Bonuses and incentive fees have raised considerable debate since the global financial crisis of 2008. Public and media are skewed towards the opinion that incentive fees for CEOs, bankers and asset managers have led to excessive risk taking and are not in the interests of clients. We investigate whether performance fees are beneficial to public mutual fund investors and if such schemes involve the same moral hazard as discretionary bonuses.

Do performance fees lead to more risk taking?

We analyse performance fee schemes of active longonly equity mutual funds to provide insight into the following questions: i) do performance fees lead to more risk taking?, ii) do investors pay for skill or for luck? and iii) do performance fee schemes lead to better returns for investors? For the third question we have conducted an empirical investigation. Although we acknowledge these three questions are to some extent intertwined, they nevertheless are distinct approaches to answer the ultimate question whether or not performance fees are beneficial to public mutual fund investors.

Typically, performance fee structures for delegated managers of mutual funds have an asymmetric distributed pay off with call option characteristics versus a benchmark. A manager should in theory increase the tracking error as much as possible (ceteris paribus) in order to maximize the value of the call option in case of a non-revolving and single-period performance fee contract. This suggests that performance fee driven managers will take more risk versus the benchmark and will construct less diversified portfolios than managers without these performance fee structures.

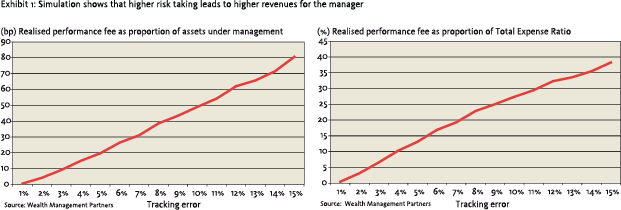

In order to emphasize the incentive for performance fee driven managers to take more risks we have run a 10.000 times-simulation of a non-revolving, single period performance fee contract, modelling an equity mutual fund p, using Sharpe´s market model:

Rp = ap + βp RB+ p ; E(p ) = 0 en E(p , RB) = 0

Rp = ap + βp RB+ p ; E(p ) = 0 en E(p , RB) = 0

With:

ap = 0; no alpha generation

βp = 1; mutual fund beta is 1 versus the benchmark

RB ∼N(8,5%; 20%); normal distribed benchmark returns with E(RB) = 8,5% and σB = 20% (both on an annual basis)

P ∼N(0: x); normal distributed error term with E(p)=0 and standard deviation (tracking error of the mutual fund versus the benchmark) = x

Suppose the mutual fund has an annual management fee of 1.3% and a performance fee of 15% over the benchmark RB (+ management fee) at the end of the year. The simulation in Exhibit 1 shows that an increased tracking error leads to higher performance fees and therefore the mutual fund manager has an incentive to maximize the tracking error, ceteris paribus.

Do investors pay for skill or for luck?

Do investors pay for skill or for luck?

The simplified approach of simulated one-period returns sheds some light into the incentive for performance fee driven managers to increase risks. In that perspective investors will have to bear in mind that aside from the incentive to generate positive alpha there is also a moral hazard to increase risk. Our simulations suggest that a significant portion of the total expense ratio of a mutual fund could be attributed to sheer luck rather than skill of the delegated manager. Note that our market model simulation assumed no skill (ap=0). At the least it is fair to say that investors pay managers not only for skill but also for luck due to the optionality of the performance fee structure.

In short, a performance fee structure has the advantage for investors that the manager has an incentive to generate alpha, but there are two main disadvantages: i) to some extent investors are paying for coincidental performance of the manager and ii) managers are incentivised to take more risks.

Mitigating factors for moral hazard

In reality, there are mitigating factors for the two aforementioned disadvantages which have not been modelled in our simulation. These mitigating factors are related to the fact that investing in mutual funds is a revolving multi-period process rather than the way our non-revolving, single-period simulation has been modelled.

First, a mitigation of the magnitude of ‘undeserved’ performance fees is in reality facilitated by the use of a high water mark. Due to the nature of our one-period simulation, the relation between the tracking error and the average performance fee depicted above will serve as a theoretical upper bound and in practice the implementation of a high water mark will therefore not always reward ‘undeserved’ outperformance in the multi-period reality. However, a disadvantage of the use of high water marks could be even more excessive risk taking when the fund is (significantly) below its high water mark. This effect is not directly investigated to our knowledge but is implied by the empirical study of Brown, Harlow and Starks (1996), who found that mid-year underperforming mutual funds tend to increase fund volatility in the latter part of an annual assessment period to a greater extent than mid-year outperforming mutual funds.

Secondly, an important counterbalancing force of excessive risk taking is provided by the importance of public reputation building by the delegated manager in a multi-period framework. Goetzmann, Greenwald and Huberman (1992) and Capon, Fitzsimons and Prince (1992) note that past performance was the crucial input for clients in the choice of which mutual fund to invest in. Furthermore, Sirri and Tufano (1992) show that mutual funds earning the highest returns during an assessment period receive the largest rewards in terms of increased new investments in the fund. These additional contributions provide, in turn, increased compensation to the mutual fund manager (Brown, Harlow and Starks (1996)).

