Executive Summary

Executive Summary

Tighter funding and transparency requirements for Dutch pension plans are prompting sponsors to review how they manage and monitor their funds. The new rules slated to take effect next year (2006) under the Financieel Toetsingskader (or FTK) will require plans to mark both assets and liabilities to market and satisfy stringent tests on current and projected funding levels. This stricter framework has underscored the weakness of previous best practices that focused on managing a fund to a strategic benchmark rather than projected liabilities. The result has been a widening gap between the benchmark and a plan’s asset-liability profile. The following article discusses the advantages of liability benchmarking to bridge that gap and introduces a new solution from State Street Global Advisors using pooled swaps to better match liabilities and mitigate the duration and inflation risks posed by long-term liability streams.

Widening Gap Between Benchmark and Liabilities

In the Netherlands, pension funds are just beginning to question the wisdom of using a strategic benchmark as the fundamental measuring stick for their investment performance. Strategic benchmarks are usually derived from an optimised translation of an asset-liability study and remain firmly in place for three years or more regardless of changes in the plan’s funding ratios or asset class risk premia. While the asset-liability studies are proprietary and of course take into account fund specific circumstances, most pension funds tend to have an asset allocation with roughly 30-50% equities and 50-70 % fixed income. Then significant time and effort are spent designing a risk budget to determine the allocation between market and active risk, which subset of asset class benchmarks to use and which specialist managers to select. Once the strategic benchmark is established, however, attention tends to stray from the asset-liability profile, as the strategic benchmark determines how the performance of external and internal managers is measured.

What became apparent during the bear market of 2000-2003 is that investors were paying too much attention to strategic benchmarks and not enough to the so- called “gap risk” left between the benchmark and the plan’s asset-liability profile1 . Gap risk results from the different behaviour of assets and liabilities. The different effect of interest rates on liabilities versus assets is one of the main sources of gap risk. By maintaining the focus firmly on the strategic benchmark, pension plans were losing sight of the true measure of investment success: satisfying their plan’s liabilities, which, like asset values, can be very dynamic in nature. In doing so, they unwittingly ignored the unrewarded risk they were taking. The FTK rules will force pension funds not only to address this gap risk but also reconsider ways to manage that unrewarded risk.

Conventional Benchmarks’ Limitations

Any asset class benchmark is by definition an artificial construct, representing market capitalisation weights with or without a set of overlay rules. For bond benchmarks, the maturity profile reflects the issuance pattern preferred by the issuer. This has several drawbacks for a pension fund’s investment strategy. The true benchmark of a pension fund is its liability profile, and apart from longevity risk, there are two main risks associated with those liabilities: duration and inflation. When using a bond benchmark as a proxy for the liability profile, one needs to consider how this bond benchmark addresses those two risks.

Duration Mismatch Between Government Bonds and Liabilities

A bond benchmark’s duration and cash flow profile is the result of its market- capitalisation weighting. Almost all government bond benchmarks have relatively low weights among longer-dated maturities, simply because most governments issue relatively few, if any, long-dated bonds. The Citigroup EMU Government Bond Index (EGBI) 15+ sub-index represents only 15.2%2 of the entire maturity index. Corporate bond or broad indices display maturity profiles even more skewed to the lower maturities. None of the benchmarks includes any bonds with maturities longer than 35 years.

A bond benchmark’s duration and cash flow profile is the result of its market- capitalisation weighting. Almost all government bond benchmarks have relatively low weights among longer-dated maturities, simply because most governments issue relatively few, if any, long-dated bonds. The Citigroup EMU Government Bond Index (EGBI) 15+ sub-index represents only 15.2%2 of the entire maturity index. Corporate bond or broad indices display maturity profiles even more skewed to the lower maturities. None of the benchmarks includes any bonds with maturities longer than 35 years.

