Modern institutional portfolios are often complex ‘Multi-Manager, Multi-Asset, Liability Driven’ or in short, ‘MA/LD’ strategies for which the risk management and analytical tools are not yet fully developed. The article outlines the risks that this lack of risk management creates, and pleads for the development of an integrated ‘analytical platform’ that supports the various specialists involved in these portfolios with quantitative instruments.

Over the last decade, two factors have made investment portfolios increasingly complex:

Over the last decade, two factors have made investment portfolios increasingly complex:

- The investment market itself has become much more complex. Many specialist managers may be required to construct a diversified ‘multi-asset’ portfolio.

- The emergence of liability-driven investing, stimulated by new regulatory regimes such as the Dutch FTK, add another layer of complexity by adding (derivative) products aimed explicitly at risk management.

Managing complex ‘MA/LD’ portfolios has truly become a multi-disciplinary effort: there is a need to select and monitor specialist managers across asset classes; to manage the aggregated asset allocation exposures across many investment vehicles, and lastly, to overlay that asset allocation using LDI instruments.

This article is not about the qualitative expertise and judgment that investment staff should have to manage such portfolios. Instead, we focus on the purely quantitative infrastructure that is required to support them in their roles, and that allows them to work together effectively. The article is structured as follows:

- We make the case that without a matching risk management platform, the complexity of MA/LD portfolios will add more to risk than to performance.

- Then, we outline what the risk management infrastructure should look like: what can it actually solve, what are the required components for that, how does one integrate it all to support a multi-disciplinary investment team, and what are the practical hurdles in implementation?

In all of this, the authors can only speak from personal experience, and do not claim to offer anything more than 'a personal view' on how to deal with the new analytical requirements arising from increasingly complex investment portfolios.

Multi-Asset/Liability-Driven portfolios: the risks of complexity

We would like to introduce the three main risks that investors encounter when they move from a conventional ‘balanced mandate1 ’ to a MA/LD strategy, and discuss their consequences.

1. Buying past performance instead of beta

Traditionally, the manager research ‘toolbox’ has been rather light. It generally consists of qualitative judgment, enhanced by returns-based analysis: by correlating a track record to certain style factors, managers are classified into style categories and an attempt is made to ‘separate sustainable alpha’ from style factors using an analysis of their past performance. Partly as a consequence of lack of further data, manager selection consultants end up buying much more ‘past performance’ than ‘sustainable alpha’.

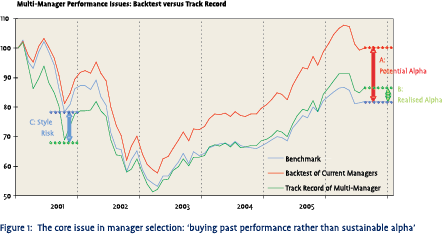

It is a common joke that multi-managers select wellperforming managers, but mostly ‘after the fact’. The result is visible in Figure 1, which is simply a representative ‘multi-asset’ track record. Although the backtest shows impressive alpha for the managers in this multi-manager portfolio, the actual track record of the multi-manager is far less impressive. Keep in mind that the actual track record was made with a mix of managers that changes over time – a backtest is done with just the currently selected managers. Practitioners in the field will recognise that this is not an isolated example – it is true for multi-management in general: only a fraction of the potential alpha (shown as ‘A’ in the chart) in a backtest gets realised into actual multi-manager results (shown as ‘B’).

2. Manager selection can create a backward-looking style allocation

2. Manager selection can create a backward-looking style allocation

‘Buying past performance instead of sustainable alpha’ may be no worse than paying for something that is not there. But there is a more dangerous side effect. If one cannot distinguish between luck and skill, a lot of the ‘past performance’ that appears in the multi-manager portfolio will in reality be style bias, compounding across managers to deliver an often surprisingly strong overweight to whatever factors performed well in the recent past. This creates the phenomenon of the ‘multi-manager, singlebet portfolio’: a portfolio in which the benefits of diversification across managers is not really present, as all managers give exposure to the same market factor(s). In Figure 1, under arrow ‘C’, the result is visible early in the bear market: manager selection was still favouring the good track records of Growth managers. As a result of the undiversified single-style bias this created, the multi-manager performed far worse than the index in the months after the market ‘trend break’.