This incentive for a manager to protect its longterm track record is an important counterbalancing force for excessive risk taking in our view. We believe this necessary public reputation-building characteristic of mutual funds heralds less moral hazard than with similar discretionary mandates. In the same kind of reasoning we assert that performance fees structures for mutual fund managers should not be compared one-on-one with the discretionary bonus schemes for CEOs, bankers and the like which led to public discontent after the financial crisis.

Are performance fees beneficial to mutual fund investors? An empirical investigation

We have argued that performance fee structures for equity mutual funds are an incentive for delegated managers to generate alpha. We also touched upon two important drawbacks for investors: excessive risk taking and paying for the manager’s luck rather than his skill. Although there are in practice mitigating mechanisms for these drawbacks, the net impact remains unclear in our theoretical framework.

We have argued that performance fee structures for equity mutual funds are an incentive for delegated managers to generate alpha. We also touched upon two important drawbacks for investors: excessive risk taking and paying for the manager’s luck rather than his skill. Although there are in practice mitigating mechanisms for these drawbacks, the net impact remains unclear in our theoretical framework.

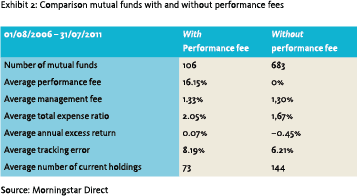

In order to shed some further light whether or not performance fees are bottom line beneficial to mutual fund investors, we have conducted an empirical investigation on active equity mutual funds with a global geographical focus. We used the Morningstar Direct database from which we selected global equity mutual funds with a European registration for sale. We excluded: i) global specialty funds (such as thematic, sector, small & midcap funds, etc), ii) funds with a track record of less than five years and iii) funds which did not provide a prospectus benchmark. This resulted in 789 funds of which 106 funds used a performance fee with percentages in the range of 5%-25% of excess returns. Exhibit 2 shows of the average characteristics of the selected funds, with and without a performance fee.

As our theoretical findings suggested, mutual funds with performance fees on average have a higher tracking error than mutual funds without performance fees (8.19% versus 6.21% respectively). This is also indicated by the average number of holdings in the fund (73 versus 144). This indicates that performance fee structures lead to less diversification and more risk taking than structures without performance fees. Funds utilizing a performance fee are on average more expensive for investors (almost 40bp) when looking at the Total Expense Ratio (TER). It is plausible that the average annual performance fee is roughly 40bp since the basemanagement fees on average do not differ much. However, despite the higher costs for investors, performance fee driven funds are showing a better bottom line performance than mutual funds without performance fees.

As our theoretical findings suggested, mutual funds with performance fees on average have a higher tracking error than mutual funds without performance fees (8.19% versus 6.21% respectively). This is also indicated by the average number of holdings in the fund (73 versus 144). This indicates that performance fee structures lead to less diversification and more risk taking than structures without performance fees. Funds utilizing a performance fee are on average more expensive for investors (almost 40bp) when looking at the Total Expense Ratio (TER). It is plausible that the average annual performance fee is roughly 40bp since the basemanagement fees on average do not differ much. However, despite the higher costs for investors, performance fee driven funds are showing a better bottom line performance than mutual funds without performance fees.

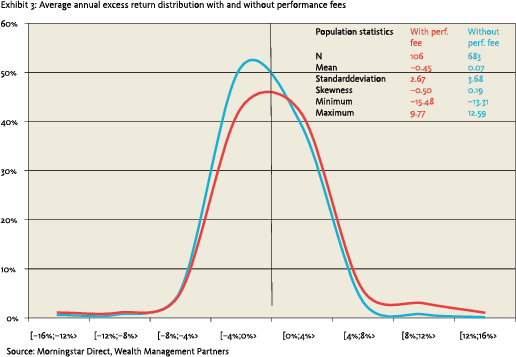

In Exhibit 3 below he have displayed the excess return distribution of the mutual funds with performance fees as well as without performance fees. Strategies with performance fees are stochastically dominant in almost every domain. Moreover, the distribution of performance fee strategies has a positive skewness, whereas the distribution of strategies without a performance fee has a negative skewness.

Conclusion

Our empirical findings of ‘ordinary’ active and public mutual fund managers (i.e., without employing a performance fee) are consistent with earlier research in the sense that they on average underperform their benchmarks, which is plausibly attributable to the costs of active management. However, our findings also imply that active management with an additional performance fee structure enhances bottom line results for investors. Although public mutual funds with performance fees generally display higher benchmark risks and lower diversification, the need for the managers to protect their public track-record prevents them from excessive risk taking and therefore mitigates moral hazard. In this respect we conclude that such schemes do not involve the same moral hazard as discretionary bonuses. All in all, our research suggests that performance fee structures are beneficial in active mutual fund management.

References

- Brown, Harlow and Starks, 1996. Of tournaments and temptations: An analysis of managerial incentives in the mutual fund industry, The Journal of Finance 51, 85-110

- Capon, Fitzsimons and Prince, 1992. An individual level analysis of the mutual fund investment decision, Working paper, Columbia University

- Goetzmann, Greenwald and Huberman, 1992. Market response to mutual performance, Working paper, Columbia University

- Sirri and Tufano, 1992. The demand for mutual fund services by individual investors, Working paper, Harvard University

in VBA Journaal door Peter van Doesburg en Marcel de Kleer (Wealth Management Partners)