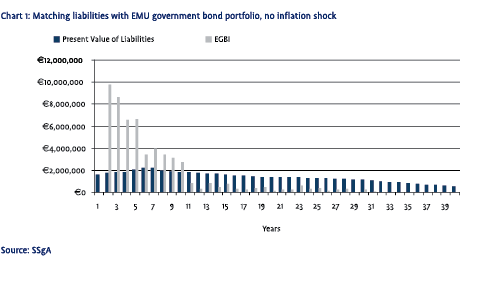

By contrast, the average duration of liabilities in the average Dutch pension fund is approximately 15 years, while the maturity of the typical liability profile extends to 50 or 60 years. Hence, most bond indices provide a very poor benchmark for the maturity profile of a plan’s liabilities and a poor match for its liabilities’ duration. This is why the gap risk exposed by the FTK cannot be properly resolved with the current practice of managing a bond portfolio against a benchmark weighted by market capitalisation. The chart 1 illustrates this point by showing the cash flow mismatch between a portfolio consisting of EMU government bonds (as represented by the Citigroup EGBI) that aims to match the duration of a typical plan’s liability profile. This chart shows the mismatch between the present value of nominal liabilities (without expected inflation uplift) and the cash flows generated by an EGBI portfolio, under the assumption of no inflation change after investment date.

Managing Inflation Risk

The other major risk to a fund’s liability profile is inflation. In the Netherlands, liabilities are mostly linked to wage and price inflation. The present value of projected future liabilities will accrue with the nominal interest rate. The nominal interest rate has two components: the real rate and the inflation rate. An implicit yet key assumption in using nominal rates to compensate for inflation risk is that the inflation rate priced by the break-even curve will in fact be realized. This means that if realized inflation is different from expected inflation, i.e., the breakeven inflation rate3, the present value of the nominal liabilities will be significantly altered. Moreover, the real interest rate component could change over the life of the liability stream. As a result, there are two major risks to a pension fund committed to inflation-linked payouts: real interest rate risk as well as inflation risk. Since conventional or nominal bonds do not contain any inflation protection other than what is priced into the nominal curve when the bond is purchased (hence the investor is not protected against inflation changes or shocks that occur after investment date), nominal bonds are not a good match for inflation-indexed liabilities.

The other major risk to a fund’s liability profile is inflation. In the Netherlands, liabilities are mostly linked to wage and price inflation. The present value of projected future liabilities will accrue with the nominal interest rate. The nominal interest rate has two components: the real rate and the inflation rate. An implicit yet key assumption in using nominal rates to compensate for inflation risk is that the inflation rate priced by the break-even curve will in fact be realized. This means that if realized inflation is different from expected inflation, i.e., the breakeven inflation rate3, the present value of the nominal liabilities will be significantly altered. Moreover, the real interest rate component could change over the life of the liability stream. As a result, there are two major risks to a pension fund committed to inflation-linked payouts: real interest rate risk as well as inflation risk. Since conventional or nominal bonds do not contain any inflation protection other than what is priced into the nominal curve when the bond is purchased (hence the investor is not protected against inflation changes or shocks that occur after investment date), nominal bonds are not a good match for inflation-indexed liabilities.

One way to address inflation risk could be by building a liability-matching portfolio using inflationlinked bonds (ILBs). Although the euro inflation-linked bond market is still relatively young, both the supply of and demand for inflation-linked bonds have grown substantially over the last few years as institutional and retail investors worldwide recognize their defensive and diversification benefits. The euro inflation-linked bond market has expanded considerably, with net new euro government ILB issuance surpassing US Treasury Inflation-Protected Securities issuance for the first time in 2003.

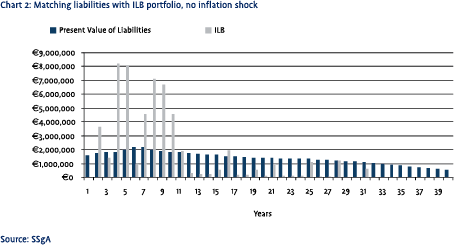

However, although the ILB cash market has matured considerably in Europe, the euro-denominated ILB market does not offer sufficient maturities to be able to match a pension fund’s annual liability profile. Moreover, ILBs do not offer ultra-long maturities and therefore do not resolve the problem of duration risk. The result is a very staggered profile, leading to considerable reinvestment risk. In other words, when bonds mature, reinvestments will be taking place on unknown terms. The potential mismatch and reinvestment risk are shown in chart 2. It shows the mismatch and reinvestment risk under the assumption that inflation has not changed over the life of the liabilities. Although the cashflow mismatch is significant, it will not change under different inflation scenarios, since ILBs provide inflation protection not offered by nominal bonds.