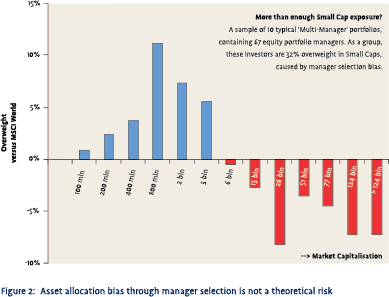

Again, this conclusion can be generalised. Figure 2 shows the aggregated overweight in Small Caps, versus the MSCI World, of 10 multi-manager portfolios we investigated in November 2005. Between 2001 and 2006, Small Cap stocks outperformed the Large Cap indices by more than 60%. Although the sample of multi-managers cannot claim to be representative, their 32% overweight in Small Caps, aggregated from across the 67 managers present their portfolios makes interesting ‘circumstantial evidence’.

This is not an academic problem. Multi-manager portfolios are inherently intransparent, making aggregated risks hard to detect. The consequence is visible in most multi-manager track records during periods where investment markets change their direction.

3. Lack of oversight makes asset allocation very hard to manage

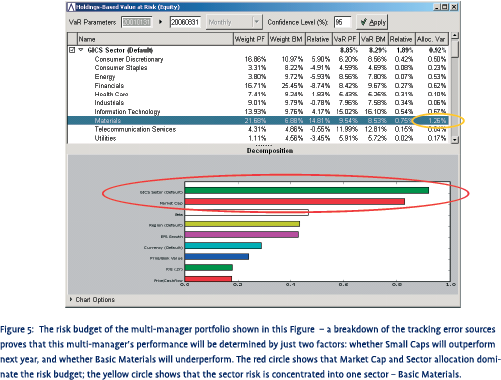

Longer term, asset allocation is the main determinant of investment results. However, investors confronted with the intransparency of MA/LD strategies often find it nearly impossible to determine their aggregated exposures. Many multi-manager portfolios, therefore, are a fairly static mix of selected managers and little attention is paid to asset allocation other than the basic weighting of asset classes. A simple decomposition of tracking error (see Figure 5 further below for an example) can be revealing – often, most tracking error comes from allocation exposures within asset classes that are the random by-product of combining the chosen managers.

Moving towards Multi-Asset portfolios: the required risk management platform

Moving towards Multi-Asset portfolios: the required risk management platform

So far, we have highlighted three fundamental needs in modern ‘MA/LD’ portfolio management:

- The ability to separate ‘past performance’ from ‘sustainable alpha’

- The ability to neutralise aggregate style exposures across managers

- The ability of the CIO to manage his asset allocation transparently

These are all abilities that are made possible by effective risk management systems. The problem of MA/LD portfolios is thus, to a large degree, a technical one. The solution could be a diverse mix of separate tools, used by the various specialists involved in manager selection, portfolio construction, asset allocation and LDI overlays.

But it is our belief that all these disciplines should be part of one, integrated, investment process. Traditionally, multi-manager portfolios have had the tendency to sacrifice asset allocation in the pursuit of ‘bottom-up alpha’. Integrated of all these specialists into one team can shift the focus back towards (liability driven) asset allocation as the central driver of the portfolio. An integrated approach also solves another problem we encountered in the section above: a combination of good managers is not necessarily a good portfolio. The ‘fitting’ of managers into a portfolio is part of the asset allocation process. Therefore, one cannot really separate manager selection from portfolio construction. An integrated approach is required.

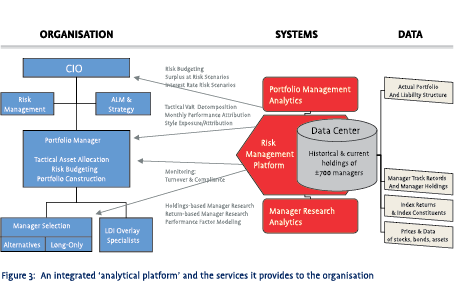

We have been experimenting with such an integrated platform over a number of years. The contours of that system are generic; our specific platform is just an implementation of it. Figure 3 shows the structure of the platform in two dimensions: (1) the technical infrastructure and (2) the organisation chart of the team that the platform enables.

Coping with huge data requirements

Given that MA/LD portfolios involve external manager selection, the system must oversee portfolio managers across the asset management industry. This oversight should not only be broad (covering hundreds of managers as the ‘research universe’), but also deep. If we have indeed concluded that relatively simply ‘returns-based’ manager research is not enough, this must mean holdings-based analysis. The system must contain current and historical portfolio holdings for hundreds of managers. Underneath the manager holdings database is a security level database with sector and country classifications, valuation multiples and style definitions that covers the portfolios of all managers that are being tracked. This poses the first challenge in building the integrated platform: many different data feeds with a daunting variety of data formats.

