflect dynamic market behaviour across the economic cycle:

- Driving capital market scenarios by the economic cycle promotes the creation of economically rational scenarios. For example 10 year versus 3 month yield curve inversions often happen near recessions but cannot persist for 10 years, whereas the naïve use of a simple derivative pricing model for simulation could easily contain scenarios with 10 years of inverted 10 year – 3 month yields

- Calibrated against historic data, the model is able to accommodate realistic asset behaviour, modelling asymmetric and fat tailed return distributions that would be missed within more traditional Markowitz mean-variance approaches.

- Economic cycles are a natural way to build mean reversion into interest rate models, avoiding common model calibration problems associated with the parameterisation of mean reversion speed.

- Stochastic credit transition matrices populate tails of credit risk distributions by allowing high probabilities of downgrade and default, and low recovery rates.

- The capital markets specification is deliberately not arbitrage free, so we can investigate reward and risk dimensions to investment strategy decisions. Arbitrage free models are inappropriate for investment strategy purposes in that by definition they have no return dimension. For example, an arbitrage free approach always assumes credit is fairly priced and therefore there is no difference in expected return when credit spreads move. In our approach we separately analyse income (current and projected spreads for reinvestment) compared with losses (cumulative defaults including transitions, net of recoveries) to explore realistic value offered by different credit classes.

- A focus on modelling fat tails in equity returns – arbitrage free models can underestimate equity risk in periods of low equity volatility and high forward rates.

- Modelling economic cycle and inflation linkages to rental income and yield curve linkage to property valuation.

in VBA Journaal door Patrick Lighaam (l), Mark Teeger (m), Gwion Moore (r)