Using Swaps for a Liability Solution Beyond Conventional Bonds

The preceding has shown how a portfolio managed against a market-weighted bond benchmark will not deliver the necessary cash flows to satisfy projected liabilities. If instead we take a pension fund’s known liability stream as our point of departure and use that as the plan’s benchmark, we could try to construct a portfolio with the same maturity and inflation profile in order to minimize interest rate and inflation risk.

Dutch pension funds with conditional or unconditional indexation policies have liabilities linked to future earnings in the form of inflation to preserve pensioners’ purchasing power. Since neither a portfolio with conventional government bonds or inflation-linked bonds can provide sufficient cash flows in line with the liability profile, Dutch pension funds are increasingly looking at the swaps market to provide the solution.

The plain vanilla interest-rate swaps market has been very liquid for a long time. The inflation-linked swaps market, however, while relatively young, has grown at a very rapid pace. It is estimated to have increased by at least 10 times from September 2002 to January 20044. Inflation-linked swaps can be arranged for every maturity out to 40 years, although liquidity diminishes rapidly after 30 years. The same liquidity issue applies to the very short end of the euro inflation-linked swaps market. Nevertheless, volumes and liquidity overall are increasing steadily. This allows pension funds to use inflation-linked swaps to fine tune their exposure to liabilities. Moreover, the longer maturities available in the swaps market help bridge the gap between the duration of a plan’s liabilities and the maturities available in the conventional bond market.

The plain vanilla interest-rate swaps market has been very liquid for a long time. The inflation-linked swaps market, however, while relatively young, has grown at a very rapid pace. It is estimated to have increased by at least 10 times from September 2002 to January 20044. Inflation-linked swaps can be arranged for every maturity out to 40 years, although liquidity diminishes rapidly after 30 years. The same liquidity issue applies to the very short end of the euro inflation-linked swaps market. Nevertheless, volumes and liquidity overall are increasing steadily. This allows pension funds to use inflation-linked swaps to fine tune their exposure to liabilities. Moreover, the longer maturities available in the swaps market help bridge the gap between the duration of a plan’s liabilities and the maturities available in the conventional bond market.

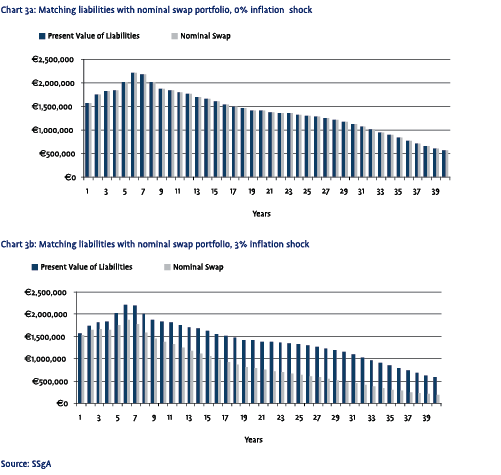

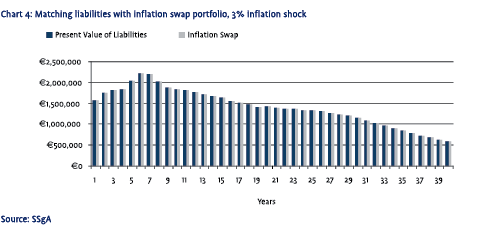

The charts 3 and 4 illustrate the improved convergence between cash flows and liabilities with a portfolio of nominal or inflation-linked swaps. Charts 3a and 3b show the changes in matching that can be achieved under different inflation scenarios by creating a portfolio of nominal swaps.

The charts illustrate quite plainly that for a Dutch plan offering indexed pensions, the mismatch risk posed by investing in a series of nominal swaps is significant. The solution would be to invest in a series of inflation-linked swaps. The Euribor swap market’s fixed maturity rates, which are known today, can be used to match real future cash flows; while the inflationary component, also known today, can be used to deliver the unknown realised protection on future pension payments. Euro inflation swaps can thus preserve the future purchasing power of Dutch pensioners to a great extent, because they are linked to underlying Eurozone inflation. Chart 4 shows the much improved convergence achieved with inflation swaps instead of nominal swaps.

Segregated Versus Pooled Swaps

As shown, constructing a portfolio of swaps greatly diminishes the mismatch risk regardless of what happens to inflation. The pension fund has locked in today’s real rate, secured its fixed rate and hedged against adverse future inflationary rises. In this way, the fund would be able to meet its future pension obligations with a very high degree of certainty.