The data problem that the above encompasses is huge – a multiple of that, with which any single asset manager needs to cope. But in practice, two mitigating facts make these requirements feasible. Technology has improved; not only computing power, but also the reliability and accessibility of external data providers has advanced rapidly. Secondly, although the scope of data is very broad, this is only an analytical platform, not an administrative one. Fault tolerance is thus a lot higher. In truth, if a single stock drops out of the holdings list of every tenth portfolio manager we cover, that is an insignificant error and wholly acceptable for the purposes of this system.

Building the required analytics

Building the required analytics

Below, we will outline the functionality required of the platform for the three principal disciplines that work together in a MA/LD portfolio: manager selection, portfolio construction and Liability-Driven asset allocation.

1. Manager Research

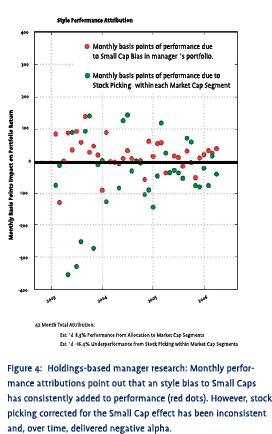

The purpose of manager selection is to sift through the manager universe, and identify managers that not only have good ‘past performance’, but more importantly, derive that performance from ‘sustainable alpha skills’. The single most powerful tool that the research analyst has, is historical performance attribution to decompose a manager’s track record into its sources of origin: sector allocation, style allocation and stock picking. Unfortunately, this is not an exact science. Performance attribution has some inherent limitations – there is no performance attribution report that can objectively subtract all asset allocation dimensions from a manager track record and then arrive at the ‘pure stock picking alpha’. There is also no way to quantify whether a sector selection alpha, for instance, is skill or luck. Accepting these limitations reduces performance attribution to a tool with which a manager selection analyst can investigate a manager. It also means that the tool should not deliver one single report, but rather, that it should offer the analyst a flexible, interactive way of slicing and dicing a manager’s history to derive a qualitative judgment. An example can be seen in Figure 4. The word ‘interactive’ is critical. If the ‘workbench’ of the manager selection analyst does not allow him to perform such analysis quickly and easily, it will directly influence the quality of his research, which is in many ways a process of interactive learning.

2. Portfolio Construction

The portfolio construction stage builds the intended asset allocation exposures out of the recommended managers. Three problems, inherent to multi-manager portfolio construction, can be alleviated through a ‘see-through analysis’ that translates a mix of managers into a single underlying portfolio of holdings:

The portfolio construction stage builds the intended asset allocation exposures out of the recommended managers. Three problems, inherent to multi-manager portfolio construction, can be alleviated through a ‘see-through analysis’ that translates a mix of managers into a single underlying portfolio of holdings:

- Separating asset allocation from manager selection. Manager selection can never fully separate ‘past performance’ from ‘sustainable alpha’. Some ‘unsustainable past performance’ will always slip through the manager selection process, and thus, multi-manager portfolios tend to build up an asset allocation bias to market factors that did well in the recent past. The obvious example today is Small Caps. But more subtle factors such as ‘balance sheet quality’ or ‘cyclical profit growth’ are relevant as well. The longer a style cycle (or investment market climate) lasts, the stronger the risk of such unwanted asset allocation by-products of manager selection become. The solution is relatively simple: ignoring the fact that the aggregated holdings come from many different managers, an asset allocator judge a portfolio’s asset allocation exposures using ‘see-through’ analysis. This is a relatively simple tool to build. However, as the stock picks of selected managers are not under control of the multi-manager, he can only act by reallocating money between managers. That makes the support tools more complex. ‘What-if’ functionality is needed to consider all options to achieve the desired asset allocation exposures. And in these simulations, the portfolio construction specialist should not be limited to just a handful of managers given to him by a manager selection consultant. Rather, he should have access to a ‘long list’ of good managers to identify those with the best fit in his portfolio.

- Rebalancing strategy. ‘Herd behaviour’ of portfolio managers can impact the aggregated sector allocation to a surprising extent. The question is how far the portfolio construction specialist should aim to control this. The last three years showed an excellent example of this dilemma: our own multi-manager portfolios, if left to their own, would have fluctuated between a 9% overand 8% underweight in the energy sector – with very poor timing. Should a portfolio construction specialist let the portfolio drift like that, or should he intervene by reallocating between managers, or by adding ETFs and derivatives just to keep the sector allocation under control?