As shown, constructing a portfolio of swaps greatly diminishes the mismatch risk regardless of what happens to inflation. The pension fund has locked in today’s real rate, secured its fixed rate and hedged against adverse future inflationary rises. In this way, the fund would be able to meet its future pension obligations with a very high degree of certainty.

SSgA believes the best approach to liability matching is by investing in nominal or inflation-linked swaps, depending on the particular indexation policy and solvency ratio. Recognizing that this represents a new way of investing for Dutch pension funds as well as the diseconomies of segregated approaches, SSgA has developed a pooled swaps solution that provides flexible access to the inflation swaps markets without the cumbersome legal, collateral and counterparty credit risk issues normally encountered. Economies of scale bring competitive pricing and the range of fund options offers clear investment benefits over conventional indices.

Expertise Required for Investing in Swaps

Investing in this kind of series of swaps requires significant effort to establish the necessary legal, operational and portfolio and risk management procedures. It also demands a specific skill set and a deep understanding of the inflation-linked swap market and its players in order to manage, execute and monitor swaps and build tools for pricing the swaps. Other issues include negotiating legal agreements, managing counterparty risk and creating flexible ways to unwind swaps.

Mindful of those hurdles, SSgA designed a pooled solution using zero coupon inflation-linked and nominal swaps covering a full maturity profile out to 40 years. The swap maturity funds pay out on an annual basis and allow tailored allocations to different liability profiles. This approach allows clients to benefit from SSgA´s expertise in managing swaps, as well as all the benefits a pooled structure brings in terms of efficiency, legal agreements, counterparty risk, best execution, flexibility and collateral management. The following discusses in more detail the areas in which pooled swap solution offers competitive advantages, as well as some drawbacks that pension funds should be aware of.

How the Inflation-Linked Swaps Market Works for Dutch Plans

A Dutch pension fund with a conditional indexation policy will typically use a sector wage inflation index as a reference. The euro inflation-linked swaps market using Dutch CPI as the reference index is very illiquid at best; Dutch sector wage inflation cannot be used as a reference at all. The most common index used for euro inflation-linked swaps is the EMU Harmonized Index of Consumer Prices ex tobacco (HICP ex tobacco). As a result, a Dutch pension fund investing in euro inflation-linked swaps to match its indexed liabilities needs to be aware of a basis risk introduced into its portfolio. Over the last few years Dutch CPI has been as high as 2% above Harmonized EMU CPI and as low as below 1% Harmonized EMU CPI. However, it is not unlikely that EMU wide inflation rates will converge over time. Moreover, Dutch pension funds with a conditional indexation policy do not necessarily have to match Dutch CPI but can determine a level that would not have a detrimental impact on the solvency ratio.

Moreover, the most liquid form of euro inflation-linked swaps is a plain vanilla swap, i.e., without a cap or floor. In other words, while liabilities will most likely not be adjusted in case of deflation, these swaps will pay out deflation if it occurs. SSgA believes the low likelihood of deflation in the Eurozone does not justify paying a higher bid-offer spread for building in a floor at 0% inflation.

Managing a Swap Portfolio

After achieving a thorough understanding of the euro swaps market (nominal and inflation), including its calculation conventions and who the main providers of liquidity are, the next steps are to acquire the skills, build the tools and set up procedures to manage, execute and monitor swaps. This is necessary at both the front- and back-office level, and all computer systems need to be able to cope with swaps.

Moreover, in order to secure best execution, a swap pricing capability is necessary in order to make sure the mid-prices quoted by counterparties reflect fair value. Building a model internally or validating external data for the structure the fund requires can cost more time and effort than many Dutch pension funds will be prepared to spend.

Establishing Legal Agreements

When entering into a swap with an investment bank, a legal agreement covering derivative transactions needs to be in place. The International Swaps & Derivatives Association (ISDA) provides market participants that want to enter into OTC derivative transactions with a number of building blocks which they can combine to achieve their individual needs within the larger context of a market recognised standardised agreement. Typically, a transaction would require the parties to execute the ISDA Master Agreement, Schedule and Confirmation. In addition, if collateral is required to be posted by either or both parties, the parties would execute the Credit Support Annex to the Schedule to the ISDA Master Agreement (the “CSA”). Negotiating the ISDA and the CSA with several investment banks can be a cumbersome and lengthy process requiring significant legal resources. Since swaps used for liability-matching purposes can have very long maturities (40 or 50 years), an agreement with the investment bank on how to mitigate the credit risk of the swaps on a regular basis is of utmost importance.

Managing Counterparty Risk

Counterparty risk arises when trading in nominal or inflation-linked swaps. Zero coupon swaps used for high duration exposure require careful treatment of counterparty risk as all value in the swap accrues until maturity. There are several ways to reduce counterparty risk. Collateral arrangements can be put in place, specifying what kind of collateral is acceptable and the circumstances under which it needs to be provided. However, during the life of a 40-year swap, the collateral accumulated as a result of marking the swaps to market can be substantial. While there are ways to reduce the risk to a level similar to that of short-dated currency forward transactions by marking swaps to market, this depends on the negotiating power of the pension fund or asset manager trading the swaps. Size and familiarity with the legal structure in which the swaps are traded, as well as capital requirements, can make a big difference in obtaining the right conditions. We believe most Dutch pensions would benefit from the kind of negotiating power a large asset manager like SSgA, with its well-known legal fund structure, would bring to such transactions.

Managing Transaction Costs

While liquidity in the euro swap market has greatly improved over the last few years, transaction costs should not be overlooked, especially when trading inflation-linked swaps. Again, size matters in getting best execution, as does the frequency with which a pension fund or asset manager is in the market to trade swaps. Moreover, flexibility to adjust the swap portfolio is necessary when conditions change; for example, a new ALM study is undertaken, part of a pension fund is sold or acquired, or changes in longevity risk modify the liability profile. Bespoke solutions designed by a pension fund or asset manager often lack this flexibility or will incur significant transaction costs when unwinding segregated swap positions. By contrast, pooled swap solutions which allow frequent trading can resolve these problems to a great extent. Moreover, pooled swap funds will allow crossing at unit level, thereby potentially avoiding all transaction costs related to entering or unwinding swaps.

Leveraged versus unleveraged swap solutions

The pooled solution SSgA designed is based on the premise that as a prudent investor, a pension fund will be adverse to introducing leverage into its portfolio. This is based on the conceptual belief that when the objective is to minimize risk on a pension fund’s balance sheet, the fund will not be keen to introduce new risk by leveraging its portfolio. The consequence of this is that the swap needs to be fully funded with cash, preferably managed in a riskaverse way. Hence by including an unleveraged liability matching solution in its portfolio, the pension fund will partially give up the potential to generate significant excess returns.

However, several Dutch funds are aiming to minimize gap risk while at the same time adopting return targets in excess of their liabilities. SSgA believes there are several ways to address this need for excess return. One solution is to implement unfunded overlay strategies over the funded liability matching solution, for instance with Credit Default Swaps. This could generate between 50 to 100 bps additional return. For higher return targets over liabilities, another approach could be to match liabilities with an unfunded swap overlay. This would introduce leverage. In that case, SSgA believes the optimal approach would be to establish a dynamic investment policy that takes into account fund specific parameters, in combination with a swap overlay that minimizes gap risk. Although some advantages of the pooled solution may no longer apply, pension funds will still be able to benefit from all the expertise SSgA has built up in providing solutions to Dutch pension funds for the requirements of the FTK.

Responding to the Pension Management Changes

The new regulatory environment has already revealed the shortcomings of previous best practices. As the new pension funding rules take effect in the Netherlands, more and more plans will require innovative solutions that help them better balance their assets and liabilities. SSgA’s pooled nominal and inflation swap approach represents a natural investment hedge to the dynamic properties of pension liabilities and is part of a new generation of investment solutions aimed at better managing the only benchmark that really counts: meeting a plan’s projected future obligations.

Noten

- Laurence B. Siegel, Benchmarks and Investment Management, 2003, The Research Foundation of AIMR

- Citigroup EGBI January 2005

- (1+Nominal Rate) = (1+Real Rate)*(1+Inflation Rate). This can be approximated by Nominal Rate = Real Rate + Inflation Rate or Nominal Rate = Real rate + Breakeven

- Barclays Capital (2004)

in VBA Journaal door Susanne van Dootingh