- Risk budgeting. The answer to the previous question leads to a new requirement for the analytical platform. Without any intervention of the portfolio construction specialist, a sector allocation that is nothing more than the random byproduct of manager selection can truly dominate the tracking error of a multi-manager portfolio. An example is shown in Figure 5. Whether or not to rebalance a portfolio just because of sector exposures depends on how diversified the sources of tracking error in the portfolio really are. If the portfolio construction is so out of line that a single ‘manager selection by-product’ such as sector exposure or style exposure dominates, one may speak of a ‘multi-manager, single-bet’ portfolio. Obviously, that requires intervention from a portfolio construction perspective.

Good models to decompose tracking error to its asset allocation sources have been developed in academia. It is obvious that the analytical platform should include them as part of the risk management process. Here, too, it is important to have multiple models running, and to be able to use them interactively whilst exploring portfolio changes. No single model will give full insight in the underlying risk structure of the portfolio.

Good models to decompose tracking error to its asset allocation sources have been developed in academia. It is obvious that the analytical platform should include them as part of the risk management process. Here, too, it is important to have multiple models running, and to be able to use them interactively whilst exploring portfolio changes. No single model will give full insight in the underlying risk structure of the portfolio.

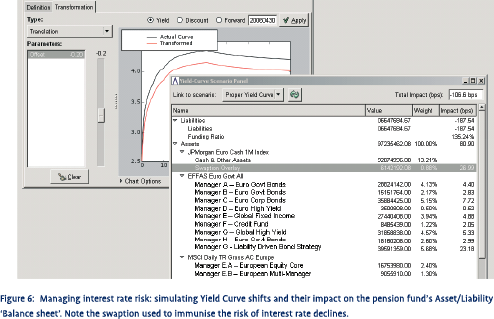

3. Adding and maintaining a LiabilityDriven Overlay

The logic of hedging liability risks through a matching asset allocation is well recognised, and has led to the emergence of Liability-Driven Investing (LDI). Now that the concept is maturing, it is desirable to have practical ways to evolve portfolio management into a wider ‘balance sheet management’ role. After all, net interest rate risk is impacted not only by the liability structure, but also by tactical asset allocation, market fluctuations and even manager selection. Integrating all of these into one exposure view on the pension fund’s balance sheet is the logical next step.

An integrated analytical platform can be instrumental here. It already contains all investments down to the holdings level2 – extending it to cover liabilities and LD derivative structures such as interest rate swaptions is entirely feasible. Relevant interest rate risk models and risk factor decomposition concepts have been developed in academia. Building these into interactive ‘what-if’ simulation tools – Figure 6 provides an example – allows portfolio management to evaluate what part of the risk budget is, or should be, covered by LD overlays or by reallocations in the underlying investment portfolio itself. Having this functionality available in a practical risk management framework is almost a requirement for controlling MA/LD strategies from a top-down perspective.

Conclusions

In this article, we have outlined the reasons why increasingly complex portfolios – multi-manager, multi-asset, liability driven – need to be supported by a risk management infrastructure capable of covering them. The role of risk management systems is also shifting away from the old ‘remote’ supervisory role, towards becoming an integrated toolbox that enables investment staff to construct their strategy and work together.

Three points are often overlooked when risk management is discussed in MA/LD portfolios:

- the need for an integrated platform, rather than a loose set of tools. Separating the various roles means a clear loss of quality in the MA/LD investment process. We illustrated how manager selection and portfolio construction need integration.

- the need for such a platform to be interactive and user-friendly. The ability to perform continuous ‘what-if’ analyses is far more important than it seems. Without ease of use, staff will not fully explore what is out there to explore.

- such a platform is an enabler for a better investment process. Multi-management has traditionally pushed top-down control (asset allocation) out in favour of the pursuit of manager alpha. With the added complexity of liability-driven benchmarks, it is time for the CIO to regain control. Without that, the concept of MA/LD will add more to risk than to return.

The practical consequences of the above points within an ‘open architecture’ framework – where manager selection spans the entire industry – imply the maintenance of a huge data platform. The technical requirements, although feasible, are challenging. Nevertheless, the importance to ‘get this right’ is such that we believe it opens up an exciting new area for investment specialists – if they can build the tools. Risk management, it seems, is no longer in the ‘back seat’ of the investment process.

Authors

Oscar Vermeulen and Richard Jacobs are founding partners at Altis Investment Management A.G., an independent fiduciary multi-manager specialist based in Switzerland.

Notes

- A traditional equity and fixed income portfolio managed by a single asset manager.

- For intransparant assets such as hedge funds, performance factor models can be used as an imperfect but ‘next-best’ alternative. Results in this field are quite interesting

in VBA Journaal door Oscar Vermeulen (l) Richard Jacobs (r)